Small business confidence splits over soft landing vs. recession. [WSJ/Vistage Aug 2023]

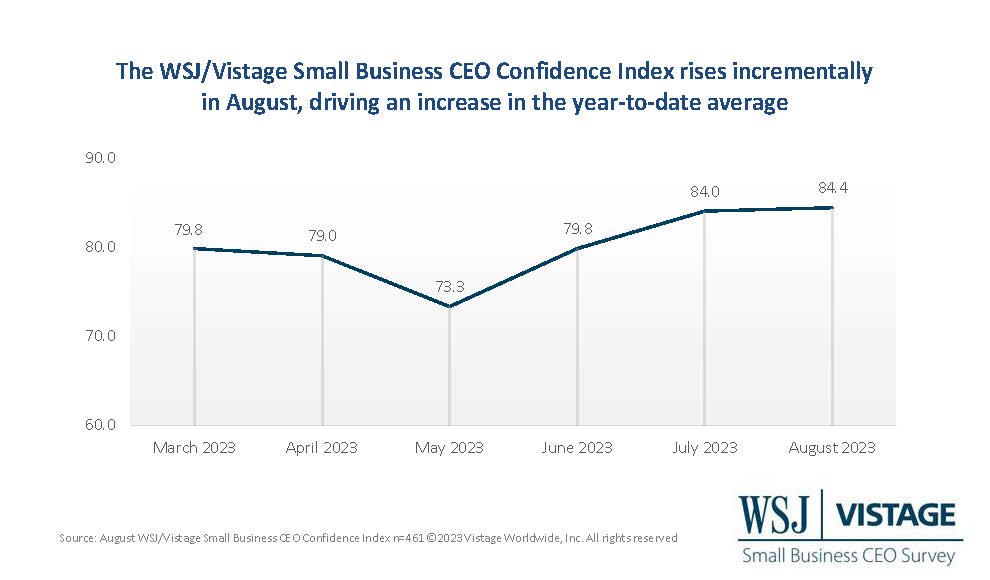

Overall confidence among small businesses rose incrementally in August for the third month in a row, with the WSJ/Vistage Small Business CEO Confidence Index reaching 84.4. The last two months have driven the year-to-date average to 81. However, this remains below the same period last year when the average was recorded at 86.4.

