Stimulus hangover crashes CEO confidence [Q2 2022 Vistage CEO Confidence Index]

It’s hard to think of the COVID-19 pandemic as “the good old days,” but from a purely economic standpoint, once the lockdowns passed and vaccine distributions accelerated, it was. Employment recovered immediately for most sectors, government stimulus put billions of dollars in the hands of consumers who promptly spent it while the PPP program passed out even more relief to qualifying businesses with no validation or verification of need required. The surge of money into the system fueled pent-up consumer demand and unleashed a torrent of growth.

The surge in demand caught the supply chain shorthanded as container ships waited weeks to offload. The price of oil briefly went to below zero as demand dried up overnight, only to surge as the pandemic waned and the consumer engine roared back to life. The Russian invasion of Ukraine further exacerbated the issue, pressuring already surging world energy costs. Now, the hangover has set in with small and midsize businesses.

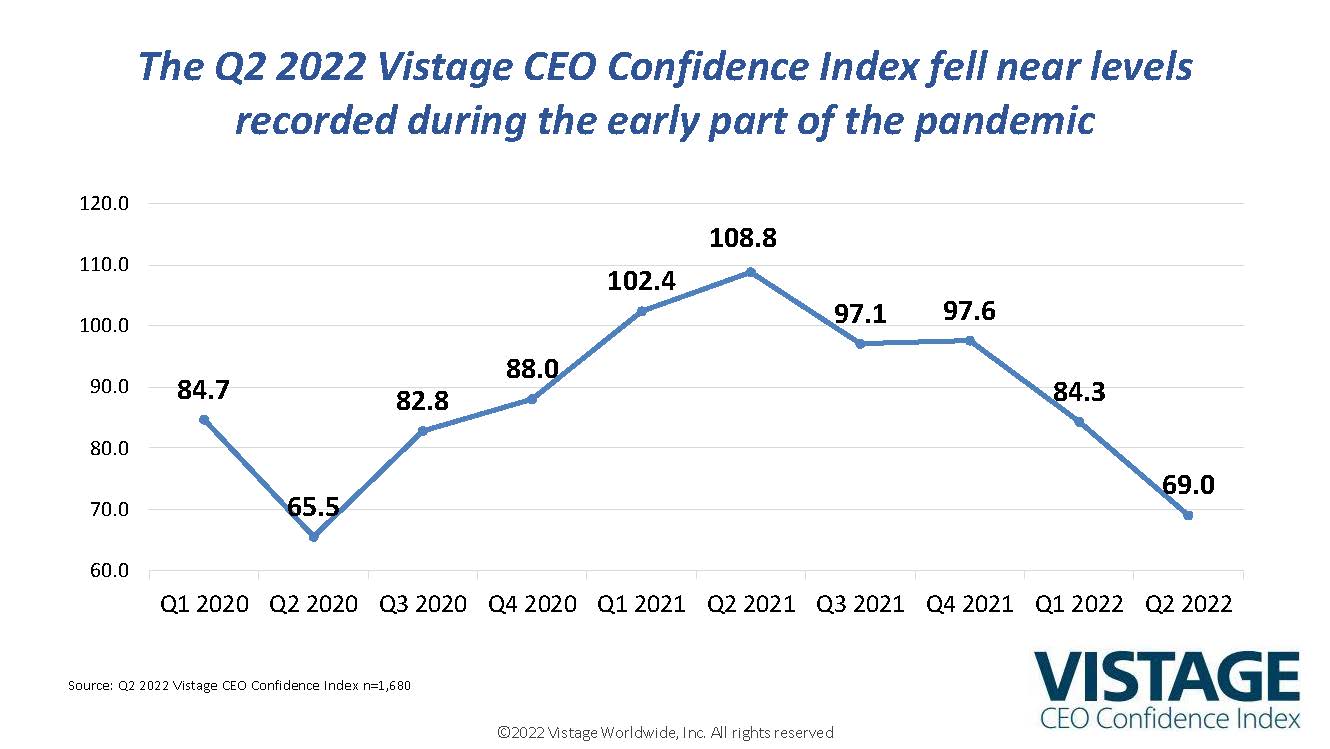

A measure of small and midsize business sentiment, the Q2 2022 Vistage CEO Confidence fell to 69.0, a 15-point drop from Q1 2022 and a 28.6-point drop from Q4 2021. Just 12 months ago the Index stood at 108.8, the highest reading since 2005. This followed one of the lowest readings — 65.5 recorded in Q2 2020 — which was taken during the depth of the pandemic. Looking deeper at the factors that comprise the Index, economic expectations have swung wildly from year to year, while plans for expansion and financial prospects have surged and then sank, just not as radically.

