Wage increases eat into small business profitability [WSJ/Vistage May 2022]

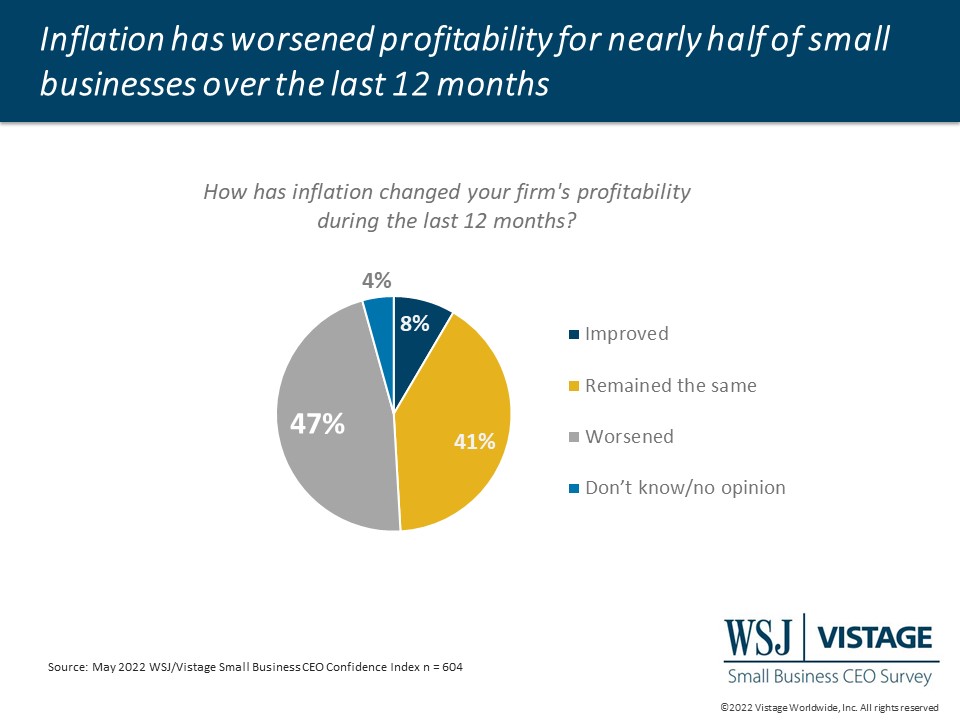

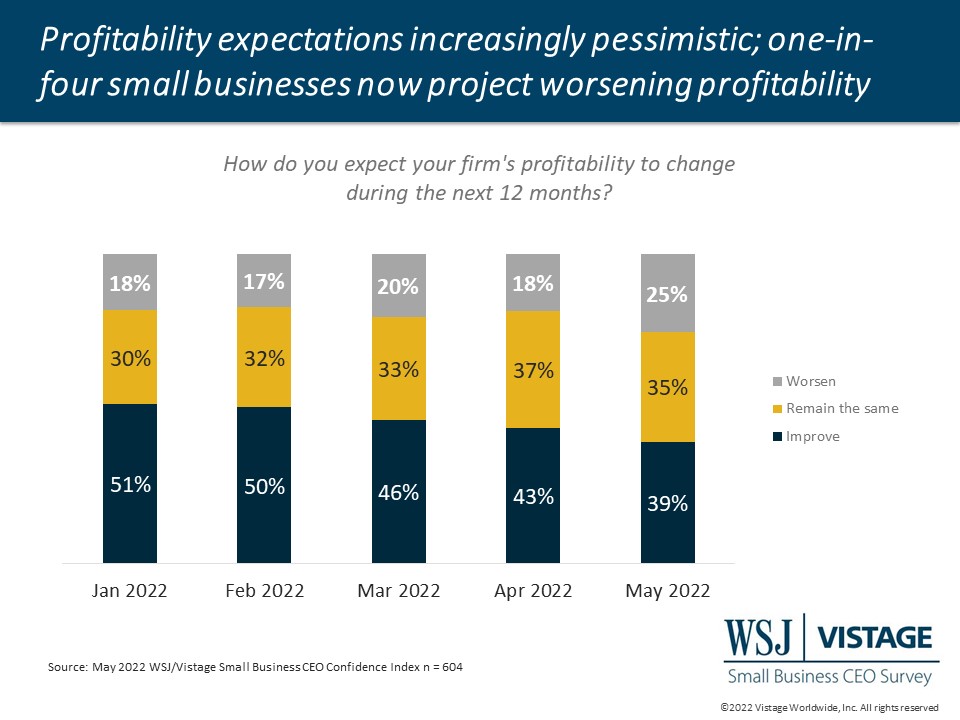

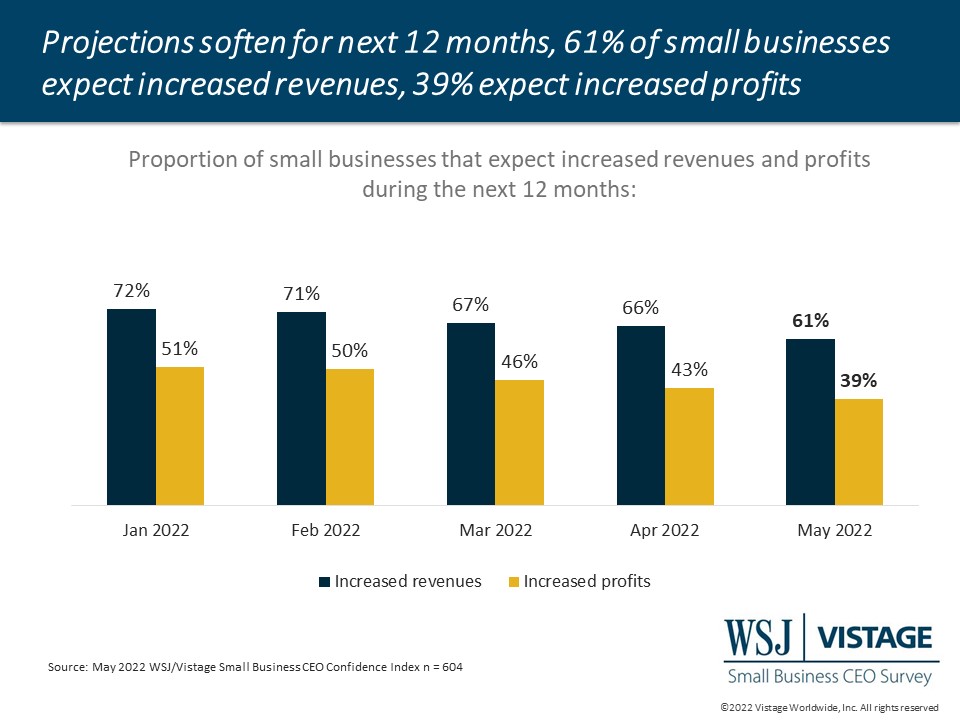

Rising prices and increased wages have taken a toll on the profitability of small businesses. 47% of CEOs report that profitability worsened in the past 12 months due to inflation. Expectations for the year ahead are increasingly pessimistic with just 39% of small businesses projecting increased profits, down from 43% last month and 62% last year. In contrast, 61% of CEOs expect increased revenues in the next 12 months, illustrating a gap between revenue and profitability projections that has only widened in the face of rising costs, further impacting profitability.