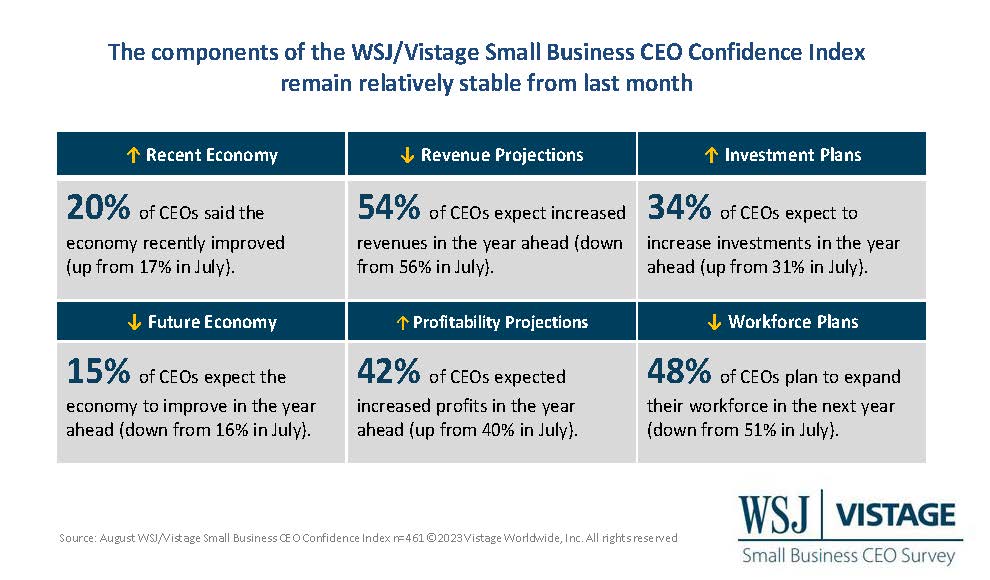

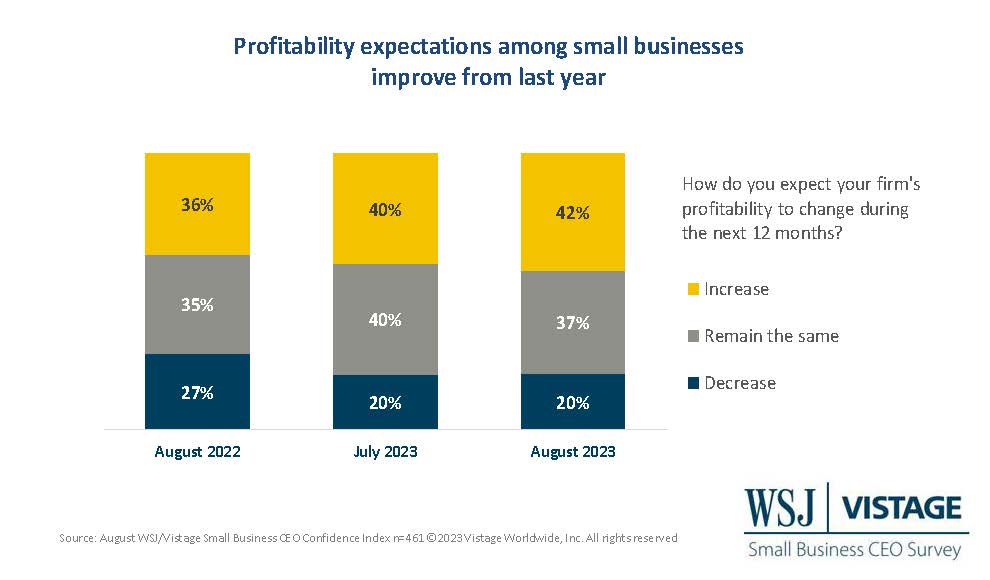

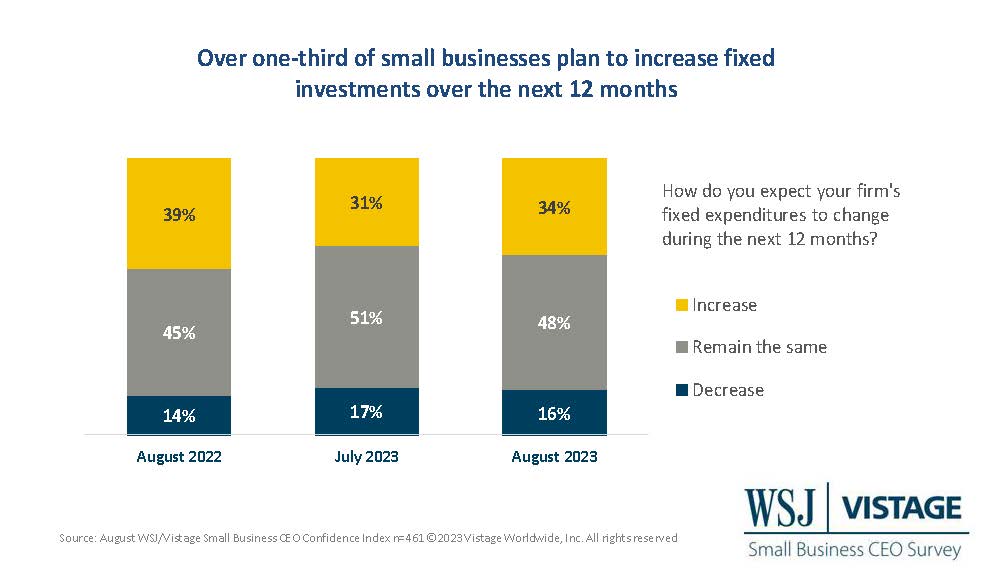

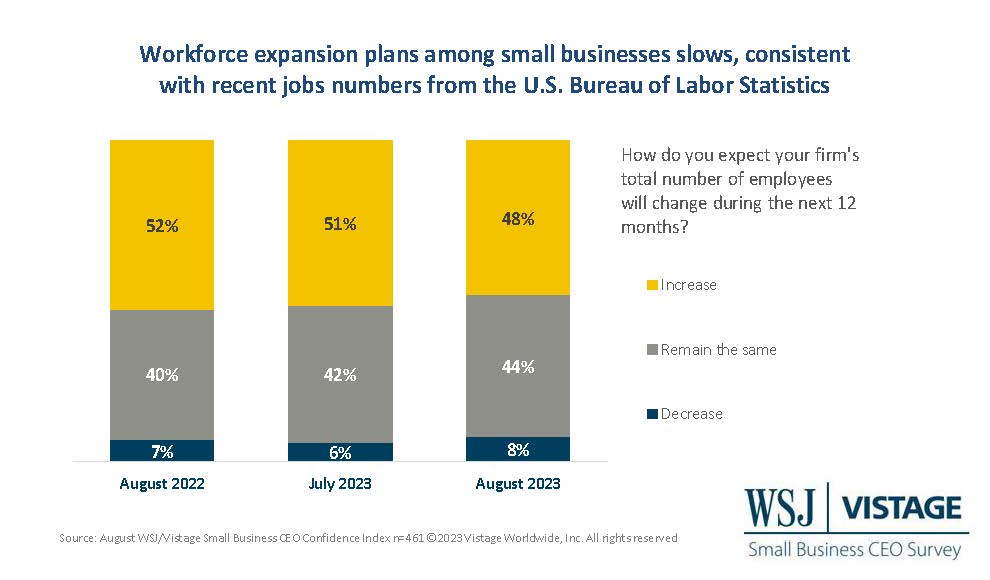

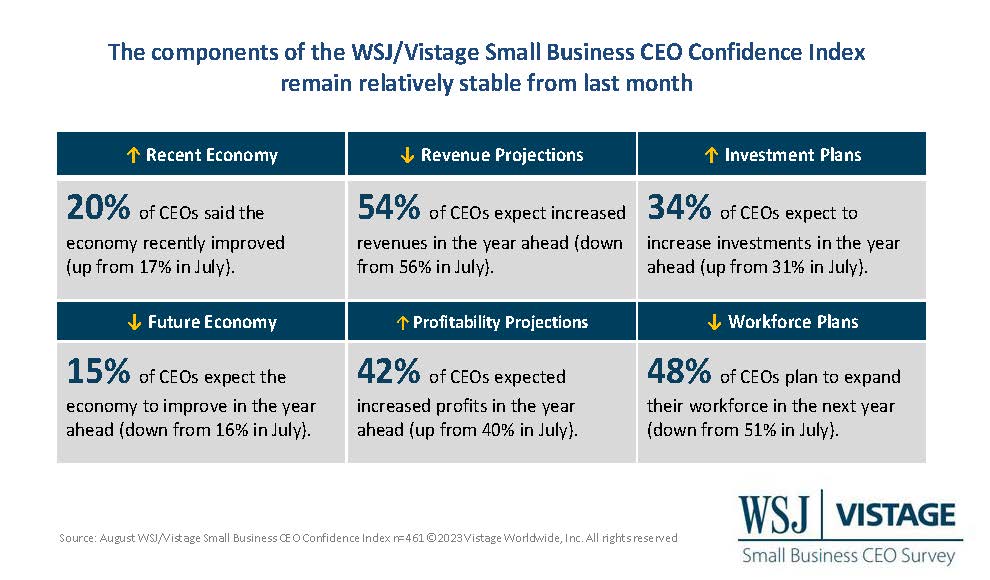

While sentiment about the economy and fixed investments are improving, stagnant readings in revenue and profit expectations — along with a decline in workforce expansion plans — have offset these increases, resulting in a negligible monthly increase in the WSJ/Vistage Small Business Index.