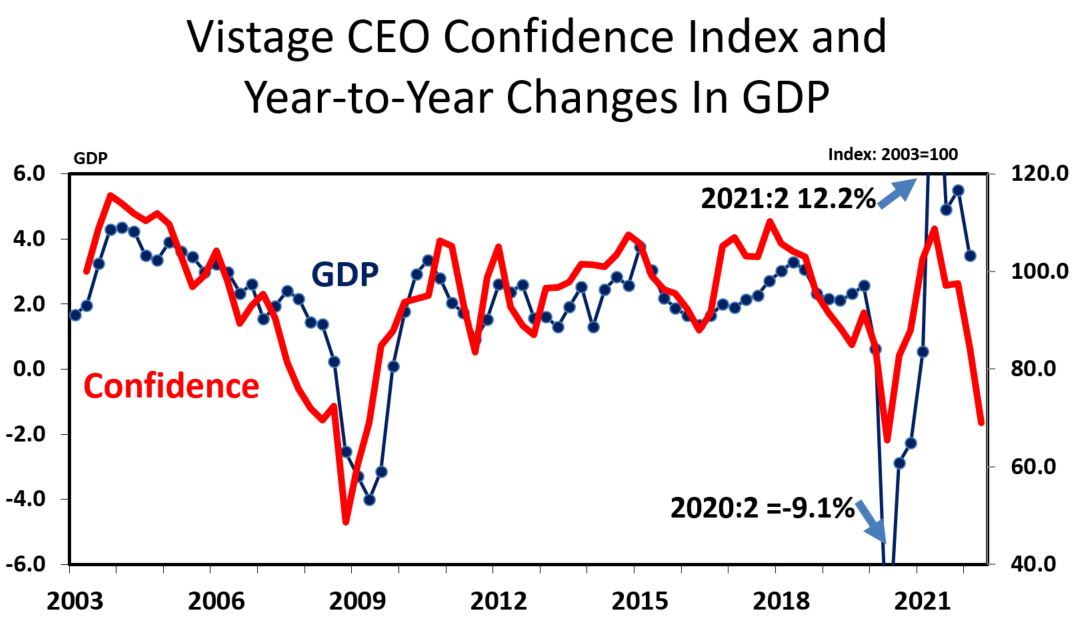

The uncertainty and volatility of the economic cycle has CEOs hypervigilant about their markets and growth implications. With today’s pressures of inflation, interest rates, cost of gas, supply chain, hiring, retention, workforce wages, and increased costs — increasing prices are on their minds. This leads to a discussion of the “R” word. Whether we are about to enter into or are already in a recession, the more important considerations are how long and how deep, questions that no one can answer. The accelerated disruption of the pandemic has led to concentrated volatility in the economy, which, in turn, is reflected in our CEO Confidence Index. And as history shows, since 2003, the Vistage CEO Confidence Index has been an accurate predictor of future GDP and growth. The forthcoming Q3 2022 survey in September will be pivotal to understanding if we have indeed hit the low.

From a historical perspective, the CEO Confidence Index points to a rapid slowdown of economic activity in the immediate term as CEOs take foundational steps to prepare for slower growth. Factoring the concentrated volatility of the post-pandemic economy and the still healthy outlook for growth and hiring suggests the economy will dip but quickly moderate as consumer demand slows but stays solid, oil prices stabilize diffusing inflation and the job market remains strong keeping consumers at work.

Business Challenges

The uncertainty and the speed of disruption in today’s economy has created many tests for CEOs. When asked to describe their biggest business challenges, hiring and retention, inflation, and supply chain far and away topped the list. Well behind — but still notable — were comments about customers, growth and sales. Also present were include timeless challenges like succession planning, financial issues like cash flow and building a strong culture. Concerns about burnout, work-from-home or COVID have faded from the list of challenges.