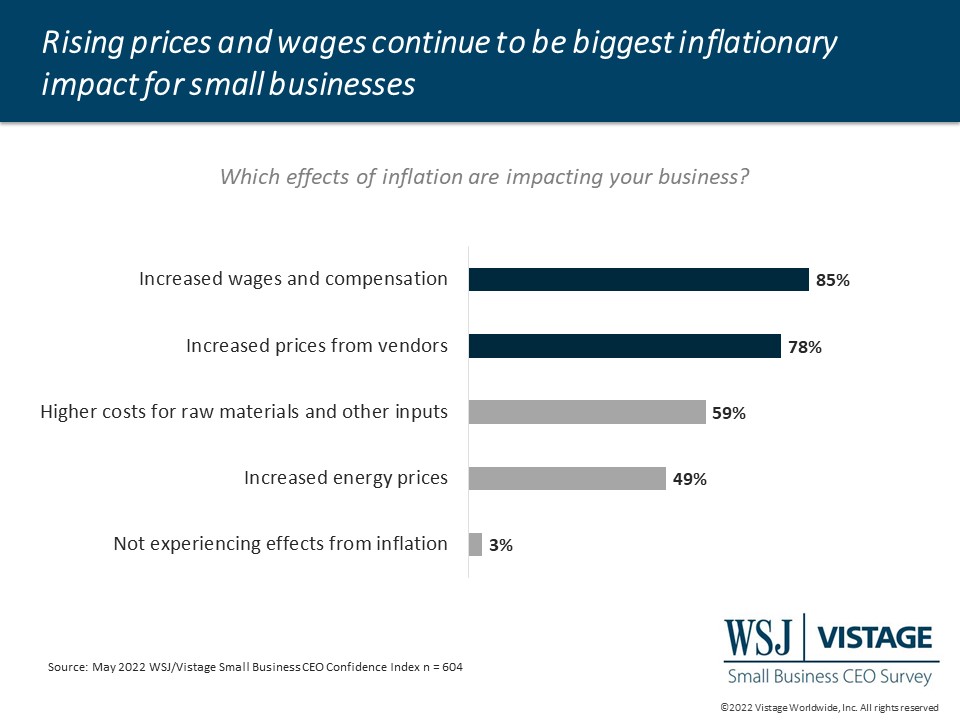

Wages continue to be the biggest inflationary pressure for small businesses with 85% reporting impacts on increased wages and compensation. Other costs add to their challenges, with 78% of small businesses reporting increased prices from vendors and 59% reporting higher costs for raw materials and other inputs.