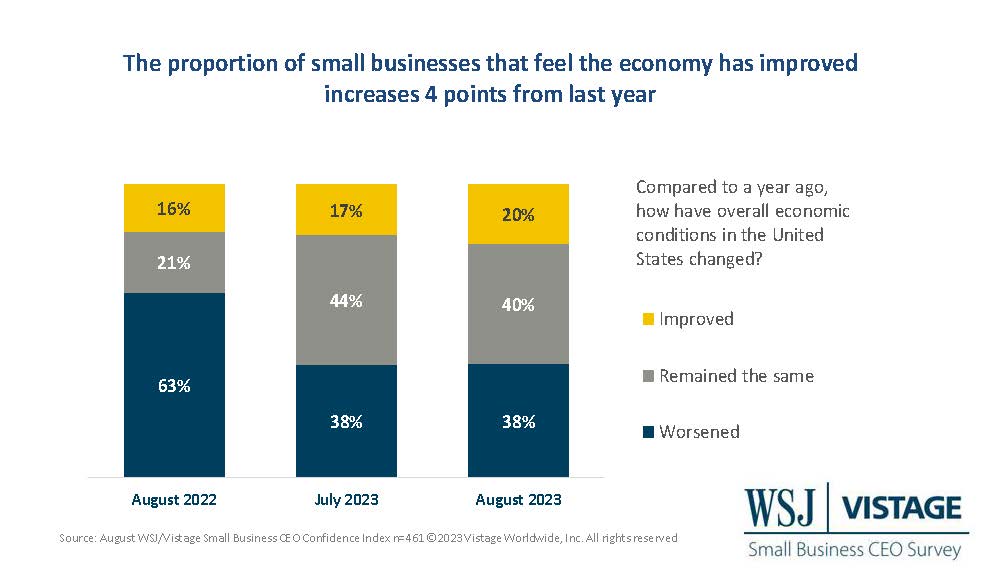

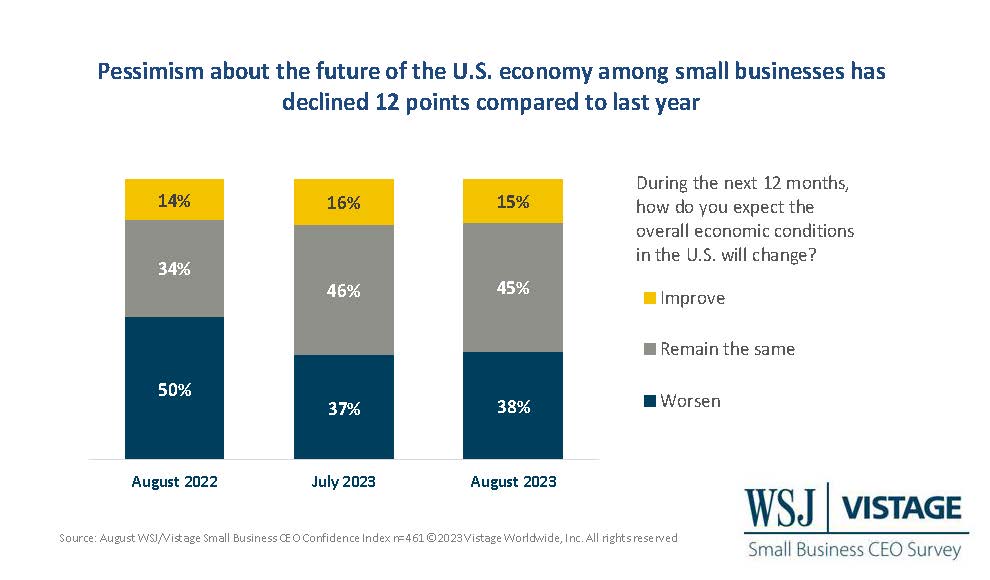

Pessimism about the future of the U.S. economy continues to hold at its lowest levels since February, while the proportion of small businesses that report recent improvements increased another three points from last month, a cumulative increase of nine points over the last three months. Small businesses are divided about the timing and the severity of the U.S. economy’s slowdown.

