Small businesses managing costs amid recession speculation [WSJ/Vistage June 2022]

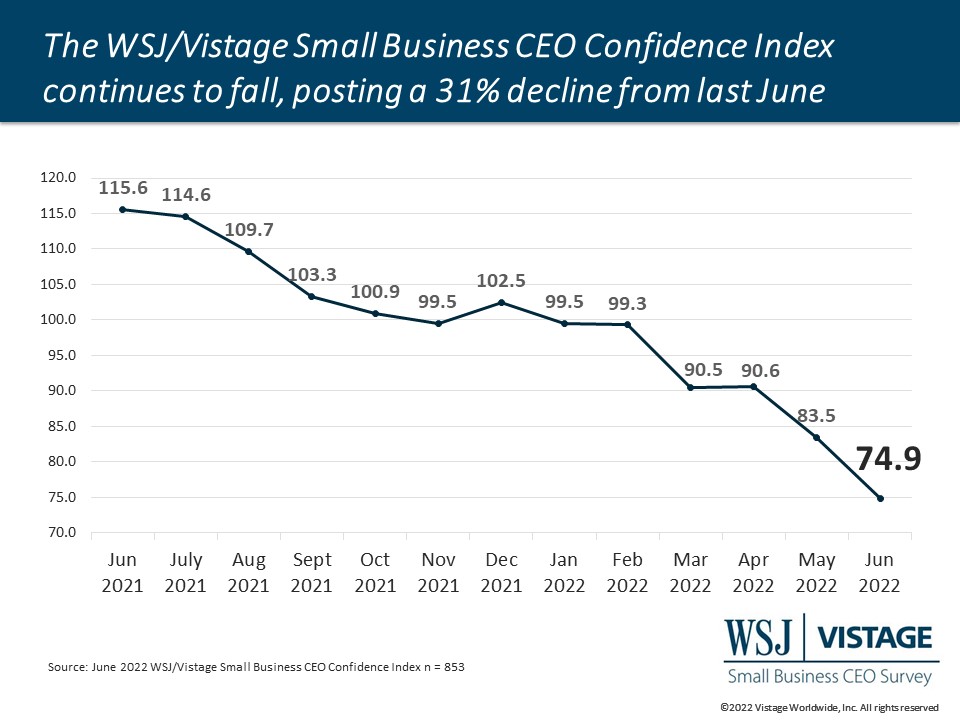

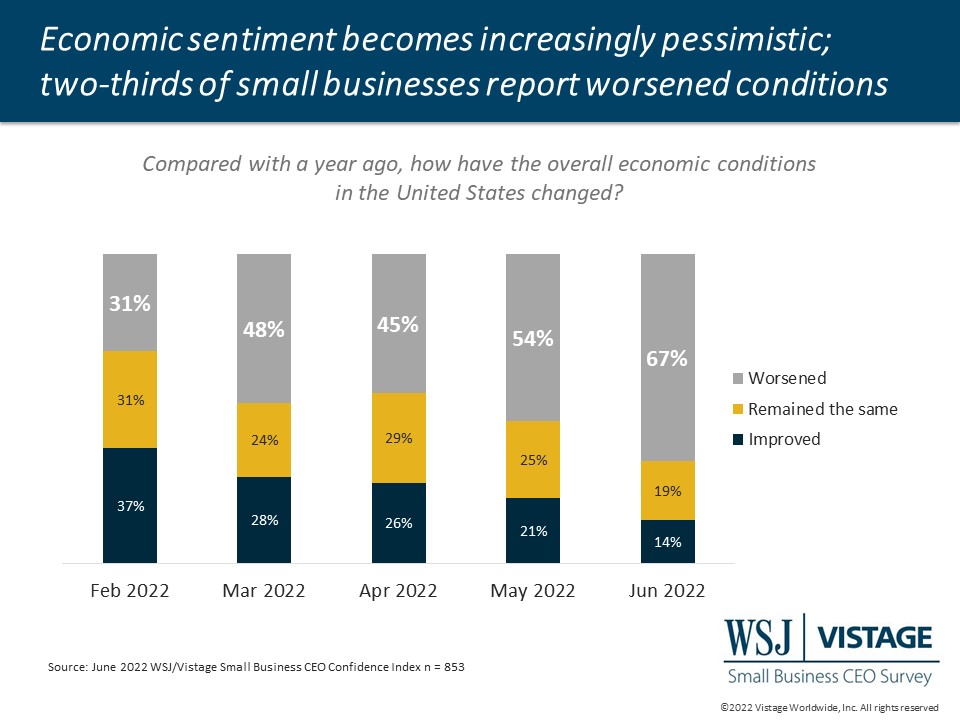

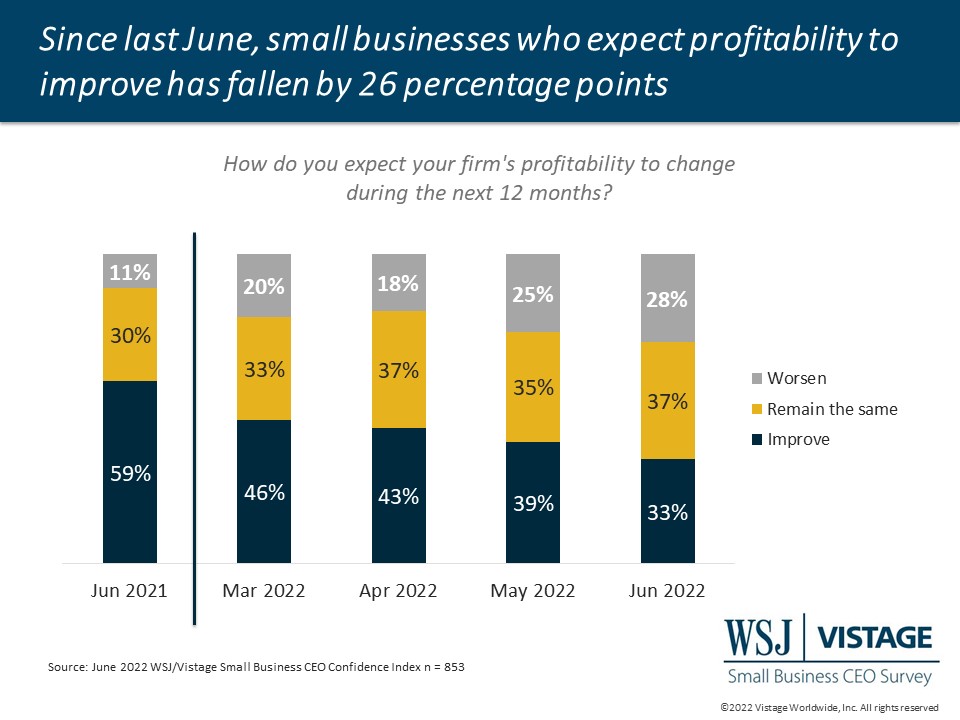

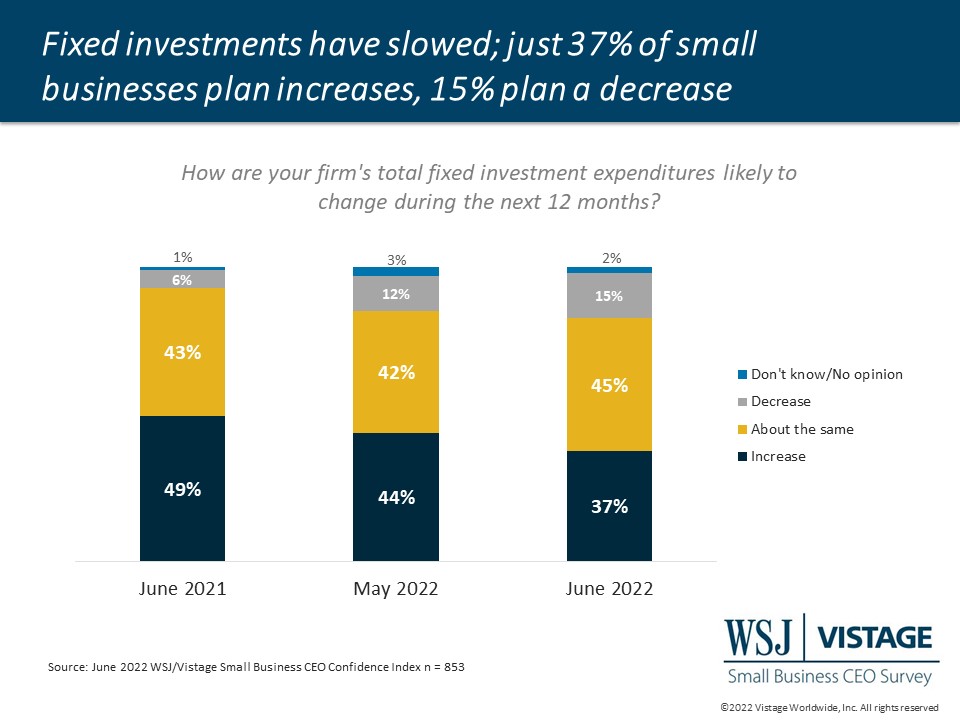

As the debate continues about whether we are in — or approaching — a recession, small business sentiment seems to lean toward that path. While the declines of the WSJ/Vistage Small Business CEO Confidence Index over the past year were originally attributed to the rapidly increasing pessimism about the U.S. economy due to ongoing uncertainty, rising costs and supply chain issues, the decline in recent months reflects significantly slowing projections and curtailed plans for the future as well.

June’s decline in the Index mirrors the decline in May 2020 after the economy shut down. However, even with the Index falling more than 30%, there are bright spots that show the clouds may clear.

Labor market is a beacon of hope

The health of the labor market continues to be a buoy that our economy clings to, and low unemployment figures indicate we are staving off the recession. The inability to meet demand due to talent scarcity may be a waning challenge. In June, 63% of small businesses reported that hiring problems impacted their ability to operate at full capacity, an improvement from 68% in March.