The double-edged sword of wage increases

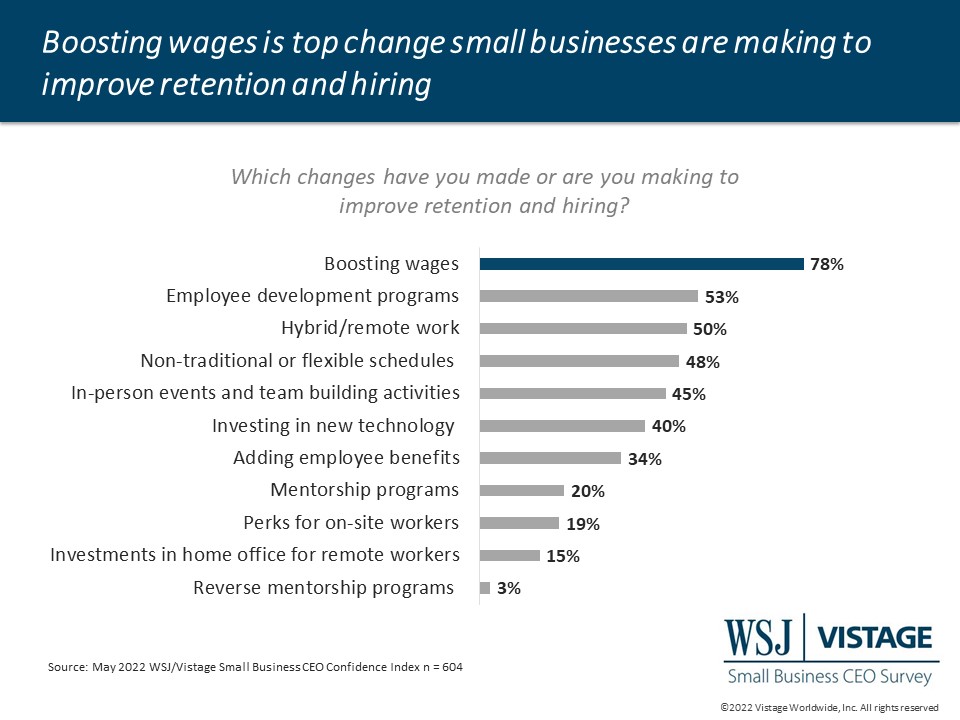

Concurrent with inflationary pressures, small businesses leverage wage and salary increases as a critical component of their hiring and retention strategies. Our survey reveals that 78% of small businesses have increased or are planning to increase wages to improve hiring retention.

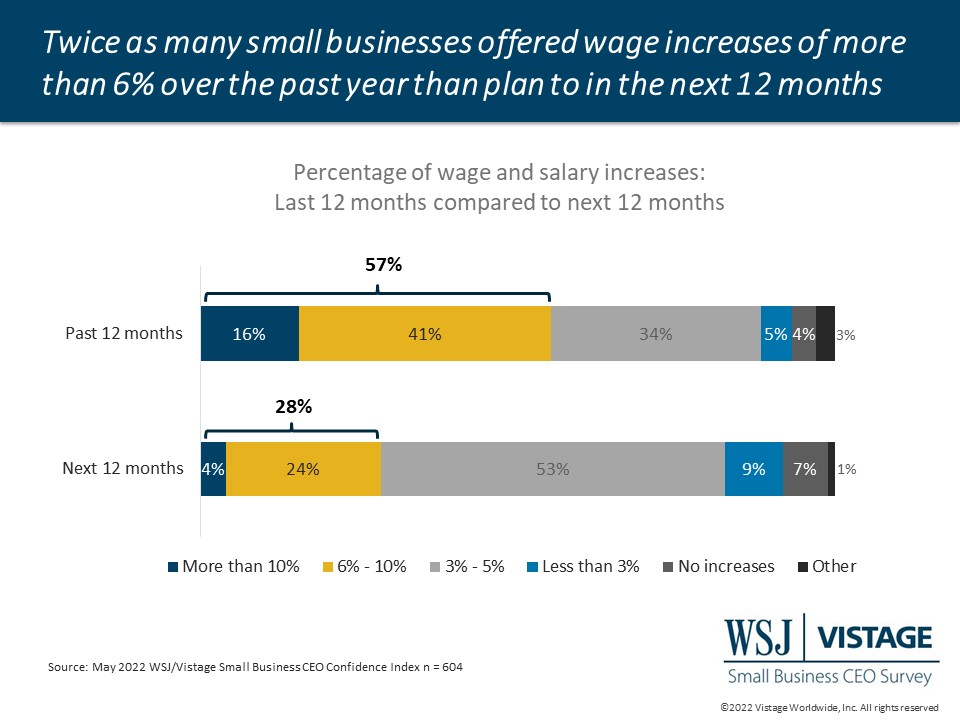

How much are small businesses investing in wages? Nearly three-in-five (57%) of small businesses report offering wage increases of more than 6% over the last 12 months. And those businesses plan to continue to offer increased wages in the next 12 months, although the raises may be smaller with just 28% planning increases over 6%.

