Small businesses increase investments to meet strong revenue projections for the year ahead [WSJ/Vistage Dec 2021]

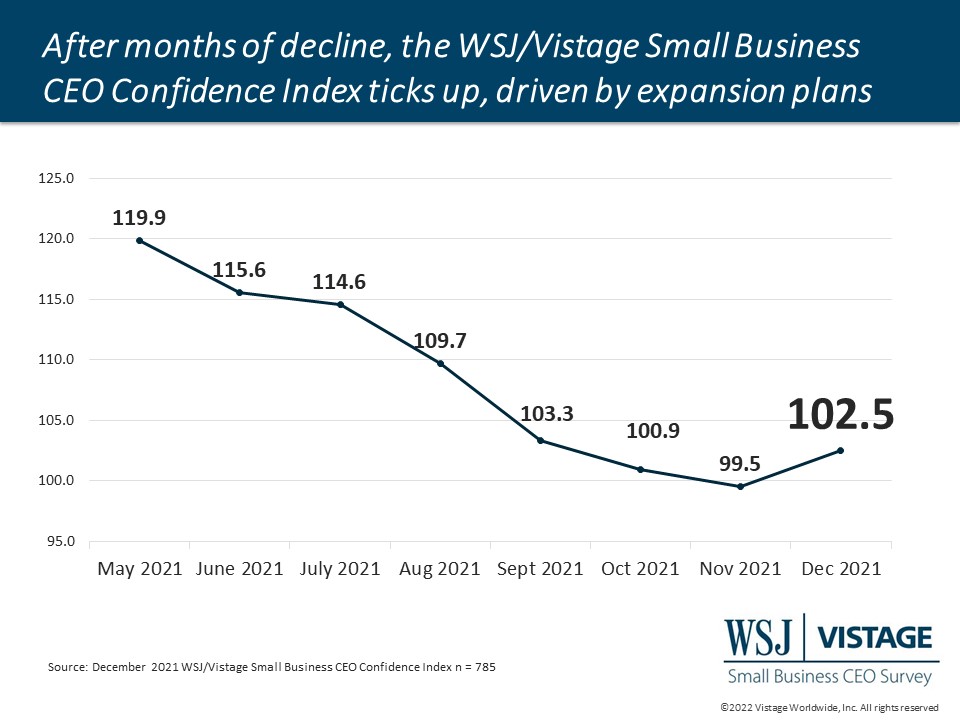

For the first time since May of 2021, the WSJ/Vistage Small Business CEO Confidence Index ticked up to 102.5 in December. What drove optimism in the face of mounting impacts of Omicron and ongoing pressures from inflation? A positive outlook for the future among small businesses: Revenue expectations for the year ahead improved, and expansion plans for both people and investments revealed growing optimism after holding steady for the 3 months prior. But headwinds are still blowing that impede more significant progress.