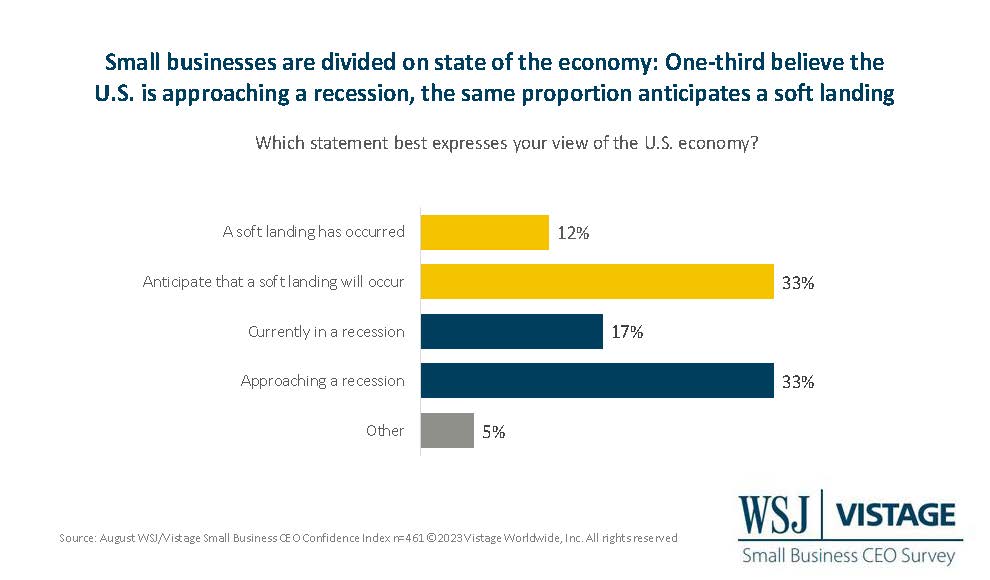

Small businesses divided on recession or soft landing

When asked about whether the economy is approaching a soft landing or a recession, 45% believe a soft landing has occurred (12%) or is going to occur (33%), while 50% of small businesses believe we are in a recession (17%) or are approaching one (33%). This divide is most likely based on industries that are in different phases of the business cycle. Many leaders rely on the definitions of the phases of the business cycle as defined by ITR Economics, which has found that certain segments are showing improvements.

What is top of mind for small businesses? Labor and cost management

Each month the WSJ/Vistage Small Business CEO Confidence Index survey captures small business sentiment on timely topics. Based on the top areas of focus for CEOs shared in the Q2 2023 Vistage CEO Confidence Index survey, this month we captured changes in the hiring landscape for small businesses as well as how they are approaching cost management.

Labor shortage eases, temp workers help with demand

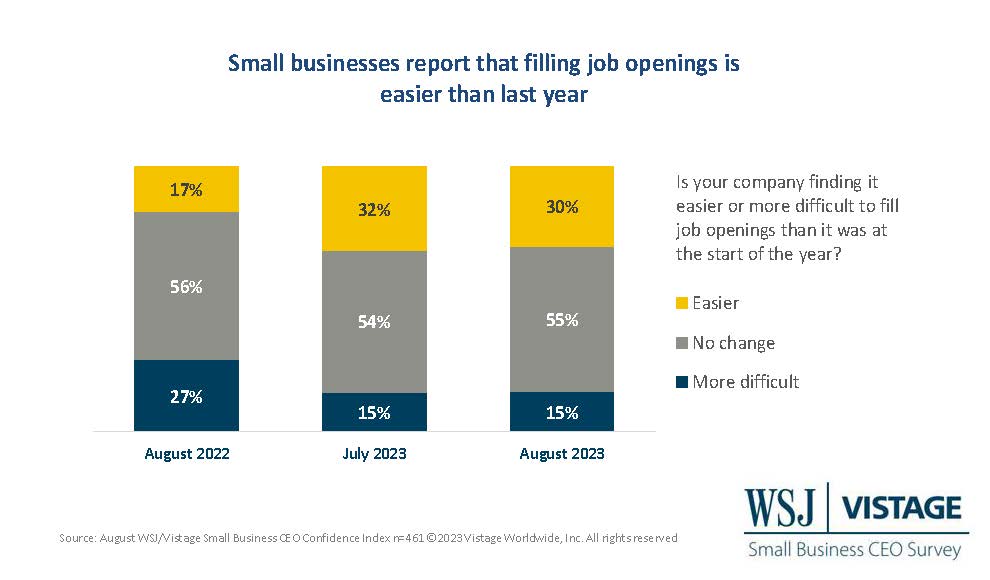

- Hiring challenges have stabilized, with 55% of small businesses reporting no changes to their ability to fill job openings over the past eight months.

