CEOs report escalating uncertainty [Q1 2022 Vistage CEO Confidence Index]

The crystal ball for 2022 is now as opaque as a bowling ball. In just 90 days since the Q4 CEO Confidence Index survey in December, we’ve seen the COVID-19 Omicron variant rise, spike and fall only to have the Russian invasion of Ukraine take its place.

The war and its resulting surges in energy prices have spurred inflation, which continues to push the once-even economic tug of war between growth and challenges to the negative side. The lowering of inflation rates and improving supply chain — once anticipated to arrive later this year — now have no predictable direction as long as the Russian war in Ukraine rages.

The result? Small and midsize business CEOs are preparing for what could be the continued deterioration of growth and more inflationary impacts over a longer period of time.

The economic headwinds of high inflation, continued supply chain disruptions and the raging talent wars have gained the edge on once-promising hiring plans, increased investment plans and projected growth. The Q1 Vistage CEO Confidence Index survey, conducted March 7-14 2022, saw growing concerns over the economy, sagging revenue and profit expectations, and strong-but-declining investment levels.

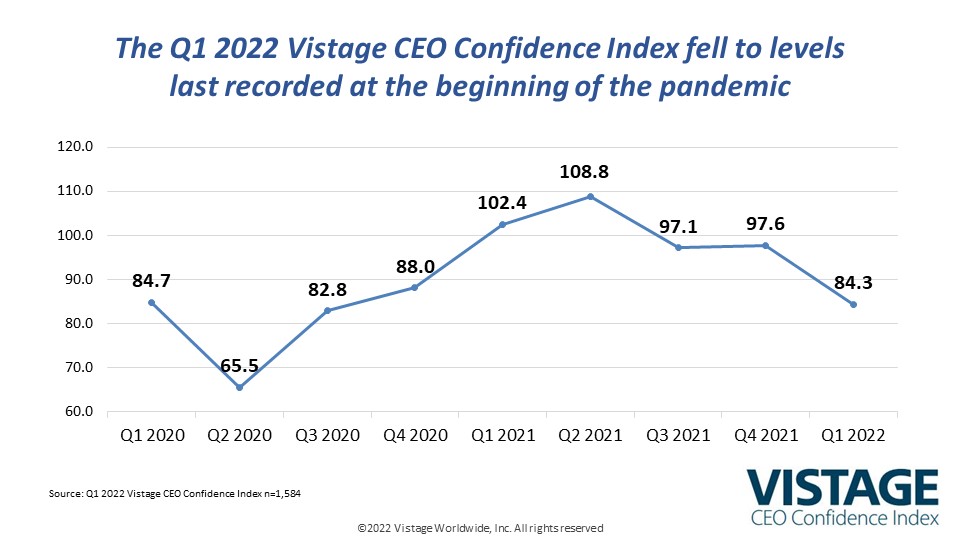

Even the proportion of CEOs planning to increase their workforce in the year ahead fell from an all-time record of 76% in Q4 to 65%. The Q1 2022 CEO Confidence Index of 84.3 reflects an escalating uncertainty buoyed by a decelerating-but-still-strong economy despite being down more than 24 points from the recent plateau reached in Q2 2021 (108.8).

The Q1 reading of 84.3 is nearly at the same level as the Index’s recording in Q1 2020 (84.7), just as COVID began to shut everything down.

Dealing with disruptions

CEOs identified rising inflation, still-struggling supply chains and the raging talent wars (in no particular order) as the major disruptions they continue to face. The absolute uncertainty of the Russia-Ukraine war only amplifies these concerns. The timing and range of potential outcomes in Ukraine is so varied that the immediate and long-term global economic impacts cannot be assessed until both sides reach a negotiated truce.

Consequently, caution creeps into the edge of every plan. The events of the next 90 days will determine if the Index dives as it did 2 years ago when news progressively worsened or turns positive with a ceasefire and path to peace.

