Small business confidence retreats amid January’s Omicron surge [WSJ/Vistage Jan 2022]

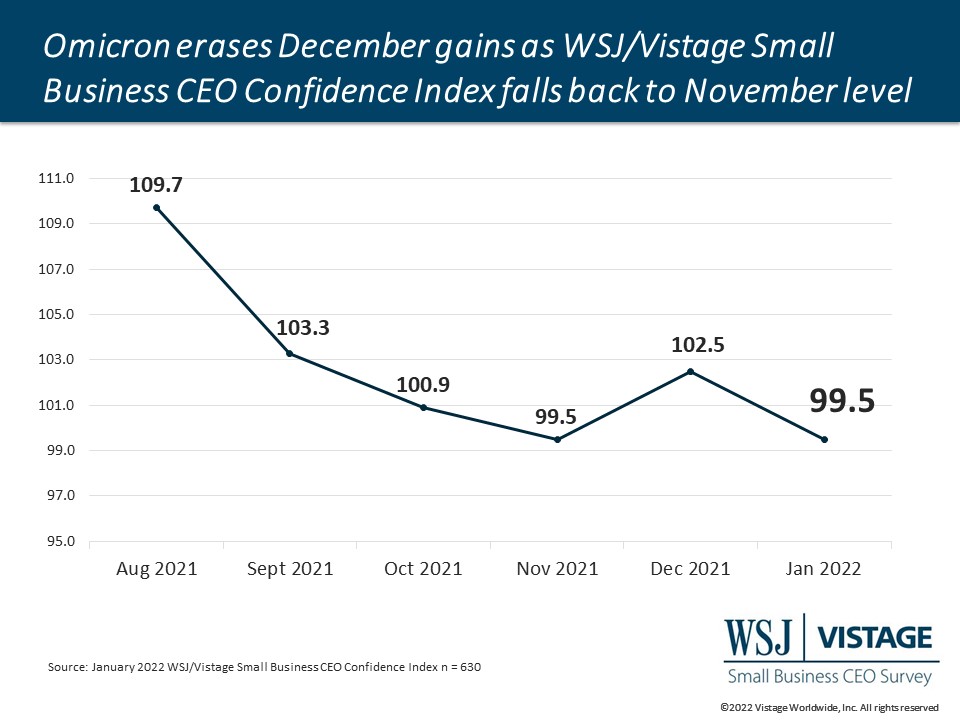

After increasing in December, volatile conditions brought by the latest surge in the COVID-19 Omicron variant reversed the gains in small business confidence. In January, the WSJ/Vistage Small Business CEO Confidence Index fell back to 99.5, identical to November’s reading.