Hiring and retention

Despite the gloomy economic data, hiring and retention was the most commonly cited business challenge. CEOs are continuing to hire, working hard on retention and are less than eager to let hard-won workers go. Comparing today to the pre-pandemic economy, 52% of CEOs plan to increase their headcount in the year ahead, down just 4 points from 56% recorded in Q2 2019. While this has declined from 76% recorded in December, it is important to note that since the beginning of 2022, 51% of CEOs have increased headcount, indicating that many projected hires for the year have already happened.

Staffing to meet current demand (76%), scaling for increased customer demand (52%) and expanding to new markets (24%) were the key drivers for the recent increase in staff.

Of the 11% who have decreased staff this year, only 23% expressed concerns about the economy as a factor in that decline. The top impacts of workforce declines included: difficulty attracting and retaining employees (63%), difficulty competing for talent with larger companies (40%) and decrease in demand (21%)

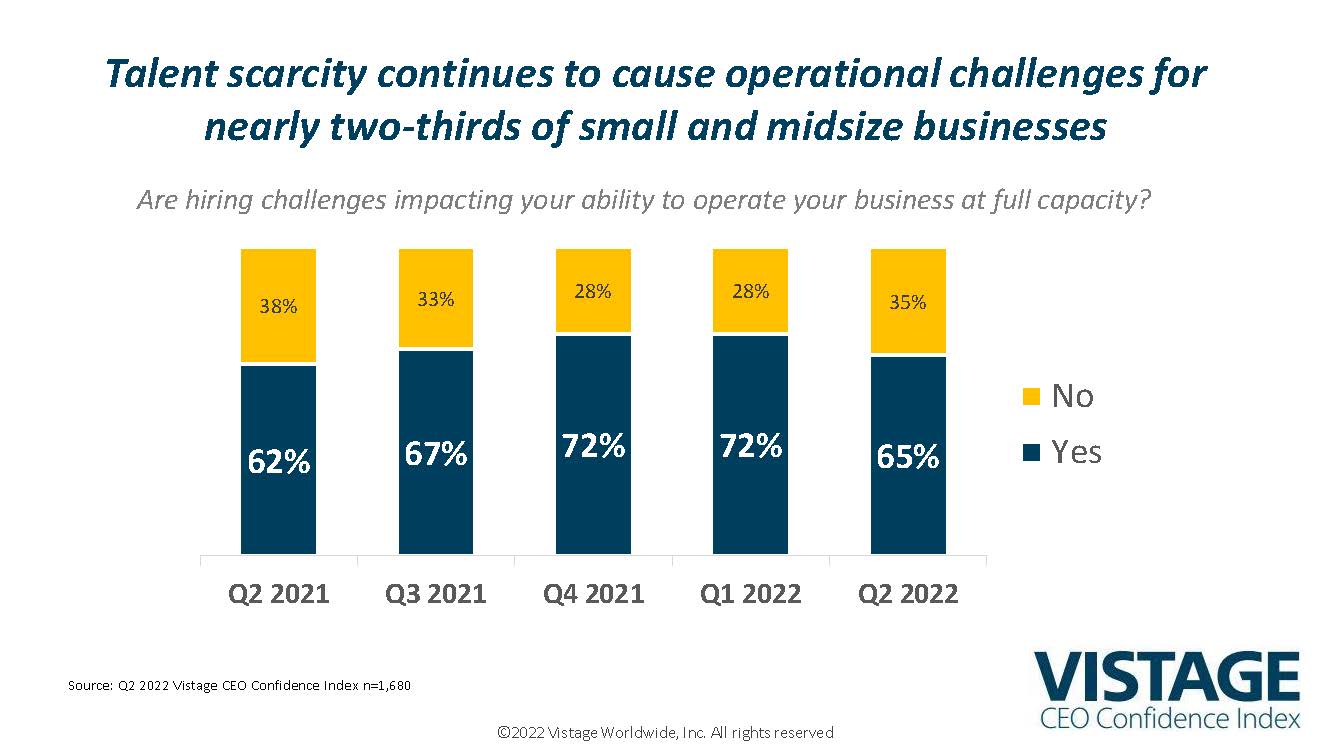

The talent wars continue to rage, just not as fiercely as before. Currently, 65% of CEOs report that hiring challenges are impacting their ability to operate at full capacity. That’s down from the 72% recorded in both Q1 2022 and Q4 2021.