Headwinds persist

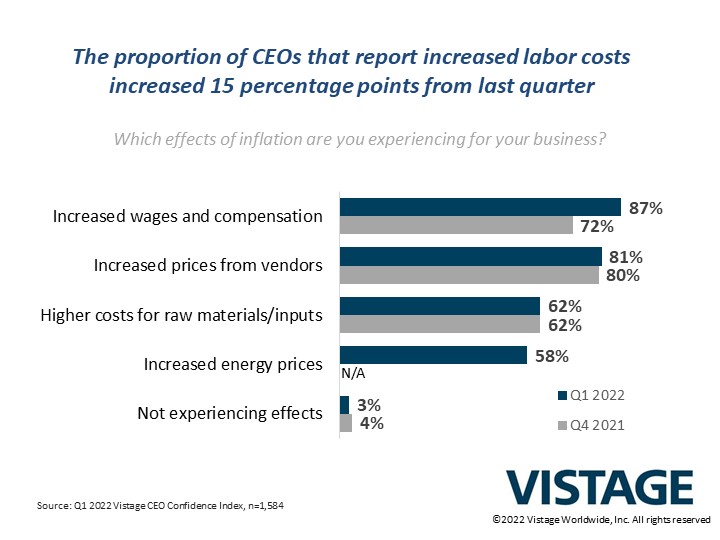

Inflation remains a major challenge for CEOs to deal with at levels they’ve never experienced. Slowing consumer demand will reduce part of the pressure, but any hopes for falling inflation seem unlikely as long as CEOs contend with:

- continued supply chain disruptions driving material shortages and increasing costs,

- relentlessly climbing wages and salaries, a necessity to compete for talent,

- and increasing pressure on energy costs as a result of the Russia-Ukraine war.

The Federal Reserve has begun increasing rates in the hopes of reigning in inflation, but that impact won’t be felt for some time, whereas a resolution in Ukraine in the near future could bring much sought-after relief.

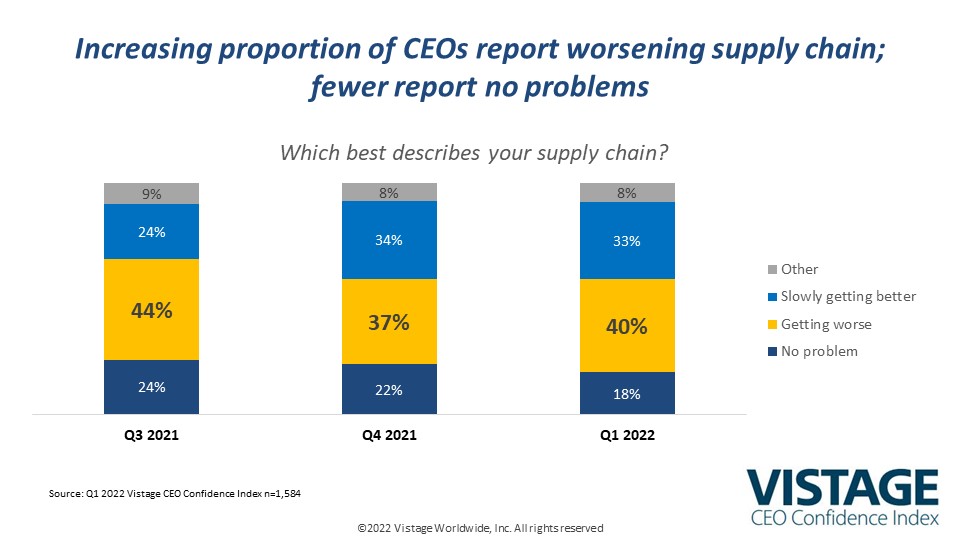

The supply chain is no longer healing. In Q4, 44% of CEOs reported their supply chain was slowly improving, up from just 24% in Q3. Now, a sagging 33% of CEOs report improvements to the supply chain, and 40% think it’s getting worse, up from 37% in Q3.

The problems of increased traffic, sporadic COVID-related shutdowns and manpower challenges within the intersection of transportation and commerce continue to plague the supply chain. Add in the supply disruptions from the Ukraine war in energy, wheat and certain minerals, and the outcome projects continued problems with a much-slower-than-anticipated recovery.

Meanwhile, the hiring and retention of people continues to be the top-of-mind issue facing CEOs in spite of the economic and geopolitical uncertainty that dominates the headlines. The competition for talent is extreme for every job type ranging from frontline to executive levels. Increasing wages continue to be a requirement for small and midsize businesses to both attract and retain their workforce.

The good news is that employee retention numbers have stabilized from the prior three quarters. While the surge of CEOs’ planning workforce expansion has backed down from last quarter’s 76%, in the Q1 survey 65% of CEOs report plans to increase headcount in the year ahead. The increase in retention and the softening of hiring may imply that some of the year’s hiring has already taken place, but strong demand remains. This remains essential as 72% of CEOs reported that hiring challenges hinder their ability to operate at full capacity.

