CEO confidence stalls ahead of economic slowdown [Q1 2023 CEO Confidence Index]

When approaching a tight corner at high speed, a race car driver will downshift, leveraging both the brakes and the engine to slow the car into the turn. By maintaining high RPMs, the driver maintains the power and has the torque to accelerate rapidly down the track as they exit the turn.

As CEOs look at the economy ahead, many are downshifting in anticipation of a slow economic “corner” ahead before accelerating into the next growth cycle.

Most recent GDP data from Q4 2022 showed growth of 2.9%, which followed the 3.1% growth rate in Q3, both indications of a healthy — but slowing — economy. Yet 1,405 CEOs indicated serious economic concerns in the Q1 2023 Vistage CEO Confidence Index survey conducted in March. Nearly half (49%) of CEOs are moderately or extremely concerned about the impact of a recession on their business. Even more (52%) said higher interest rates were impacting their business, and another 20% anticipated they will in the future. The long-anticipated recession, a.k.a. the corner in our racing analogy, is not here yet, but the signals are clear that CEOs are preparing for the pending slowdown.

Perception is reality

Economic concerns pulled the Q1 2023 Vistage CEO Confidence Index down to 72.6, erasing two-quarters of lukewarm gains. Looking back at the economy, 58% of CEOs thought it had gotten worse, and only 9% reported it has improved despite those solid GDP growth numbers. The sentiment looking forward was no better; 53% of CEOs believe economic conditions will worsen in the year ahead offset by 9% who thought they would improve. Looking at the individual components that comprise the Index, revenue and profit expectations are below 10-year norms (2010-2020) by 16%. Plans for investments and people have remained near the average. The result is a sagging Index which indicates a slowdown at best and a recession as a probable result.

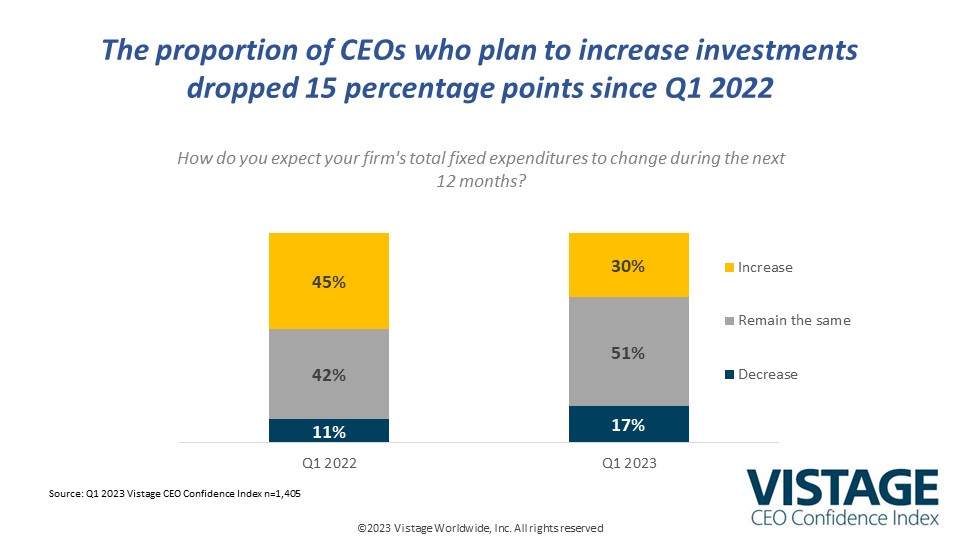

Investments are a clear gauge of SMB CEO confidence. Just 30% say they will increase investments in the year ahead, and 17% report plans to decrease investments. The number of CEOs who plan to decrease investments has been consistent over the last 4 quarters while the proportion of CEOs who plan to increase investments has dropped 15 percentage points since Q1 2022, falling from 45% to 30% and reflecting the defensive shift. Part of that slide coincides with the movement in hiring. 54% of CEOs plan to increase headcount in the year ahead, well below the peak of 76% in Q4 2021 — when the frenzy for talent was at a high — yet still approximate to the norm.