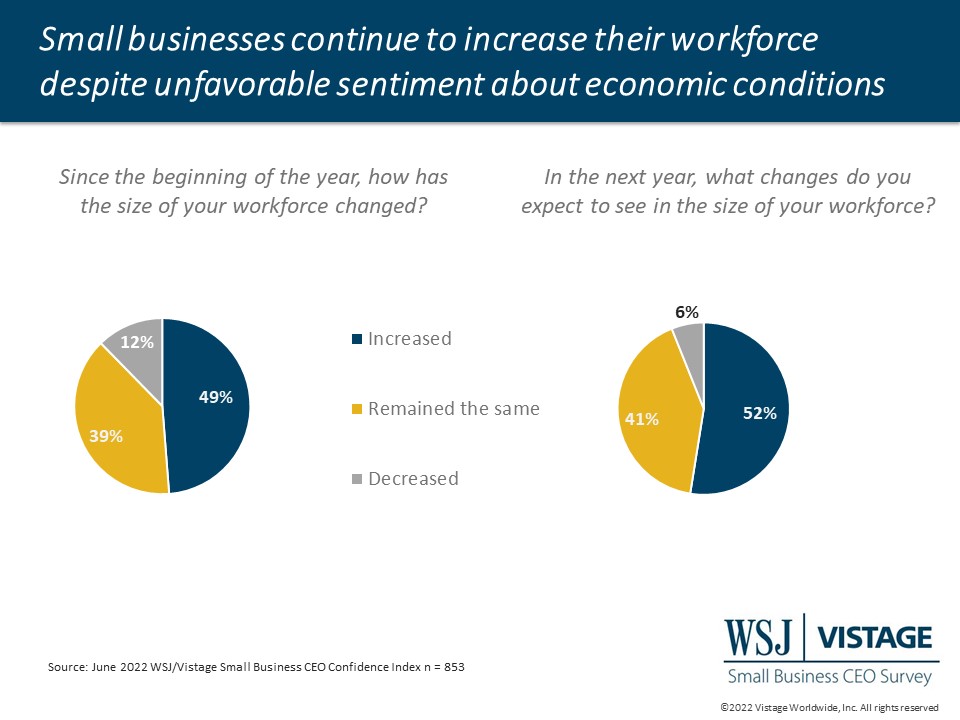

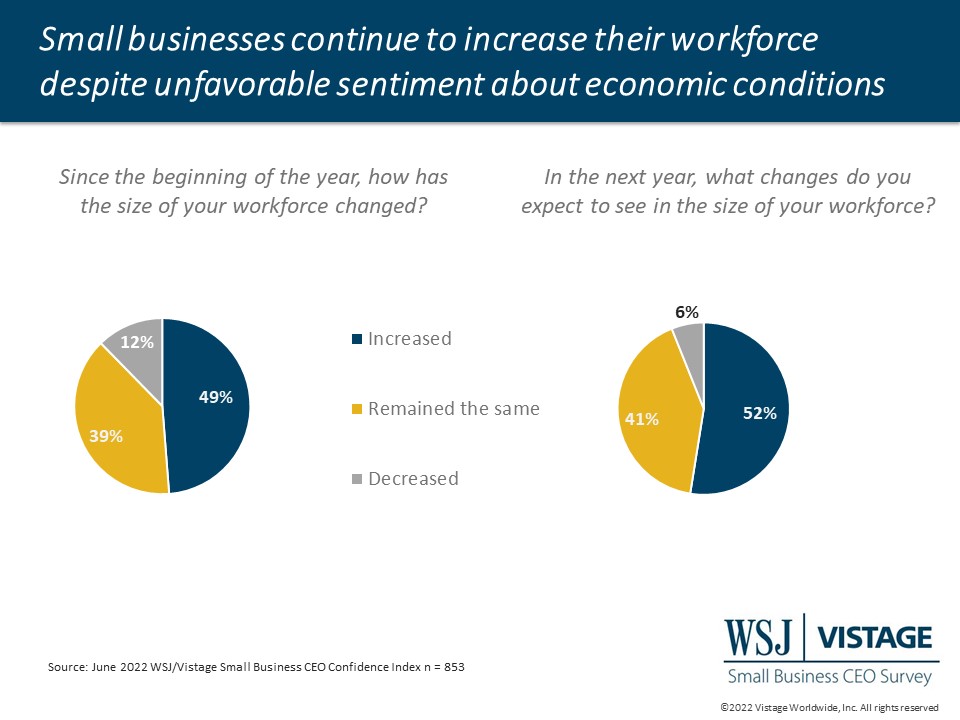

Looking ahead, 52% of small businesses expect to increase their workforce in the next 12 months. While this is down from December’s record-setting 75%, when asked about their workforce changes since the beginning of the year, 49% of small businesses reported increases, revealing that the planned hiring has taken place. Another bright spot? Retention has improved as 69% of small businesses report that rates have remained the same since the beginning of the year.