With steady economic growth expected over the next 3 years, hiring demands will only intensify. Retention becomes one of the most critical CEO dashboard data points. There are many strategies and tactics to improve performance and productivity like employee development, manager training and investments in technology, but increasing headcount is required for sustainable, predictable growth. People are the fossil fuel of the growth engine.

Cyber strikes

As if all this wasn’t enough, a cyberattack remains the greatest day-to-day threat to any business. In the Q4 2021 CEO Confidence Index survey, 5% of CEOs reported a cyberattack that resulted in lost data, while an additional 20% experienced a cyber event but lost no data. The horror stories of companies paying lots of Bitcoin to release their data are well known. The good news is that now 51% of small and midsize businesses say they have an active, up-to-date cybersecurity plan in place.

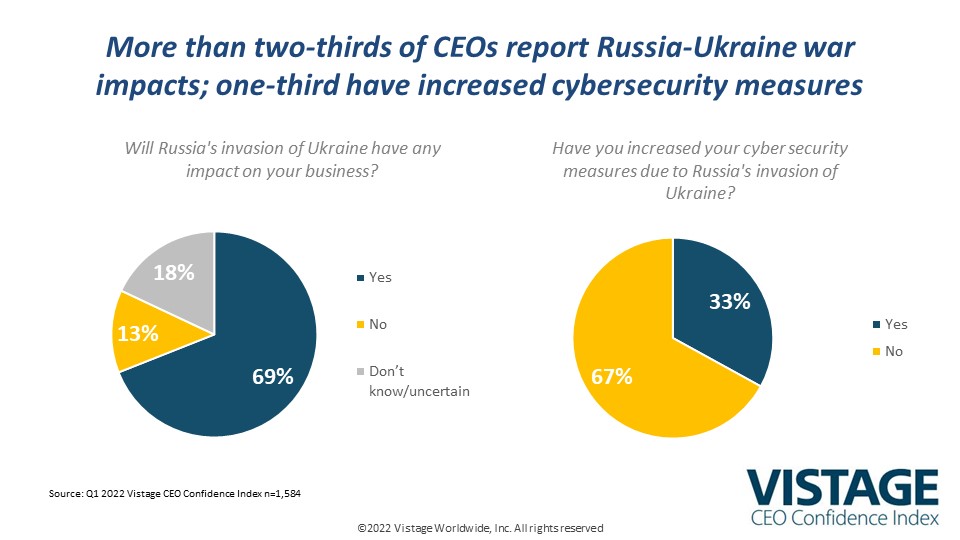

The cyber landscape and its threat to SMBs have only escalated with the Russia-Ukraine war. Warnings of increased cyberattacks have expanded beyond government and big business technology ecosystems as they now aggressively target SMBs and high net worth individuals. In response to the increased threat, 33% of CEOs have increased their security measures as a result of Russia’s invasion.

In addition to your organization, consider updating or upgrading your personal and family security measures; cyber will always be an immediate risk.

Challenges ahead

Hiring and retaining people remains the top leadership and business challenge for CEOs as reported in our recent report, CEO Projections 2022: Embrace the Employee Revolution. Unless we enter into a significant recession — and that is possible given the Russia-Ukraine war — the ability to compete for and retain people will determine who grows the fastest and the most.

The pent-up surge of employee “quits” might be past the peak as the Bureau of Labor Statistics reported 2.9 million quits in February compared to November’s 4.5 million. During this time projected hiring numbers dropped a bit and disruptions grew. Uncertainty not only impacts those hiring but also impacts workers considering changing jobs. As we saw during COVID, when things were uncertain, fewer people voluntarily switched jobs. Once confidence was restored, the job migration accelerated.

We’re 3 months into 2022, and already we’ve seen two major disruptions with no end in sight to the war. Economic projections remain strong for the balance of 2022 and 2023. However, the trauma of the pandemic that began 2 years ago is now amplified by headlines of war, raising the fear, uncertainty and doubt quotient for CEOs.

Lessons learned from COVID about the importance of cash flow, having an established line of credit and projecting a strong corporate culture will be applied should the war drag on throughout the year. Eventually, the conflict may reach an acceptable stalemate, providing a semblance of stability and allowing for new rules of security, finance and trade with Russia to take hold. Deescalation will dramatically reduce CEO fears and enable them to focus on growth.

In either case, COVID provided hard-learned lessons around flexibility and resiliency, and CEOs who navigate through the uncertainty that defines this new reality will be rewarded further down the road.

Related resources

Category: Economic / Future Trends

Tags: CEO Confidence Index, cybersecurity, Hiring and Retention, supply chain