To address hiring challenges, 80% of small and midsize businesses have boosted wages, with an additional 10% planning to implement wage increases in the future.

Second to boosting wages, 70% of CEOs are investing in employee development with another 22% planning to do so in the future. Development efforts are twofold, first as a differentiator to attract new employees, and secondarily to retain and improve the existing workforce. Remote work options continue to be an employee demand and 62% of CEOs are allowing remote work options.

Hiring and retention will remain a top challenge regardless of how the economy swings. The “Great Resignation” has become the “Big Upgrade” as workers of all types and at every level look for a better work experience in terms of role, responsibility, compensation, benefits, work environment and flexibility. The requests of the Millennial/Gen Z workforce prior to the pandemic have become demands in today’s competition for talent. With unemployment still historically low, the empowered workforce will continue to have options.

The feverish pace of hiring will slow some, but the significance of employee retention will only grow. Until layoffs become the norm and unemployment rises, the Big Upgrade will continue. Choices may be fewer, but still abundant. As the adage goes, “a recession is when your neighbor losses his job, a depression is when you lose yours.” Right now, few employees are losing their job outside of specific sectors like technology. In fact, many people are upgrading.

Inflation

Inflation has steadily risen from effectively zero in June of 2020 to today’s 8.6%. Once again, the accelerated disruption of the pandemic has resulted in concentrated volatility as inflation went from a very steady 1.5% or so from the good old days to the 40-year high we are currently experiencing. Inflation has become a key business challenge for CEOs to navigate, and it’s even harder to anticipate its peak or duration.

The top driver of rising costs is wages and compensation according to 89% of CEOs. Close behind, 82% reported increased prices from their vendors. Increased energy prices, which contribute to the cost of everything, were identified by 63% and increased costs for raw materials and other inputs became issues for 61% of CEOs. The result? The rising cost of everything is raising the price of everything — a vicious price cycle that feeds on itself.

Consequently, 76% of CEOs will be raising prices again in the year ahead. We’ve come to accept higher costs for everything we purchase, from “added fuel surcharge” on a bill or higher prices at the grocery store. The hangover from a massive stimulus of money into the system has yet to run its full course, but over time slowing demand will occur just as supply catches up. What will continue to stoke inflation will be the continued increase of wages and benefits to attract and retain talent and the concentrated volatility of crude oil supply and price.