Growth projections drive increases in investments, headcount

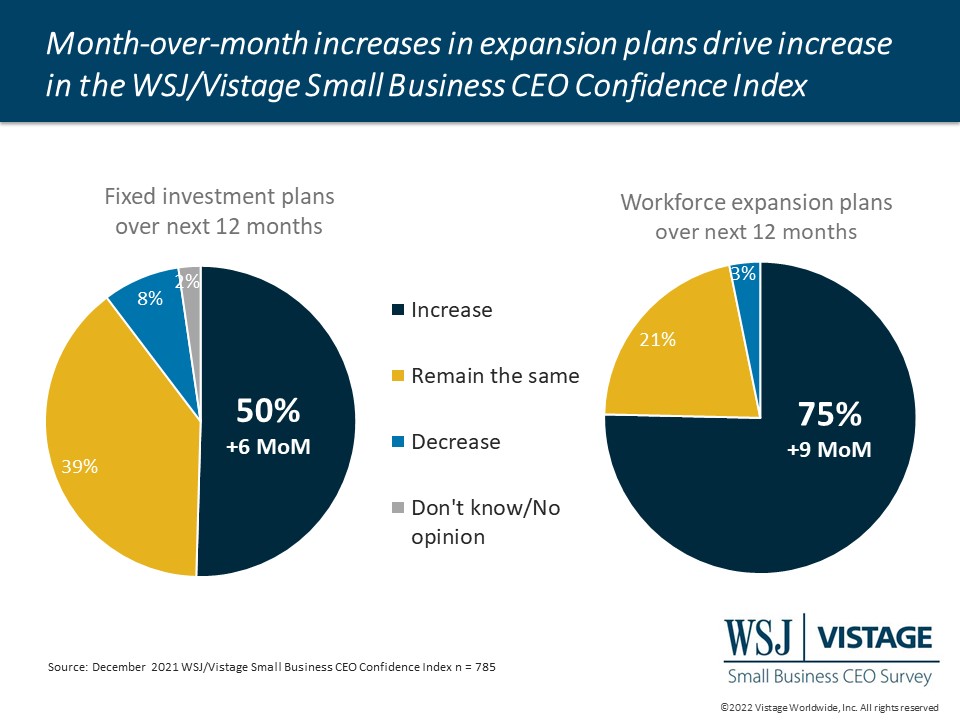

Growth projections grew 4 points in one month, with 73% of small businesses projecting increased revenues in the next 12 months in December, up from 69% in November. More significant than the optimism for growth was the increase in plans for expansion among small businesses. Three-quarters (75%) of small businesses reported plans to increase their workforce in the year ahead, which was a 9-point increase from November and matched the record-level reached last May. Plans to increase fixed investments jumped 6 percentage points from November, with half of small businesses increasing investment spending in 2022. Now is the time for small businesses to invest as interest rates remain low but are projected to rise.

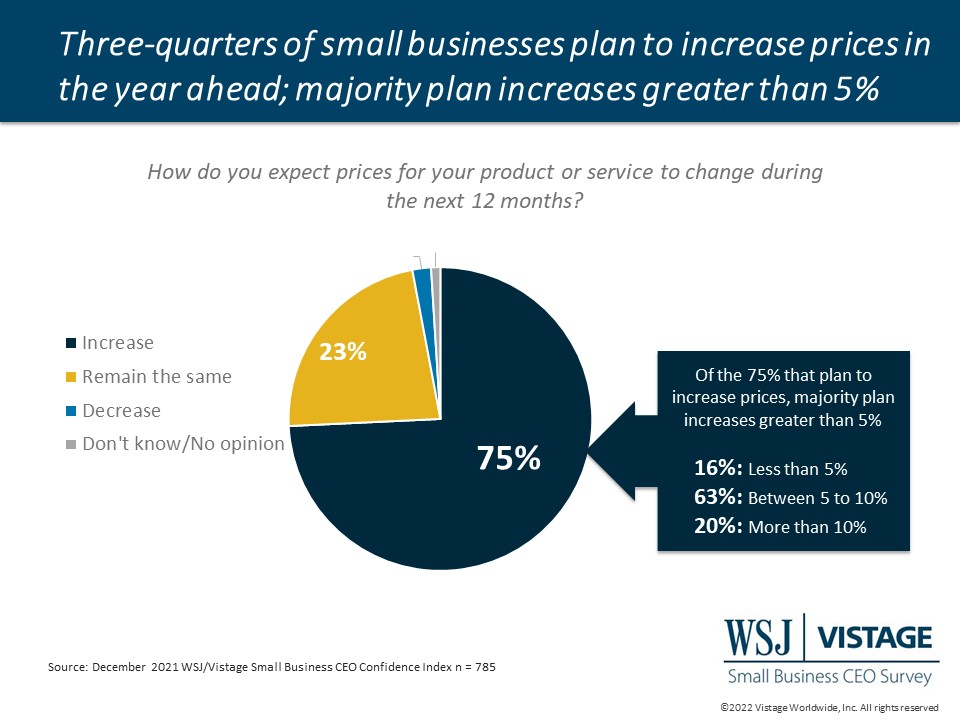

One component impacting positive revenue projections is increased selling prices. Nearly two-thirds (63%) of small businesses raised prices in the last 90 days, and 75% plan to raise prices in the year ahead, indicating that price increases are being constantly evaluated and implemented. When asked about the increases planned for 2022, just 16% of small businesses indicated less than 5%, and 63% indicated between 5 and 10%. One-in-five small businesses reported their price increases would be greater than 10%. So while increased prices might be reflected in revenues, they are clearly not adding to the bottom line as there is not a corresponding boost in profitability. Just 49% of small businesses expect increased profits, 34% expect them to remain the same and 17% expect profitability to worsen. The gap between revenue and profitability expectations will grow greater if cost pressures increase.