Prices rising faster than wages

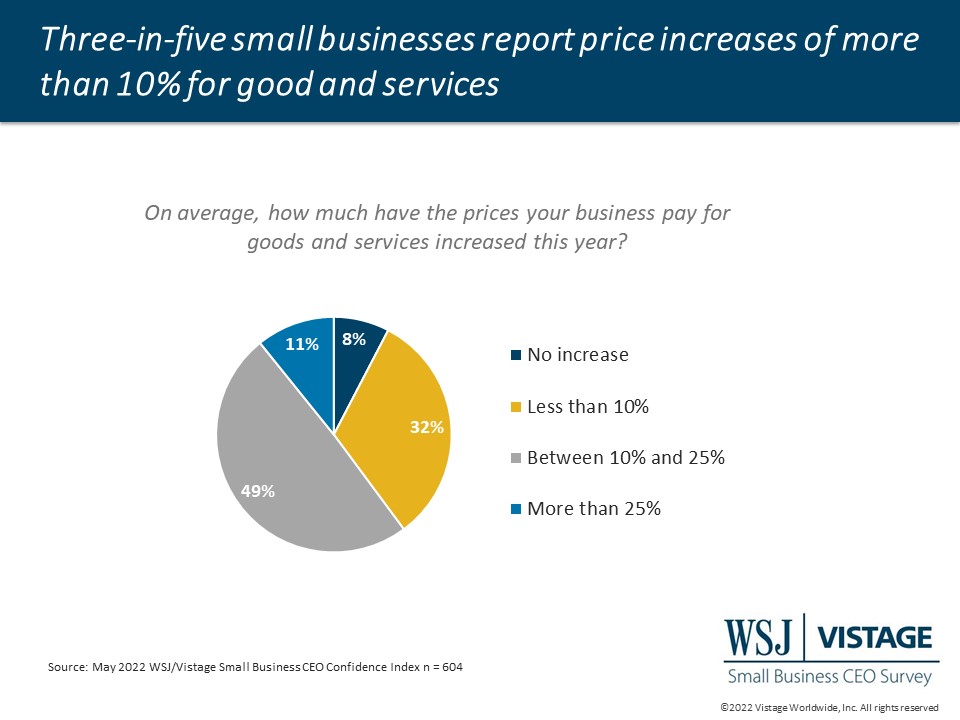

Second only to wages, more than three-quarters of small businesses reported increased prices from vendors. However, the prices of goods and services are going up at an even greater rate than wages according to those we surveyed; price increases of over 10% were reported by 60% of small businesses surveyed.