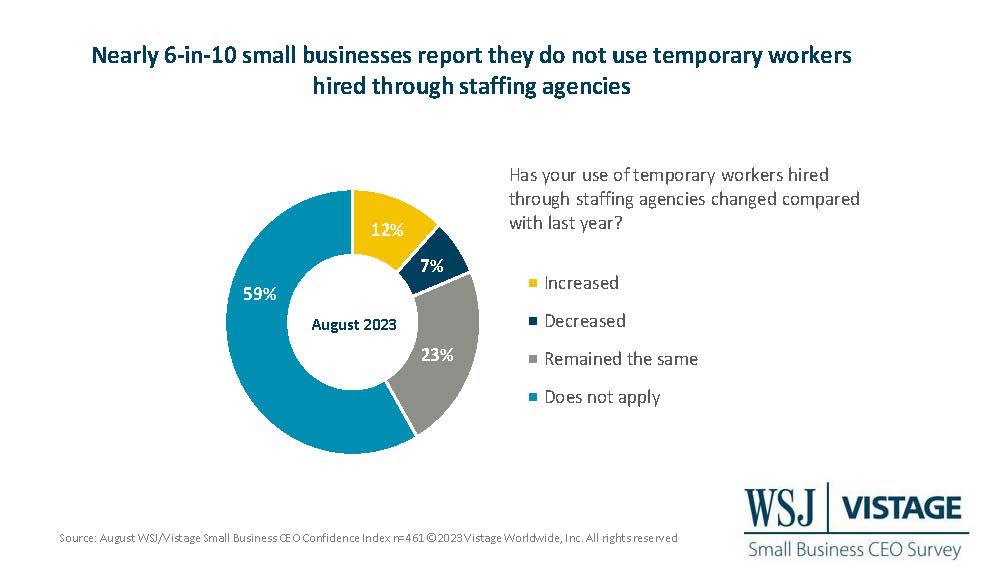

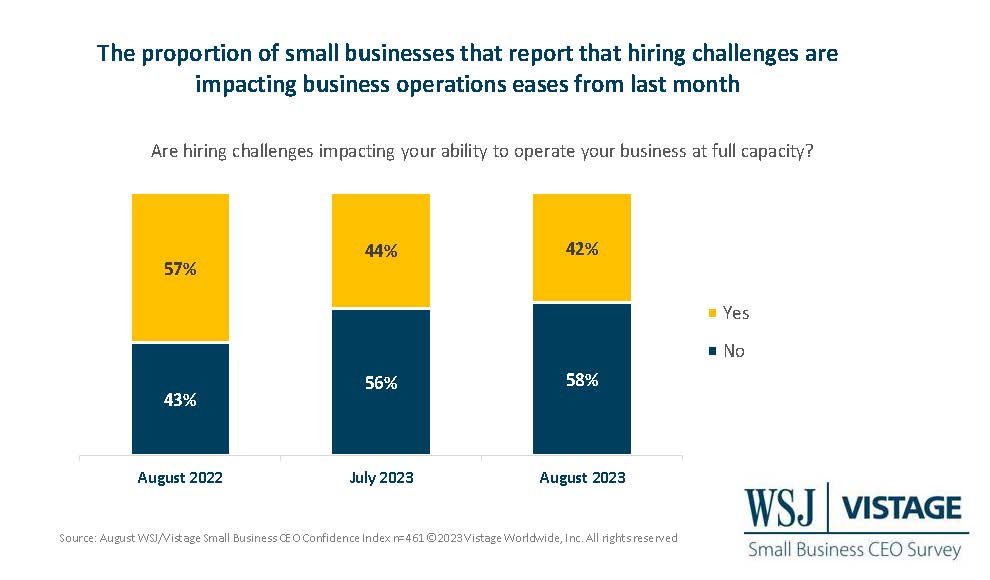

- Despite 42% of small businesses reporting negative impacts of talent scarcity, temporary workers have not been used by 59% of small businesses.

- Of the small businesses using temporary workers provided by staffing agencies, 29% have increased usage compared to last year, while 16% have decreased temp workers.

- The majority (55%) of small businesses that rely on temporary workers report no changes in their reliance on this source for labor.