Capacity impacted by the one-two punch of Omicron and talent scarcity

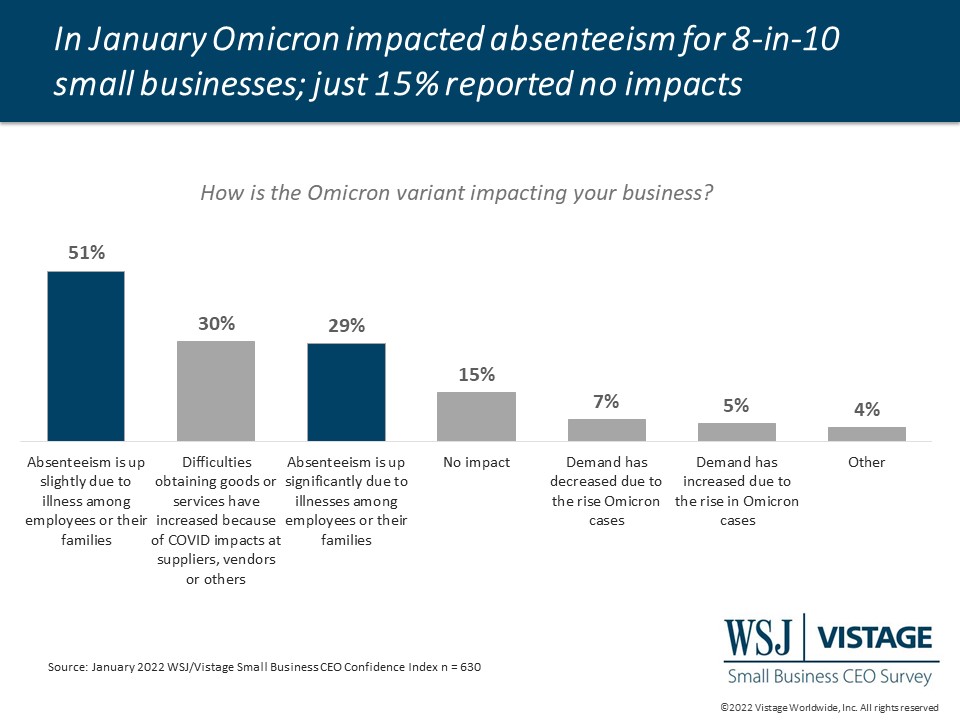

Talent remains the biggest inhibitor to growth, and the Omicron surge added insult to injury by impacting the workforce even more. Small businesses reported that the biggest effect of Omicron was an increase in absenteeism, with 51% reporting that absenteeism was up slightly and an additional 29% reporting that absenteeism was up significantly. Absenteeism due to COVID was a short-term challenge as the majority of small businesses (53%) reported their COVID policy was a five-day absence in accordance with CDC’s current policies, 9% of small businesses have a seven-day policy and 14% maintain a ten-day policy. However, this short-term problem did cause disruptions in growth as 68% of small businesses operated at reduced capacity and 10% turned business away in response to these Omicron-related absences.

Unfortunately, absenteeism’s impact on operations during the Omicron surge only added to existing challenges presented by talent shortages. With the tight labor market and their plans to expand their workforce, 68% of small businesses reported that hiring challenges are impacting their ability to operate at full capacity. Talent is one headwind that remains relentless, but supply chain headwinds are beginning to slowly lessen over time.

Supply chain challenges begin to ease

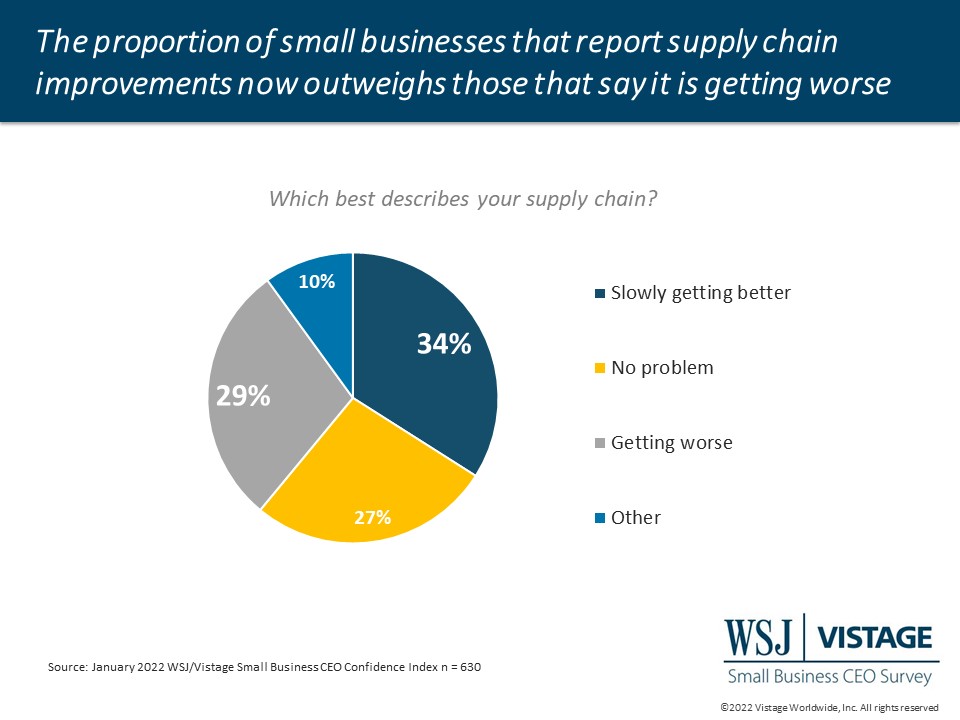

For the first time since last year, the proportion of small businesses that reported their supply chain is improving is greater than those that say it is getting worse. In the January survey, more than one third (34%) of small businesses reported their supply chain is slowly getting better, which is up from 30% in December and 23% in September.

Currently, less than one quarter (24%) of small businesses report the price of goods and materials is the primary supply chain issue. Delivery and fulfillment time present the biggest challenge for 39% of small businesses, followed by the availability of inventory (32%).