Supply Chain

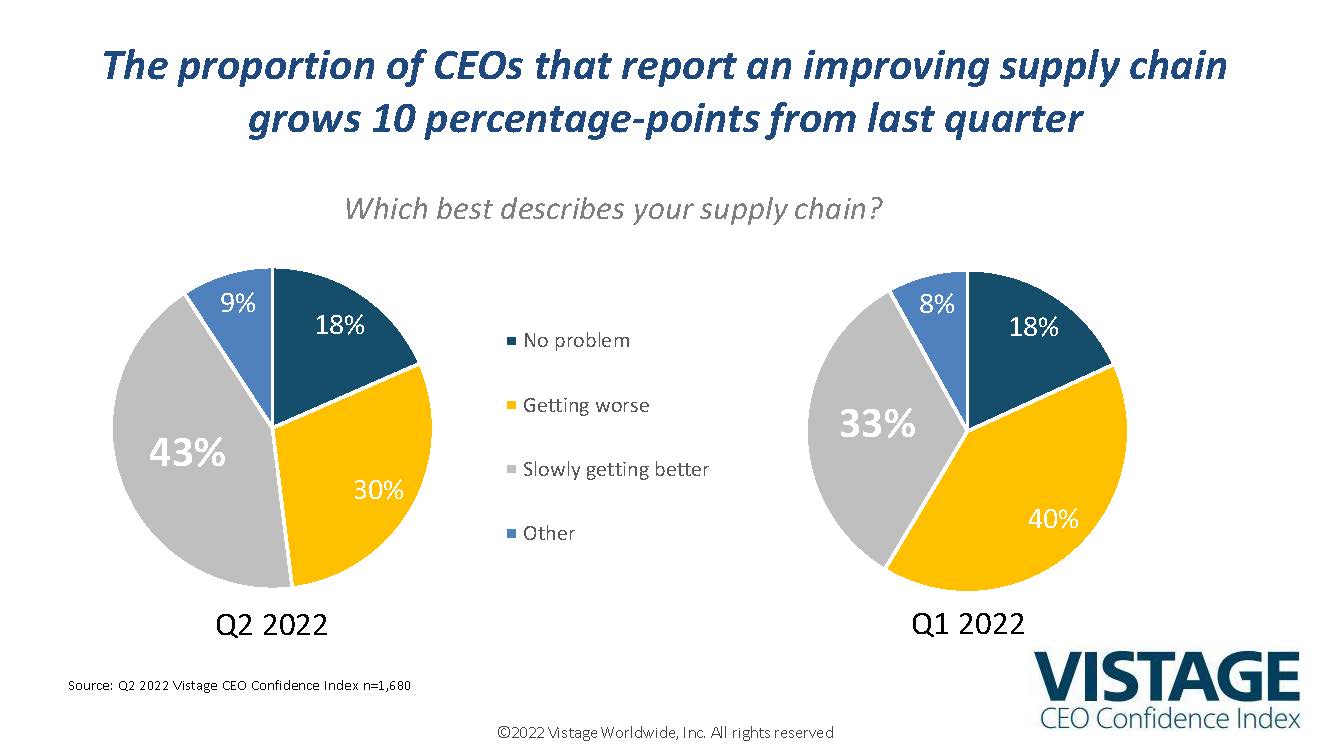

Availability of components and raw materials, slow deliveries, and transportation issues are the key drivers behind supply chain business challenges, all of which contribute to inflation as costs rise across the supply chain. While far from the rhythm of a predictable pre-pandemic world, the supply chain is slowly healing. 43% of CEOs said exactly that, up from 33% in Q1 2022. 30% still see it getting worse but that’s down from 40% in Q1 and exactly 18% report supply chain was “no problem” in both surveys, which is largely driven by the industry of respondents.

The improving supply chain still has a lot of opportunities to re-establish consistency and confidence. Recent lockdowns in China and the disruption of manufacturing and transportation will send more ripples of volatility through the system. Slowing demand will relieve some of the pressure as global demand steadies and global economies slow. Continued improvement will reduce some of the inflationary pressures driven by the supply/demand continuum.

Resetting Reality

Volatility and uncertainty best describe the June 2022 economic landscape. The accelerated disruption brought on by the pandemic has taken us from the good old days of 2019 and prior when steady growth and historically low interest and unemployment rates were the norms to a rapidly shifting, unpredictable, post-pandemic environment we must all now function within. We’ve entered a new economic reality where the bar for expected economic activity will need to be reset.

Elevated inflation will become part of everyday life and a closely monitored data point. Completely benign in the good old days of the pre-pandemic economy, inflation will vacillate at levels above the Federal Reserve’s desired 2%. Higher interest rates will also reset above the artificially, historically low rates from the past few years. From the cost of capital to credit card debt, interest rates will be higher and reverberate throughout the economy. Energy costs will not subside even as demand settles back a bit. Renewable sources of energy can barely keep pace with always growing demand. And human capital is the fossil fuel of the growth engine, which translates into a long and protracted talent war where the emerging, empowered workforce resets the definitions of work and workplace.

The business classic “Who moved my cheese?” tells the story of two mice, one who keeps looking for the cheese in its usual spot and the other who quickly realizes the cheese was gone and seeks out other sources of cheese. This paradigm shift highlights the fact when a shift occurs, everything resets to zero. The cheese has moved. Those that realize and take action to find new cheese will mitigate the effects of this downtown and be best poised for the next surge of growth.

Related Resources

Category: Economic / Future Trends

Tags: CEO Confidence Index, Hiring and Retention, inflation, supply chain