4 ways CEOs can get recession ready

Many business leaders are seeking advice on how to survive a recession as they watch signals suggesting an impending economic slowdown.

Persistent high inflation is pushing interest rates higher, which is offset by historically low unemployment rates driven by workers seeking better compensation.

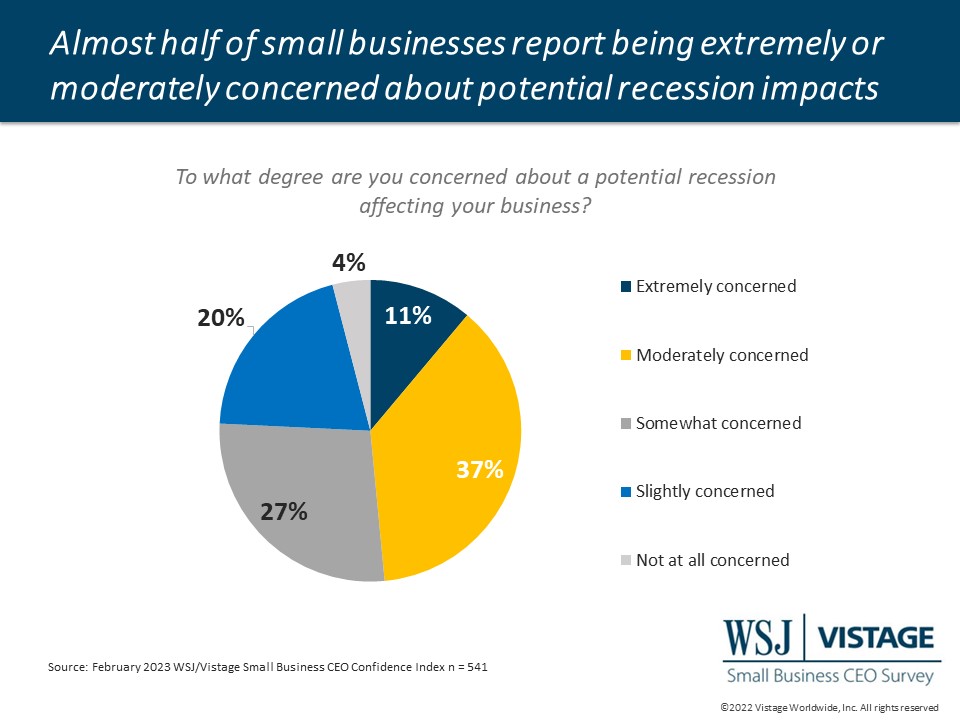

In fact, the February WSJ/Vistage Small Business CEO Confidence Index found that 48% of small businesses are extremely or moderately worried about the impacts of a recession on their organizations.

The result is the “Aftermath Economy,” which is defined as a period of low-to-no growth as the economic aftershocks of the pandemic subside. A recession may or may not be in our future, but what is assured is a period of instability as business conditions reset and realign for a yet-to-be-named growth cycle.

How to prepare for a recession

Finding the path to grow forward will first require a transition through the slowdown and preparation for a potential recession, all the while keeping an eye on opportunities presented in the aftermath.

Everything has changed in the Aftermath Economy. There are new economic realities that create a challenging environment for growth. The workforce has changed as a result of the pandemic and generational shifts. The workplace has changed for hybrid knowledge workers and essential workers. There have also been abrupt changes in customer buying behavior. Yet the foundation for business growth remains the same.

Tips for businesses to survive recessions

The foundation for business growth, whether in a recession or not, requires four key areas of focus:

1. Fiscal discipline

The hard-learned financial lessons of the pandemic remain in effect. Cash flow, access to capital and a diversified supply chain create the financial foundation to manage through any downturn without having to make dramatic cuts.

Inflation will force a continued increase in costs that must be managed through strategic price increases. Rising interest rates will make CEOs consider investment decisions that have a clear ROI.

The cost of labor will continue to increase, however, cutting headcount should be a last-ditch tactic. Learn more perspectives and tips on cash management in a recent UBS discussion on financial resilience.

2. Operational execution

The ability to operate at full capacity requires a fully staffed, trained and experienced organization powered by leading-edge tools and technology. Highly engaged workforces have higher retention and productivity rates.

Providing an empowering and secure workplace — equipped with the best tools/technology and led by high-quality bosses — creates the optimal platform for performance. CEOs control the elements of execution.

They define and amplify the culture, and provide the physical tools and workspace. They choose and empower bosses to promote strategy, define activities and goals, and maintain standards for performance.

3. Workforce competition

Workforce velocity — which is measured by quit rates, open headcount and days to fill — is a phenomenon of the Aftermath Economy. Stubbornly high quit rates are fueled by an insatiable demand by small and midsize businesses (SMBs) for talent.

While big companies, particularly those in the tech industry, have announced layoffs, 60% of Vistage CEOs plan to increase headcount. This, in turn, leads to increased open headcount rates that are taking longer to fill with someone less experienced and asking for more compensation.

Competing for talent begins with retaining the current workforce. Compensation matters, but now flexibility and employee experience become competitive differentiators in the never-ending talent wars.

4. Get close to customers

Everyone is dealing with the Aftermath Economy, including your customers. They are struggling with the same economic, workplace and workforce challenges. Getting closer to your customers is always the right answer, but more so in the aftermath.

Communicating price increases provides an opportunity to reinforce value and understanding of the customer’s needs. Partnering in hard times yields benefits when growth returns. It’s also an opportune time to call on your competitors’ top accounts to determine if there are needs that you can fulfill better than your competition.

How to take advantage of a recession

Growing forward in the Aftermath Economy will be hard. It will take 18 to 24 months before we find the path to the next growth cycle. Until then, CEOs will need to adhere to the disciplines of finance, focus on the principles of business execution, embrace an evolved workforce and provide them with a high-performance workplace. CEOs will also need to adapt as leaders along with their executive teams to uncover opportunities in the aftermath.

To understand the changing sentiment of small and midsize business leaders in the face of recession forecasts, watch for our analysis of the Q1 2023 Vistage CEO Confidence Index in April. This leading indicator can inform and validate your decisions about your strategies and investments.

Related Resources

Strategic pricing when inflation crashes into recession

Market volatility, rising rates, and recession – Asset protection for a down cycle [Webinar on-demand]

Category: Financials

Tags: financial management, inflation, pricing strategies, Recession