Expansion plans ease amid slowing demand

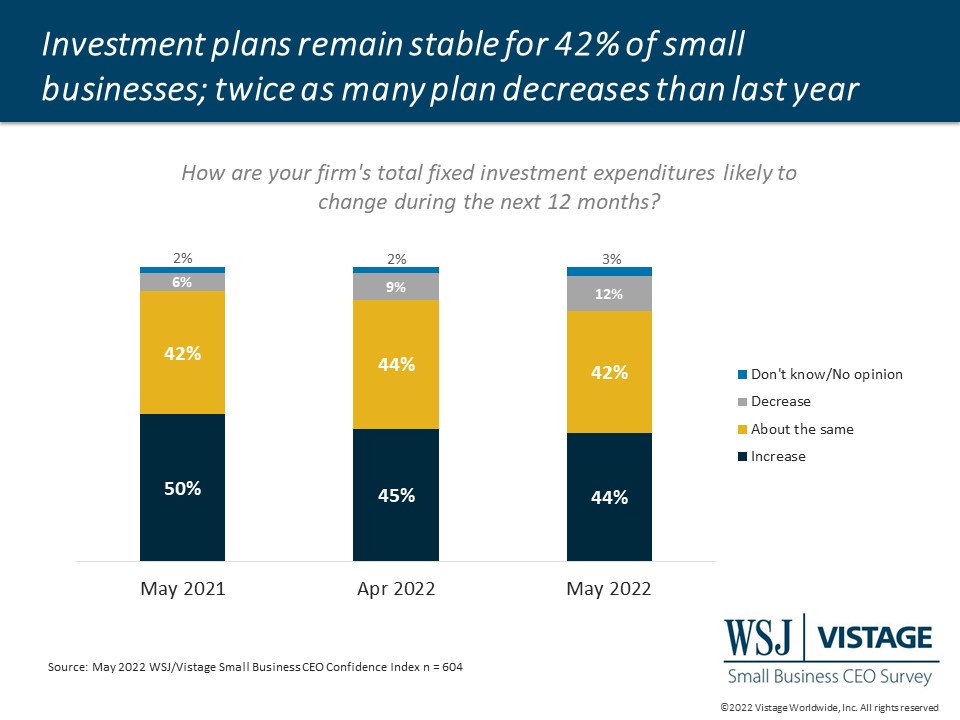

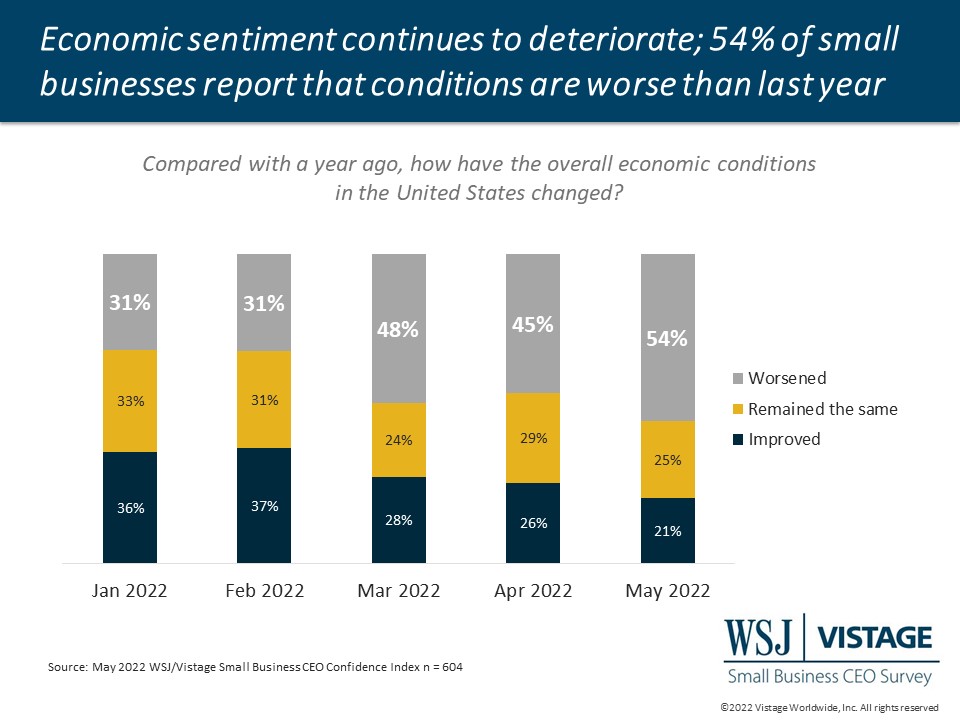

While there remains the question of a recession versus a soft landing and decelerated growth, small businesses are becoming more conservative in their spending, easing off workforce expansion and decreasing fixed investments. While 42% of small businesses plan to keep their investment spending stable, 12% are decreasing their fixed investments, double last May’s reading. Workforce expansion plans have softened as well with just 59% planning to increase their workforce in the year ahead. With economic uncertainty at near-record highs, small businesses are becoming more conservative to ensure they are not left with excessive debt or payroll amid slowing growth.

May Highlights:

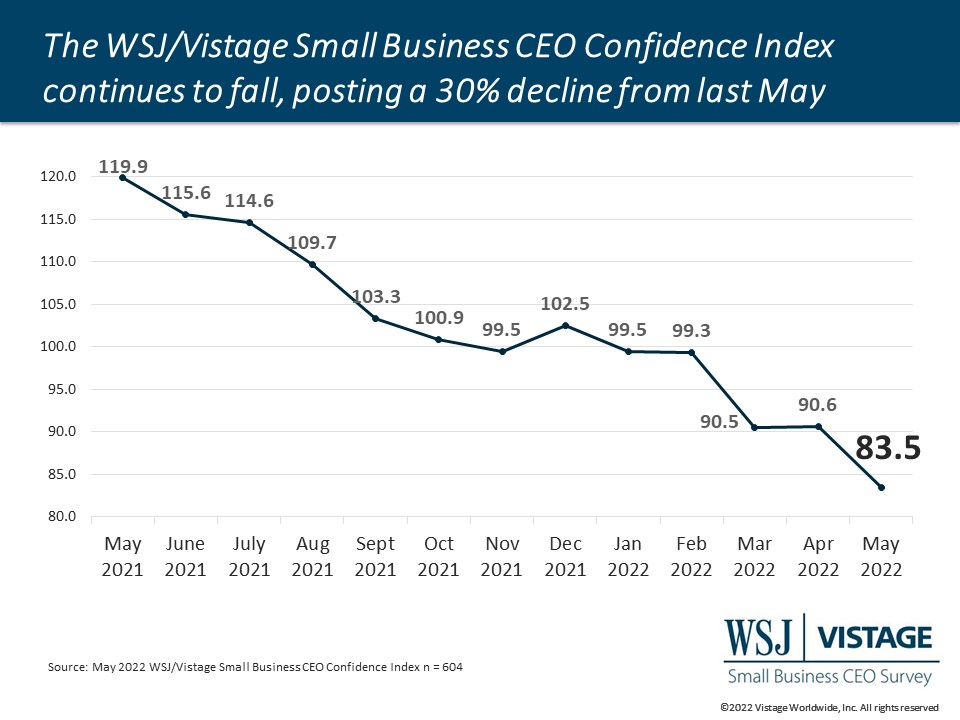

- The WSJ/Vistage Small Business CEO Confidence Index declined to 83.5 in May, a 30% drop from last May’s peak of 119.9.

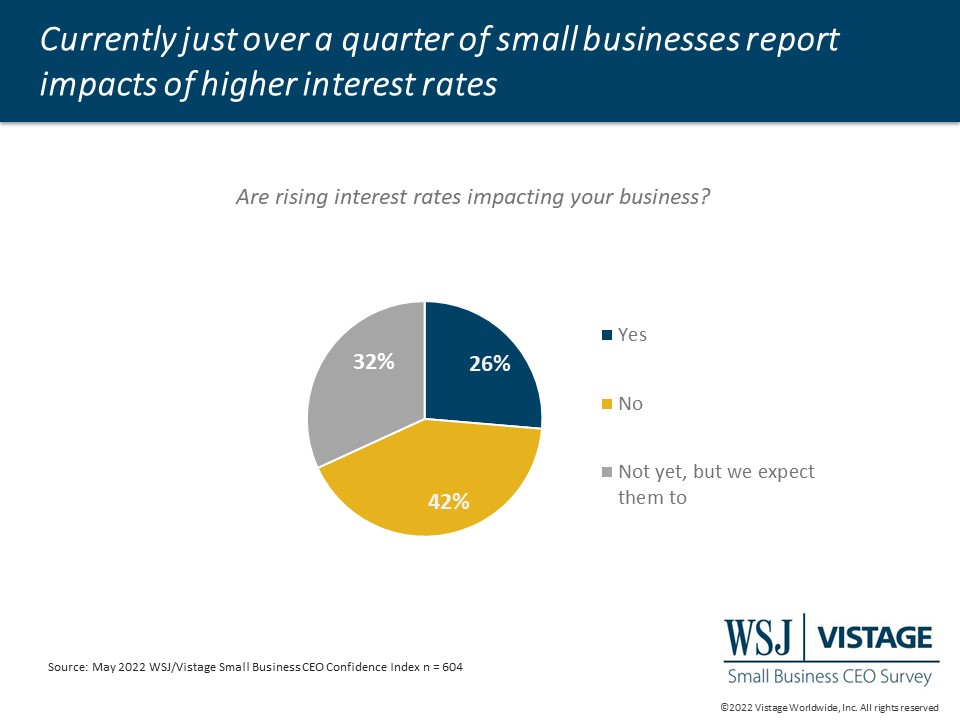

- While fixed investment plans remain stable, rising interest rates will impact future investing; 26% have been impacted by rising interest rates and 32% expect future impacts.