Tension between inflation and growth

Small businesses see growth opportunities ahead with 72% projecting increased revenues in the next 12 months, but constraints of inflation continue to hold back expectations for increased profits. Just 51% of small businesses expect profitability to increase, and 18% expect it to worsen. This is in drastic contrast to the peak in May when 62% of small businesses expected profitability to increase and just 8% expected a decline.

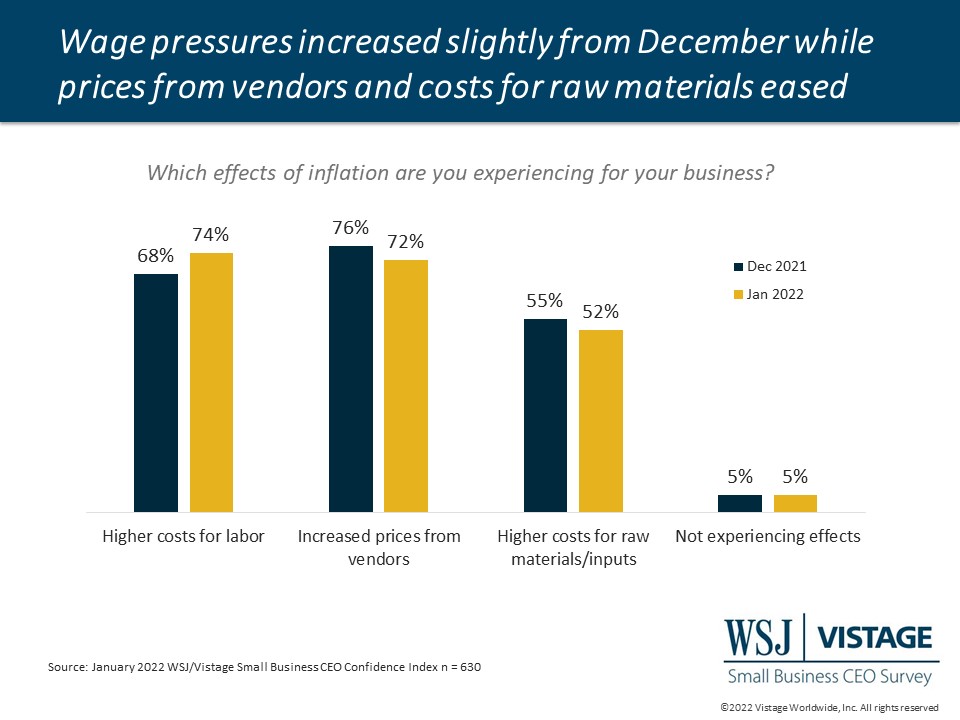

While the costs of inputs might be easing, prices from vendors and wage pressures continue to temper profitability gains. Nearly three-quarters (74%) of small businesses are impacted by higher costs for labor, which t are necessary to compete in the talent wars. Last month’s report noted that compensation was the top tactic small businesses were using to address hiring challenges, with 73% boosting wages, 38% adding employee benefits and 24% offering hiring bonuses.

Some of the headwinds impacting small businesses are starting to slow, but talent remains a gale force wind with record quit rates impacting all businesses. Retention remains a priority to keep the employees they have today.mall businesses also need to take advantage of the opportunity to find talent from those leaving voluntarily as part of the Great Resignation. Talent is the biggest priority for small businesses. First they must regain operational capacity as employees return from COVID absences, then focus on adding people required to gain the momentum needed to realize their projected growth potential.

Download the January report for complete data and analysis

For the complete dataset and analysis of the January WSJ/Vistage Small Business CEO Confidence Index survey from the University of Michigan’s Dr. Richard Curtin, download the report and infographic to learn more, including:

- Optimism about the economy continues to decline.

- Expansion plans over the next 12 months increase, driven by hiring goals.

- Revenue expectations grow while profit expectations continue to moderate.

DOWNLOAD THE JANUARY 2021 WSJ/VISTAGE SMALL BUSINESS REPORT

DOWNLOAD THE JANUARY 2021 WSJ/VISTAGE SMALL BUSINESS INFOGRAPHIC

About the WSJ/Vistage Small Business CEO Survey

Interactive data from the WSJ/Vistage Small Business Survey

The January WSJ/Vistage Small Business CEO Survey was conducted January 10-17, 2022 and gathered 630 responses from CEOs and leaders of small businesses with revenues between $1 million and $20 million. Our February survey, in the field February 7-14, 2022, will capture the sentiment of small businesses as Omicron recedes.

Related resources

Category: Economic / Future Trends

Tags: coronavirus, Hiring, revenue, WSJ Vistage Small Business CEO Survey