Cost management remains a priority

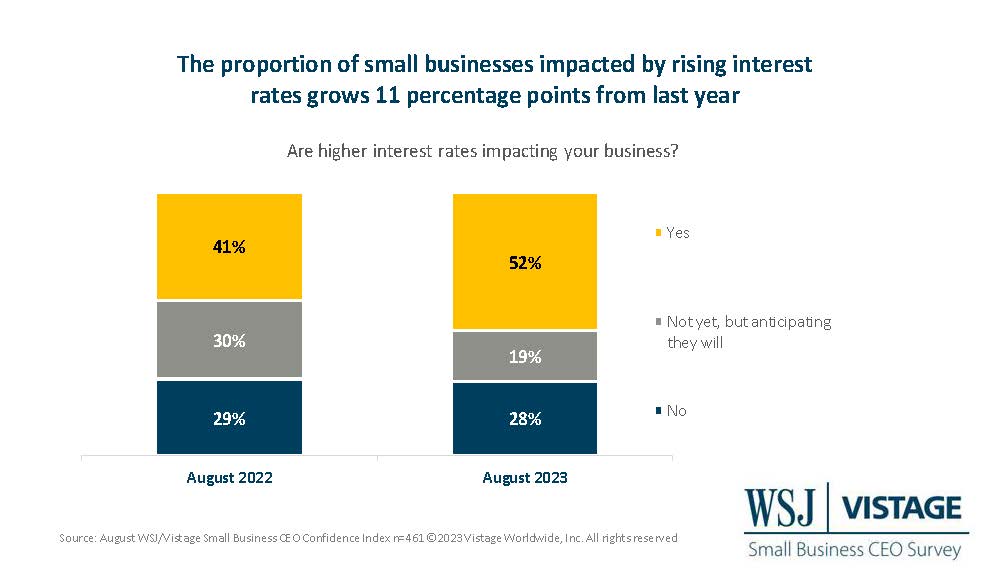

- Higher interest rates are impacting more than half (52%) of small businesses surveyed, holding to last month’s findings and a 5-point decline from 57% in June.

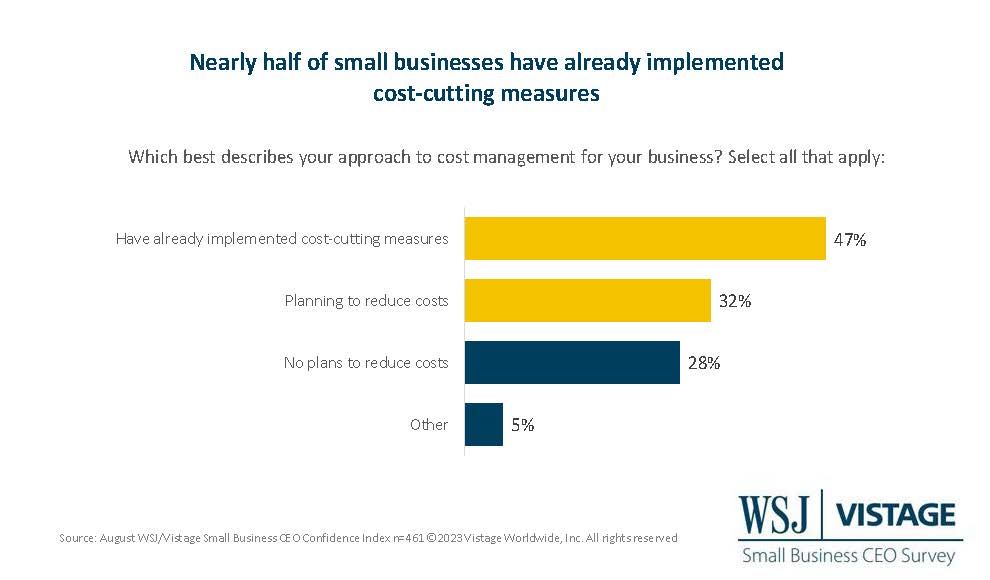

- When asked about their approach to cost management, 47% of small businesses have already implemented cost-cutting measures, with 32% planning to in the future. Just 28% report no plans to reduce costs.