Adding insult to injury

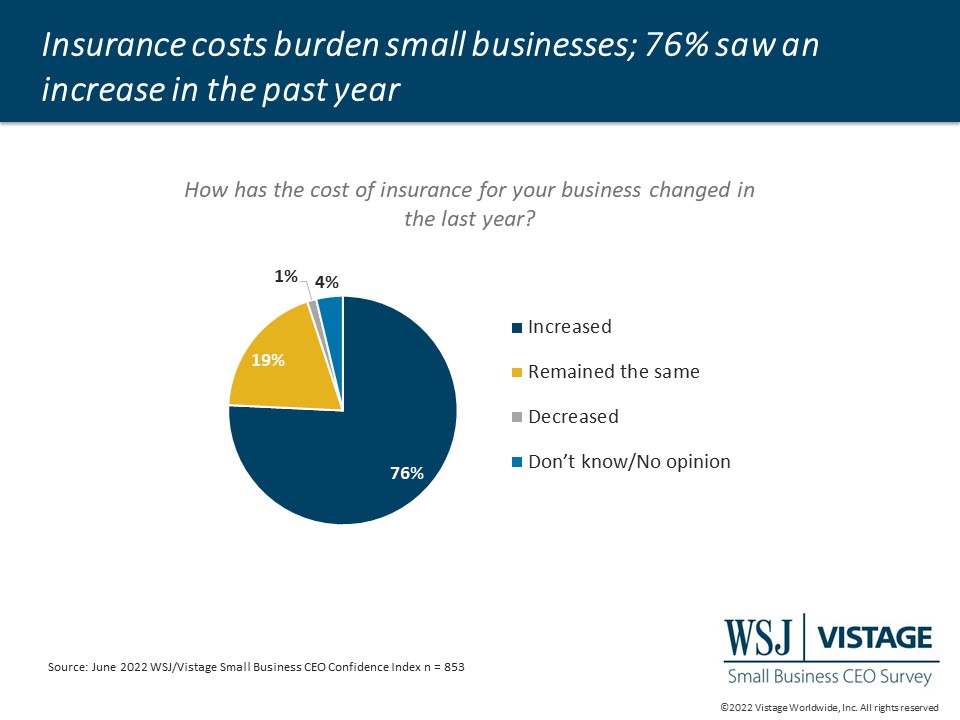

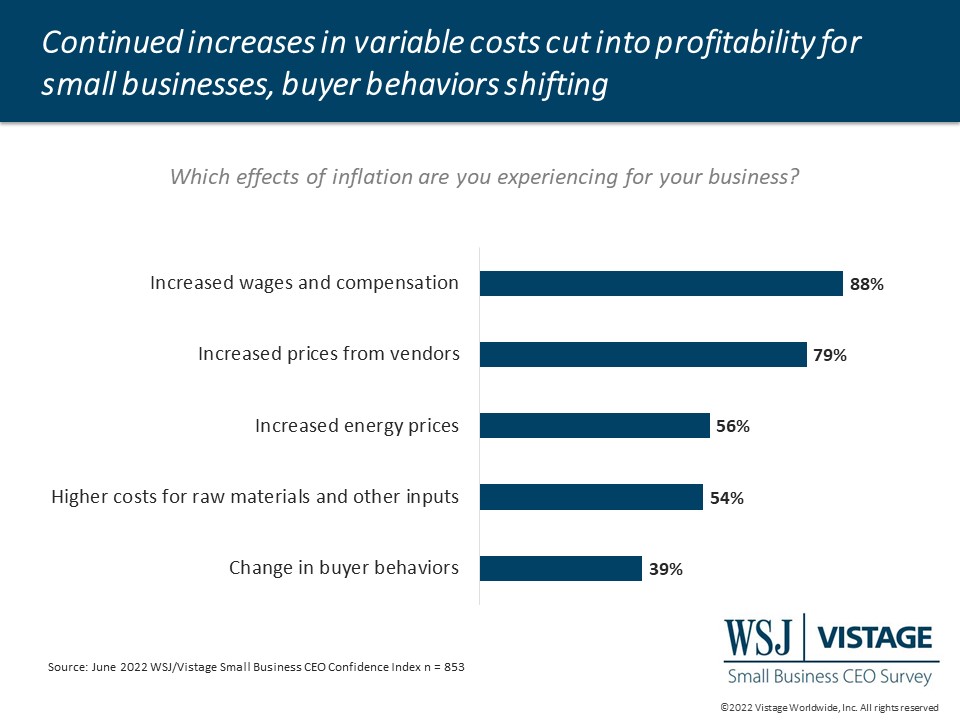

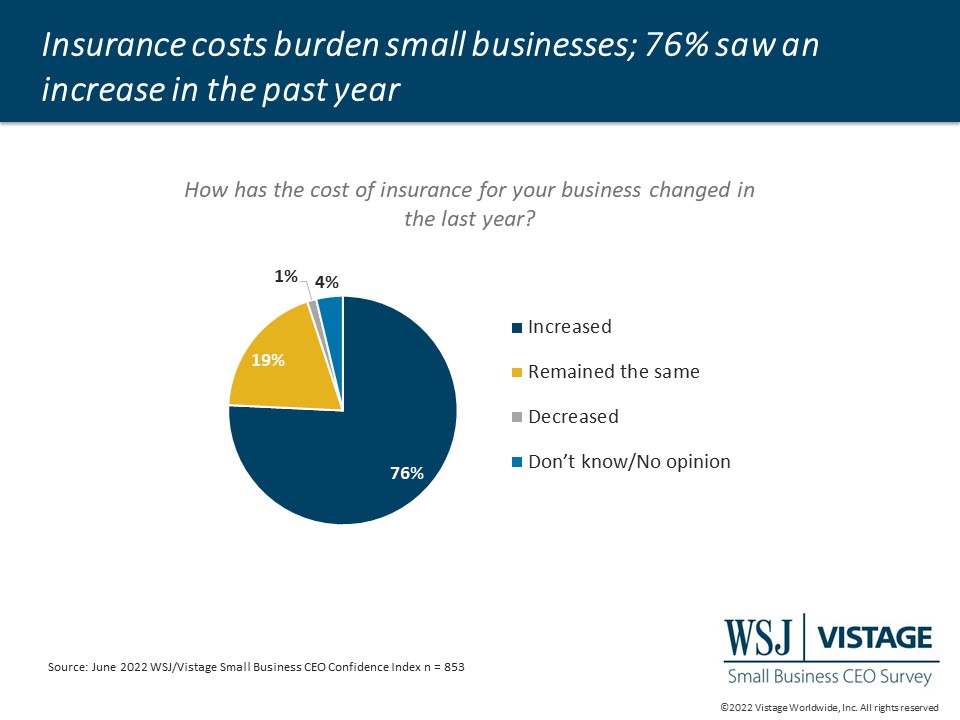

Inflationary pressures persist, with wages and compensation topping the list as 88% report that as their biggest inflationary pressure. While wage increases are a necessary part of competing in the talent wars, other costs for compensation add to the mix. When asked about insurance costs, 76% of small businesses report that insurance costs have increased.