Headwinds continue to dim confidence

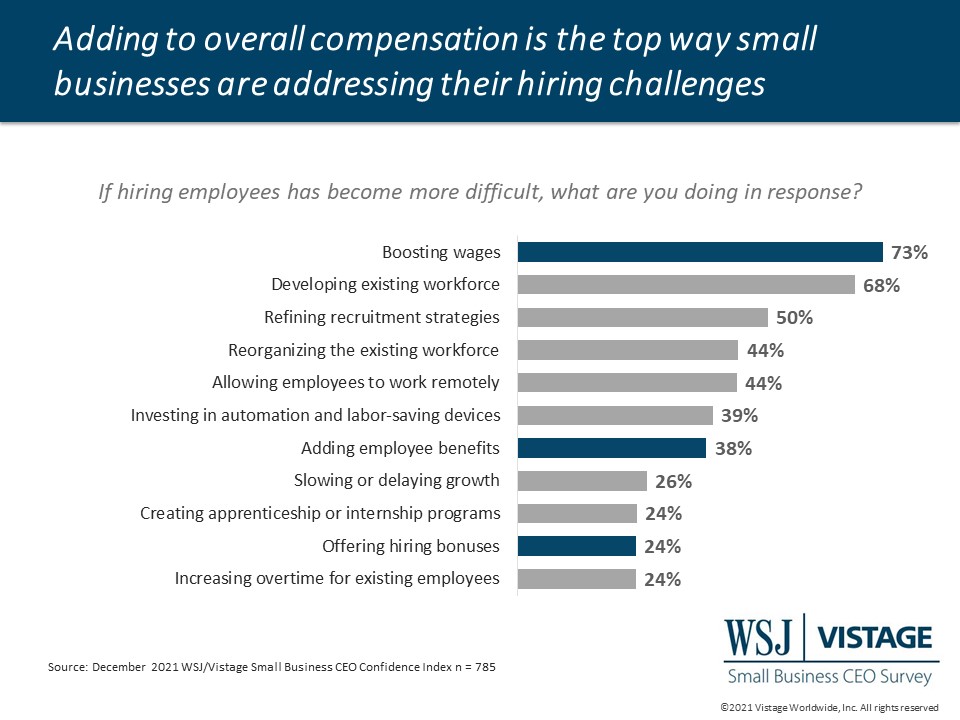

The challenge for small businesses will be how quickly and cost-effectively they will be able to grow their workforce to realize their revenue projections. Not only are small businesses adding more people, they are also paying more with 73% boosting wages in response to hiring challenges. And hiring is critical to meeting demand as 68% of small businesses surveyed in December reported difficulty operating at full capacity, up from 55% in October.

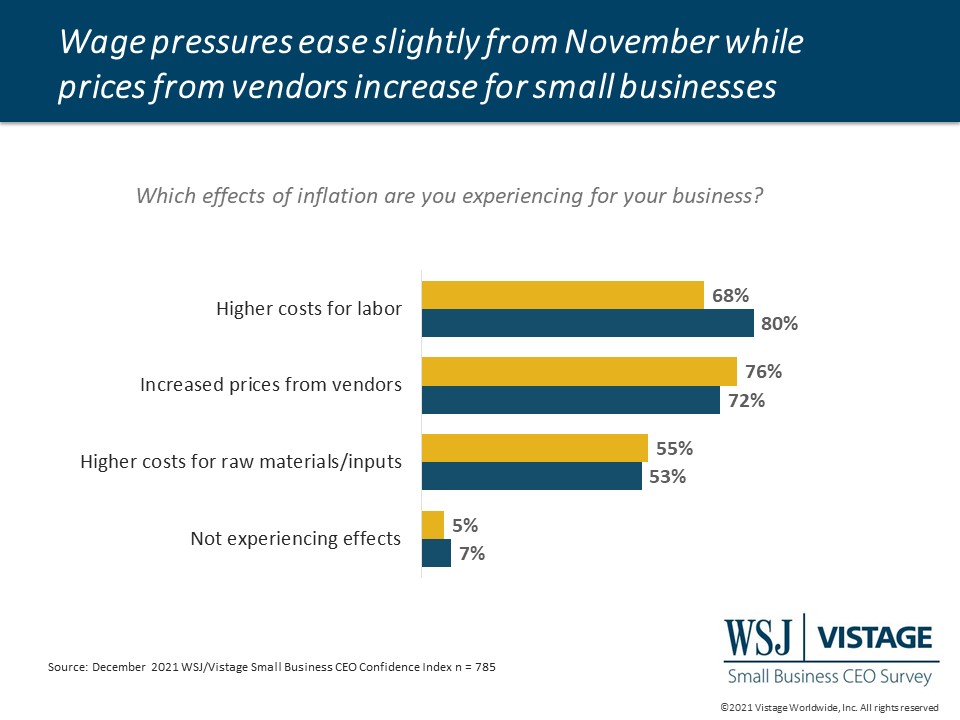

Supply chain challenges continue to be a problem for 34% of small businesses, while 30% report they are slowly getting better, and 28% report their supply chain has not been a problem. Supply chain challenges and inflationary impacts are causing pessimism about the economy among small businesses. Just 46% of small businesses said the economy had improved compared to last year, the lowest reading since 39% reached in March 2021. Looking ahead, small businesses remain divided about the economy, which is largely based on what vertical they operate in as supply chain challenges impact certain segments more than others. More than one quarter (26%) of small businesses expect the economy to improve, while 31% expect it to worsen. Inflationary pressures are a big driver of that pessimism, with more than three-quarters (76%) of small businesses surveyed citing increased prices from vendors.