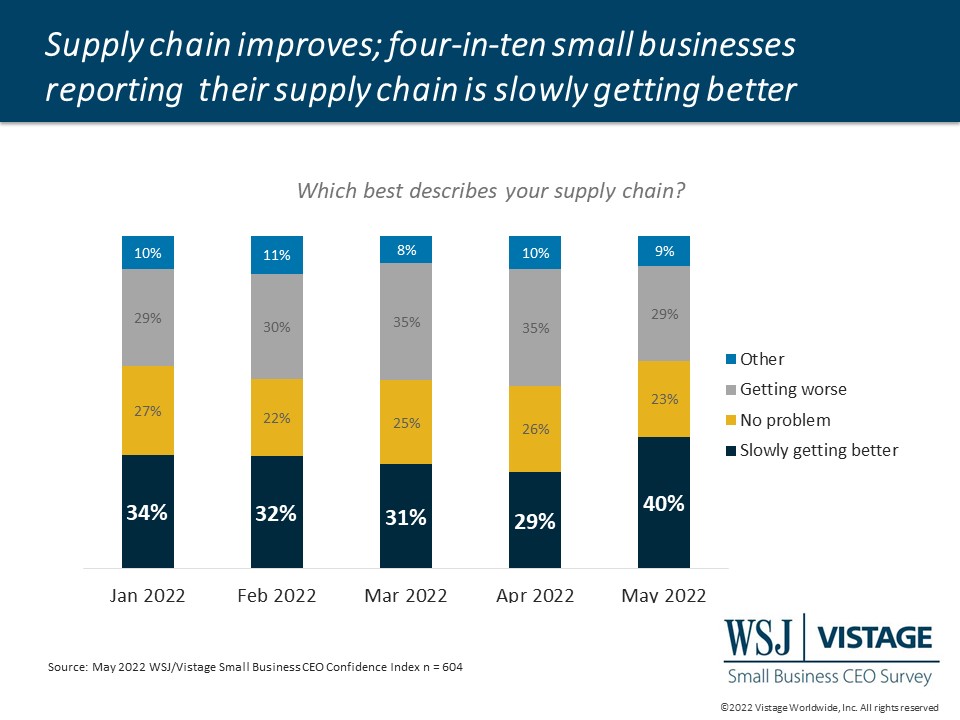

- International turmoil creates additional headwinds for small businesses: 32% report direct or indirect impacts coming from lockdowns in China, and just 25% are impacted by the war in Ukraine, down from 41% expecting impacts in March.

Download the May report for complete data and analysis

For a complete dataset and analysis of the May WSJ/Vistage CEO Confidence Index survey from the University of Michigan’s Dr. Richard Curtin, download the report and infographic:

DOWNLOAD MAY 2022 WSJ/VISTAGE SMALL BUSINESS REPORT

DOWNLOAD MAY 2022 WSJ/VISTAGE SMALL BUSINESS INFOGRAPHIC

About the WSJ/Vistage Small Business CEO Survey

Interactive data from WSJ/Vistage Small Business survey

The May WSJ/Vistage Small Business CEO survey was conducted May 2-9, 2022 and gathered 604 responses from CEOs and leaders of small businesses with revenues between $1 million and $20 million. Our next survey will be in the field June 6-13, 2022.

Related Resources

The CEO Pulse: Hiring Resource Center

The CEO Pulse: Inflation Resource Center

Category: Economic / Future Trends

Tags: profitability, rising costs, WSJ Vistage Small Business CEO Survey