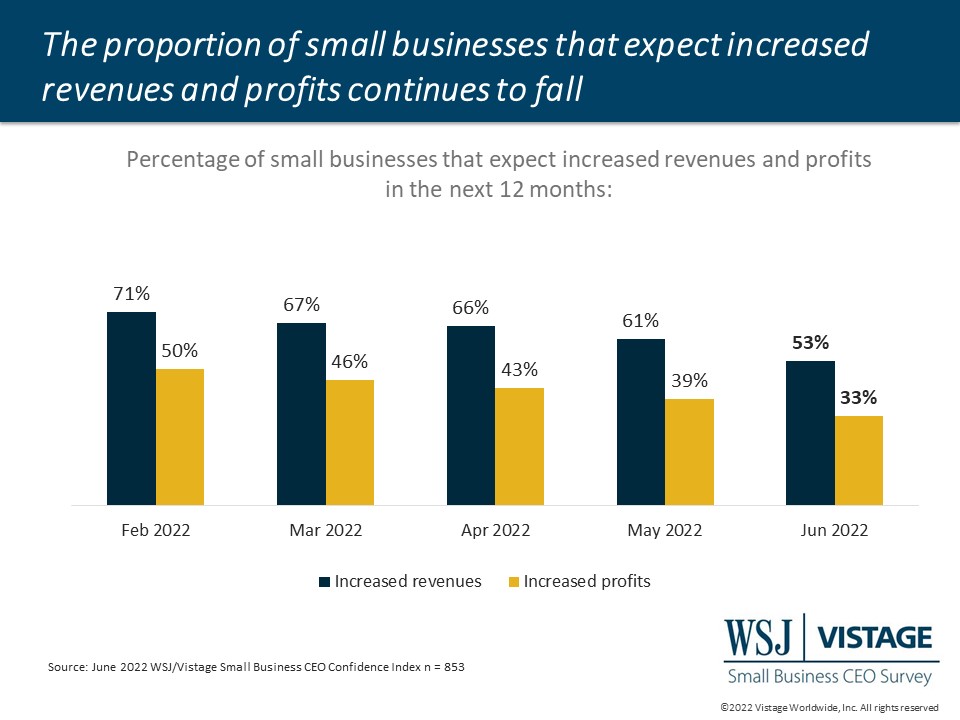

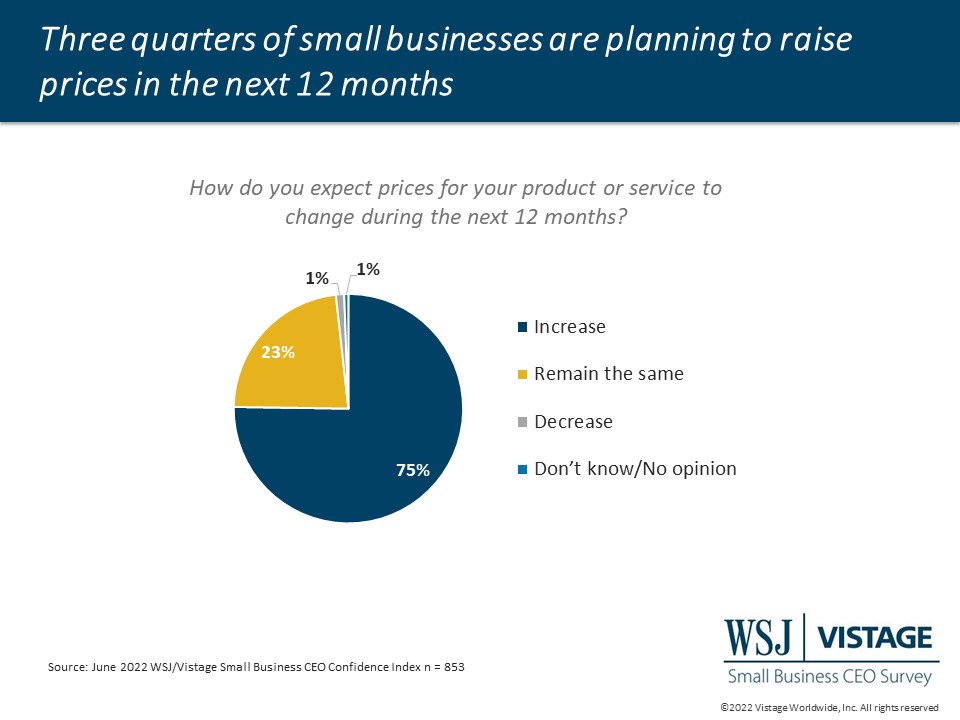

With rising costs come rising prices; more than three-fourths of small businesses also plan to raise prices in the coming year, likely not the first — or the last — price increase they will implement to preserve declining profitability.