Omicron looms

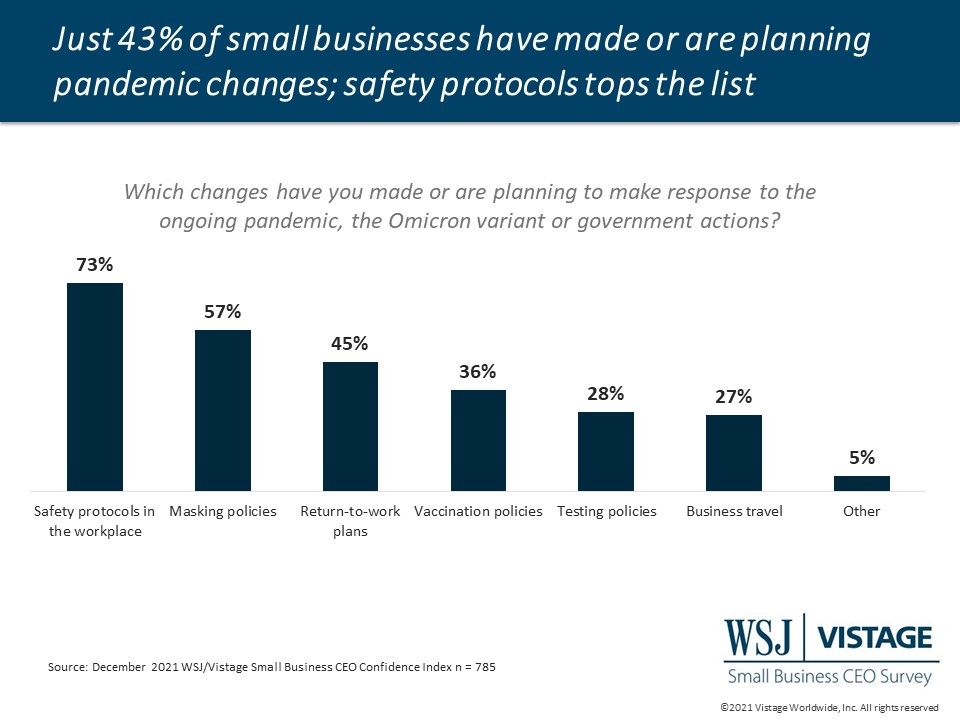

The majority of small businesses surveyed have less than 100 employees so mandates for testing or vaccines that were pending for the New Year were not a concern for them. As the survey was in the field December 6-13, 2021, small businesses were also not yet fully experiencing the impacts of the new Omicron variant. Even before Omicron surged, less than half (43%) of small businesses had already made — or were planning to make changes — in response to the pandemic and government recommendations. The top change reported by those small businesses making adjustments was changing safety protocols (73%), followed by changes to masking policies (57%). Vaccine policies have been historically unpopular among small businesses; just over one-third (36%) reported making changes to those policies. Contrast this to larger companies in our Q4 2021 Vistage CEO Confidence Index survey where a total of 58% of small and midsize businesses with over 100 employees reported they had made changes (51%) or were planning to (8%).

With most communities now reaching record-setting peaks in coronavirus cases across the U.S., the optimism in December is likely to dim as small businesses manage the impact of workers on quarantine and a dip in demand. These headwinds are likely to die down sooner than talent, inflation and supply chain, but managing the impacts of these fast-moving variants presents a challenge for small businesses leaders as they attempt to build a strategy for the future whle reacting to constantly shifting circumstances.

Download the December report for complete data and analysis

For the complete dataset and analysis of the December WSJ/Vistage Small Business CEO Confidence Index survey from University of Michigan’s Dr. Richard Curtin, download the report and infographic to learn more, including:

- Optimism about the economy continues to decline

- Expansion plans over the next 12 months increase, driven by hiring goals

- Revenue expectations grow while profit expectations continue to moderate

DOWNLOAD THE DECEMBER 2021 WSJ/VISTAGE SMALL BUSINESS REPORT

DOWNLOAD THE DECEMBER 2021 WSJ/VISTAGE SMALL BUSINESS INFOGRAPHIC

About the WSJ/Vistage Small Business CEO Survey

Interactive data from WSJ/Vistage Small Business Survey

The December WSJ/Vistage Small Business CEO survey was conducted December 6-13, 2021 and gathered 785 responses from CEOs and leaders of small businesses with revenues between $1 million and $20 million. Our January survey, in the field January 10-17, 2022, will capture the sentiment of small businesses as Omicron cases spike.

Related resources

The CEO Pulse: Inflation Resource Center

Category: Economic / Future Trends

Tags: coronavirus, Hiring, revenue, WSJ Vistage Small Business CEO Survey