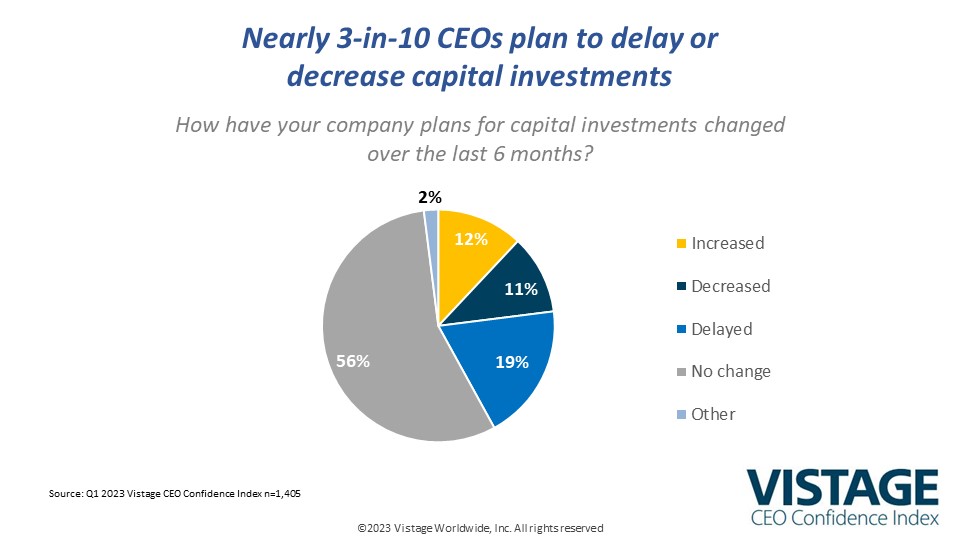

Downshifts in capital investments are beginning to signal that the economic concerns expressed by CEOs are real. Nearly one-in-five CEOs (19%) say they have delayed capital investments with another 11% reporting they have already decreased investments. Slowing down, delaying and postponing investments were common themes expressed when these CEOs were asked about their capital spending plans.

We are delaying non-essential CapX projects ’til we see positive economic indicators.

— David Pflum, President of DriSteem

We delayed three of our planned openings for this fiscal year due to margin compression and inflation.

— Kathie Niven, President and CEO of Biscuitville Inc.

Still, 56% say they are not changing plans, and 12% are increasing capital investments, which indicates they intend to power into the slowdown.

Our CEO Projections 2023 report revealed that the top investments among small and midsize businesses for 2023 are hiring and technology. Investments in automation help to address the talent shortage and improve productivity. Replacing aging equipment and rehabbing or building new facilities prepare and position the business to grow into the next growth cycle. Despite the pessimism, many CEOs are struggling to absorb the tremendous growth they recently experienced or are continuing to grow into the broader slowdown.