Supply chain waters continue to calm

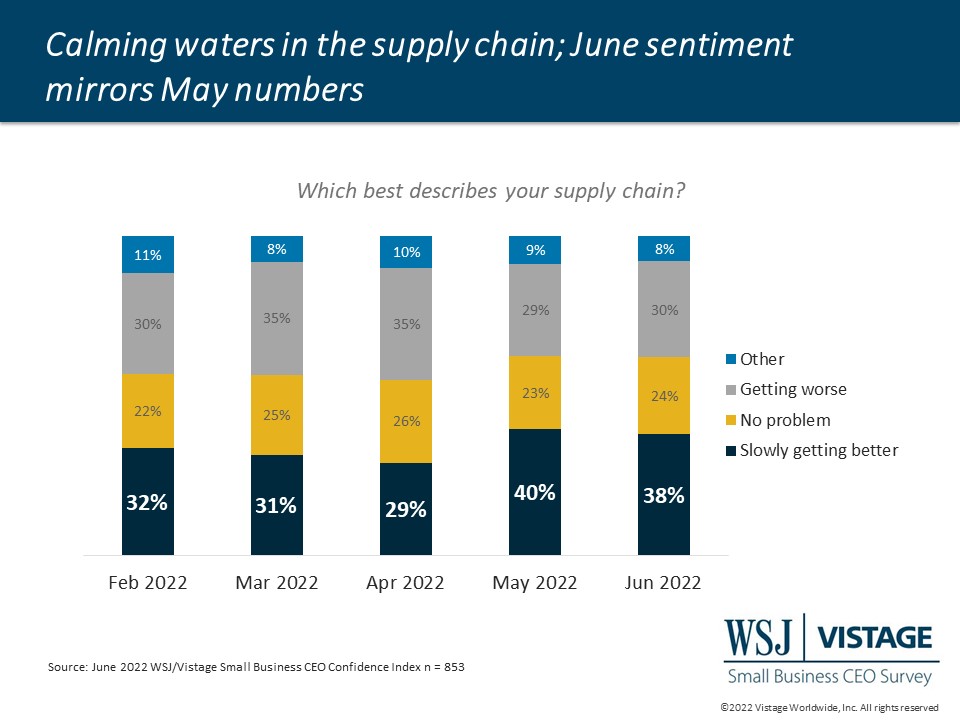

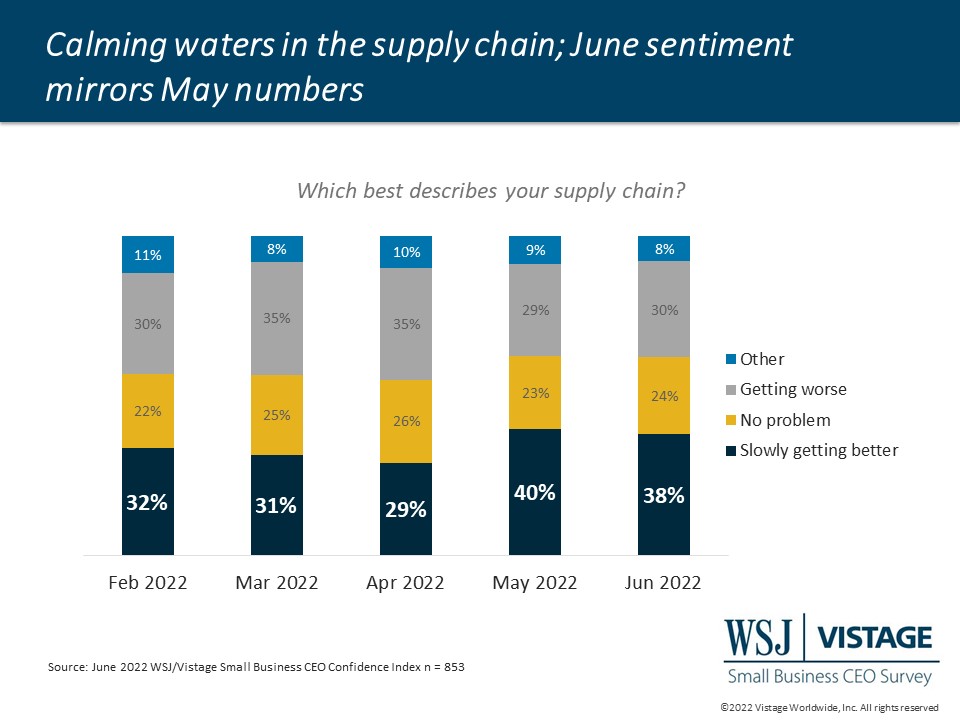

While supply chain challenges persist, they are moving — slowly — in the right direction, with 62% of small businesses describing their supply chain as either “no problem” (24%) or “slowly improving” (38%). While there’s been little month-over-month change, when compared over the last few months, this is an improvement over the 56% reported in March.

June Highlights:

- The WSJ/Vistage Small Business CEO Confidence Index posted another steep decline, reaching 74.9 in June, dropping over 30% from last year.

- Second to wages and compensation is increased prices from vendors, with 79% of small businesses reporting impacts.

- Even with ongoing supply chain challenges, just 10% of small businesses have implemented or are considering nearshoring.

Download the June report for complete data and analysis

For a complete dataset and analysis of the June WSJ/Vistage CEO Confidence Index survey from the University of Michigan’s Dr. Richard Curtin, download the report and infographic:

DOWNLOAD JUNE 2022 WSJ/VISTAGE SMALL BUSINESS REPORT

DOWNLOAD JUNE 2022 WSJ/VISTAGE SMALL BUSINESS INFOGRAPHIC

About the WSJ/Vistage Small Business CEO Survey

Interactive data from WSJ/Vistage Small Business survey

The June WSJ/Vistage Small Business CEO survey was conducted June 6-13, 2022, and gathered 853 responses from CEOs and leaders of small businesses with revenues between $1 million and $20 million. Our next survey will be in the field July 11-18, 2022.

Related Resources

Category: Economic / Future Trends

Tags: Hiring, inflation, rising costs, supply chain, WSJ Vistage Small Business CEO Survey