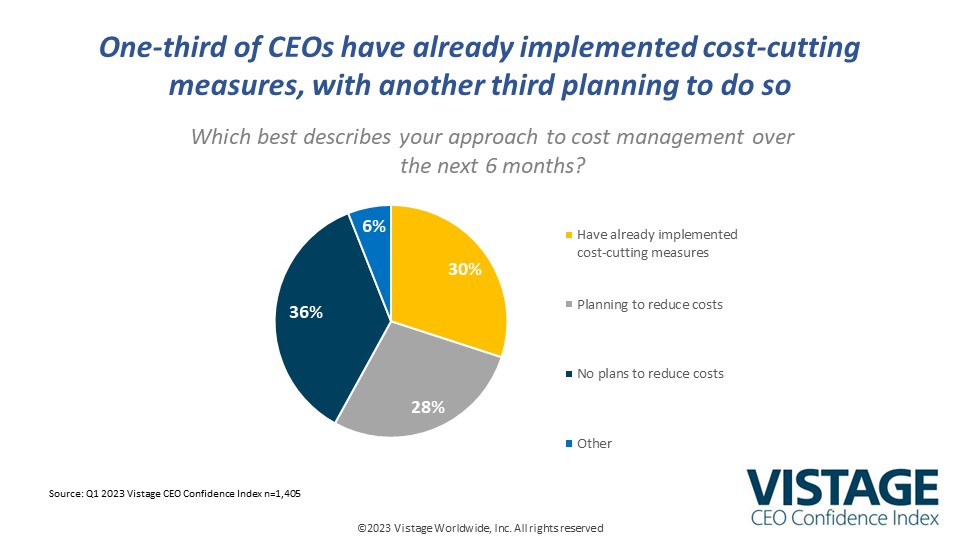

Another slowdown signal is the attention of CEOs to manage their costs. Following the economic trauma of the pandemic, CEOs are well-versed in managing cash flow and controlling expenses. Of those surveyed, 30% have already implemented cost-cutting measures over the next 6 months with another 28% planning to do the same, leaving 36% not currently planning on cuts.

Of those planning/taking cost-cutting actions, 50% are reducing or more likely to delay hiring. Only 7% said they had reduced headcount, but in preparation for a slowdown, many are considering it. Workforce benefits and employee development are almost untouchable with just 9% planning to find savings there. Sales and Marketing are also on the “do not touch” list at 13%.

Hiring slows

Relatively speaking, workforce expansion slows as the economy slows down. Following the hiring hysteria of 2021, hiring has slowed from lightning speeds to simply fast. Quit rates have slowed most recently to 3.9 million in February, which is well off the peak of 4.5 in April of 2022, yet “workforce velocity” — the disruption to the labor force measured by quit rates, open headcount and days to fill roles — remains well above pre-pandemic levels. Unemployment data has yet to show a rise. There remain almost 2 jobs for every worker with workers having unprecedented visibility to opportunities.

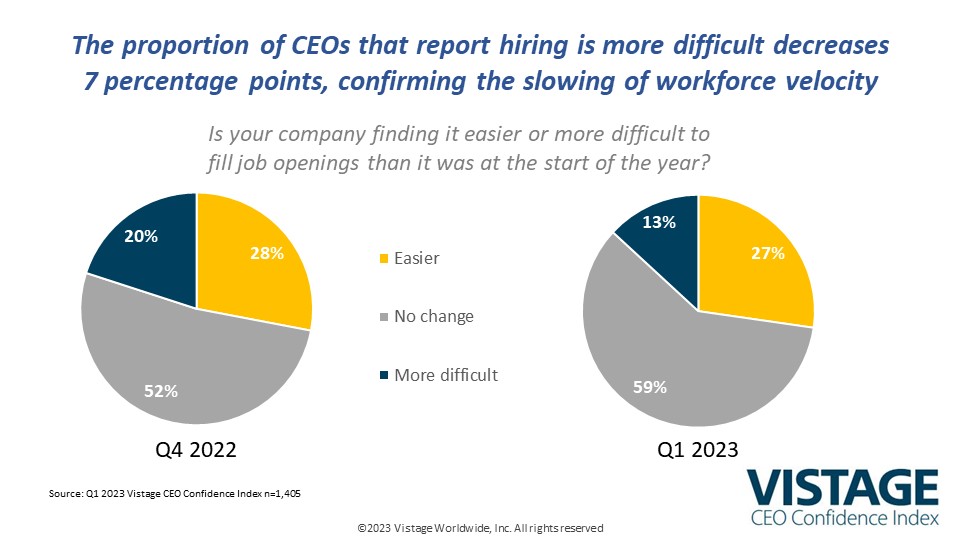

Finding talent is as challenging today as it was in 2019, the difference is that organizations have invested deeply in their hiring strategy, resulting in improved retention and slowing the need for adding incremental headcount. Only 27% of CEOs said it was easier to find workers today versus the start of the year, while just 13% said it was more difficult — down from 20% in Q4 2022 — further confirming the slowing of workforce velocity.

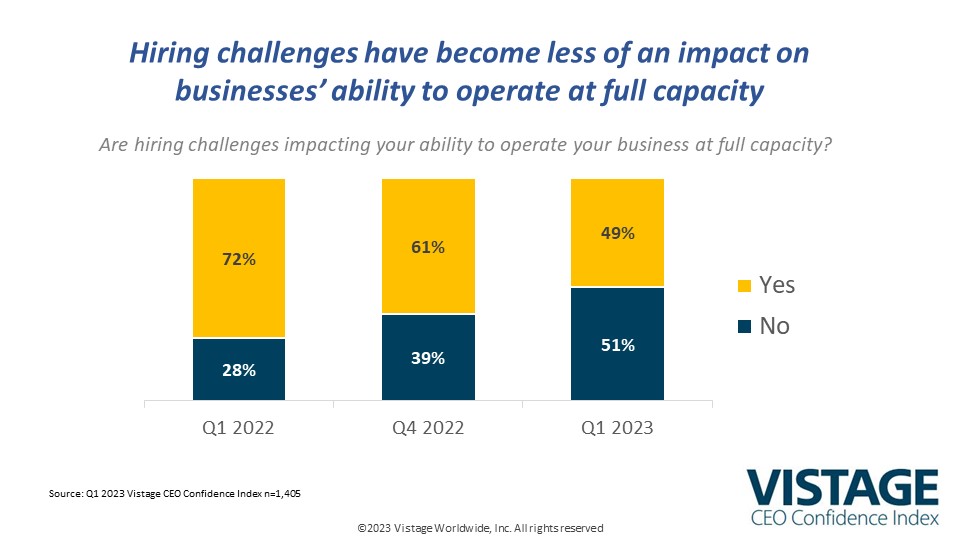

Another indicator of a slower pace of hiring is the impact of open headcount. An organization’s ability to operate at full capacity means there is a team of skilled, connected and engaged workers operating in a high-performance workplace. The absence of workers impacts that ability. A year ago, 72% said hiring challenges were impacting their ability to operate at full capacity. That number fell to 61% by Q4 and dropped to 49% in the current survey.

Many organizations are just better at hiring now than they were pre-pandemic. Our Q4 survey showed that 59% of CEOs have refined their recruiting strategies with another 29% planning on implementing changes to hire quality workers. These organizations have built up their hiring functions and now have the muscle memory to continuously seek out talent. While growth in headcount may be slowing, workforce velocity remains high forcing all organizations to be continuously hiring.

Find the apex

The race car driver continues to decelerate into the apex of the corner, at which point they get off the brake and accelerate into the straightaway. Unlike the driver, CEOs downshifting into an economic slowdown don’t know how far away or the shape of the approaching economic corner. Finding that corner in the Aftermath Economy will be hard. Many CEOs are preparing for a recession. It will take 18-24 months before we approach the next growth cycle. Until then, CEOs will need to adhere to the disciplines of finance, focus on business execution, and embrace an evolved workforce providing them with a high-performance workplace.

There will never be enough workers to satisfy headcount demands. The slowing of workforce velocity is just a temporary lull. Once the economy gains its footing and begins to rush into the next growth cycle, it will be too late to rethink your hiring strategy. The demand for talent and the costs that go with it will continue to escalate through the decade. Downshifting hiring volume into the slowdown while keeping the recruiting engine revving will position an organization to accelerate when the opportunity arises.

Related Resources

DOWNLOAD THE Q1 2023 Confidence Index REPORT

DOWNLOAD THE Q1 2023 Confidence Index INFOGRAPHIC

Category: Economic / Future Trends

Tags: CEO Confidence Index, economic forecast, Hiring and Retention, Recession