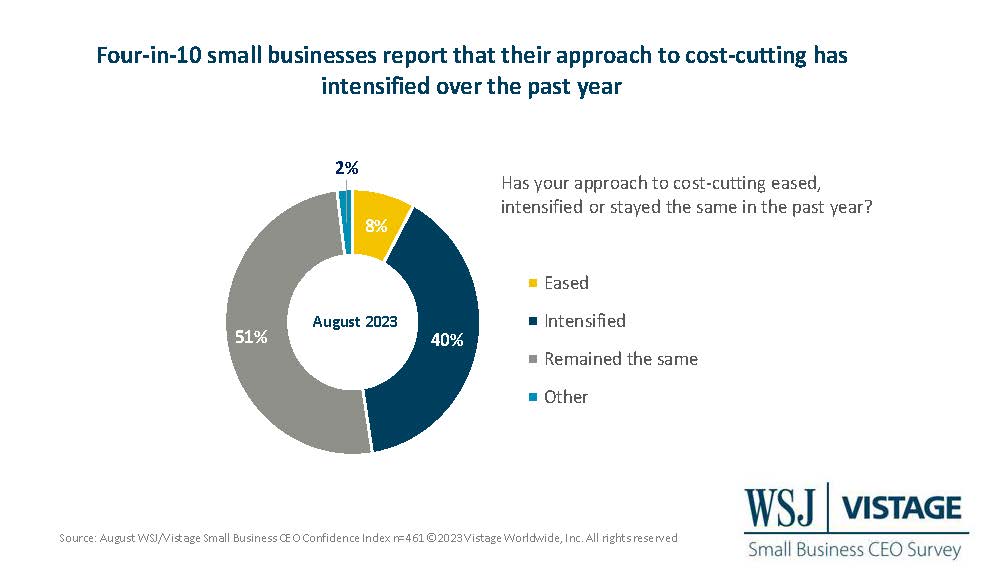

- Over the past year, 4-in-10 small businesses report that cost-cutting has intensified, while the majority (51%) say their approach has remained the same over the past year.

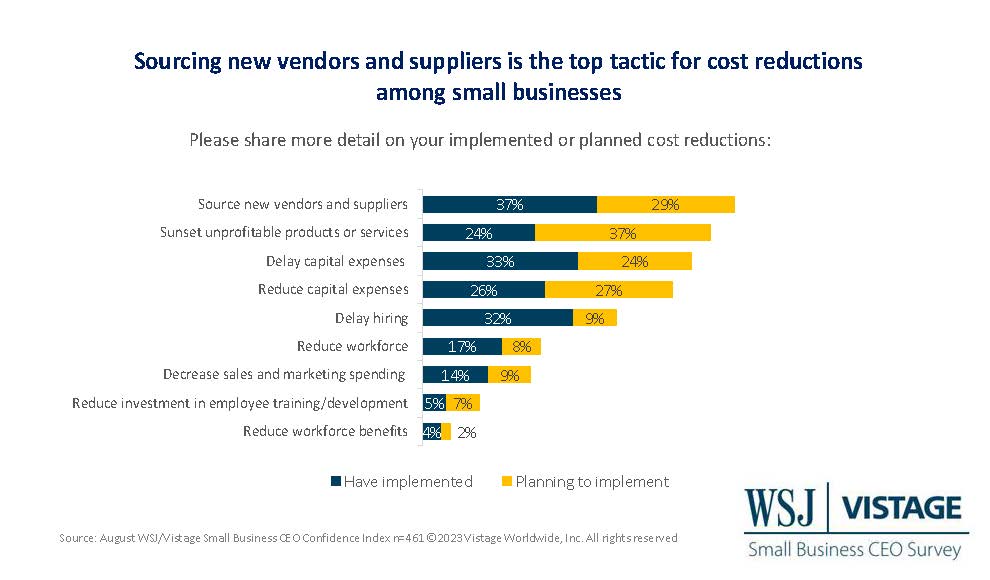

- The top tactic of cost-cutting efforts is sourcing new vendors and suppliers, followed by delaying capital expenditures.

Components of the WSJ/Vistage Small Business Index

Highlights of the data — informed by 461 leaders of small businesses that responded to the August WSJ/Vistage Small Business CEO Confidence Index survey that was in the field August 7-14, 2023 — include:

- Current Economy: 20% of small businesses said the U.S. economy has improved compared to last year, up from 16% last month. Meanwhile, 38% said the economy worsened. This is down from 69% last July.

- Future Economy: 15% of small businesses expect the U.S. economy to improve in the next 12 months, while 38% expect it to worsen — these figures are holding when compared to last month’s.

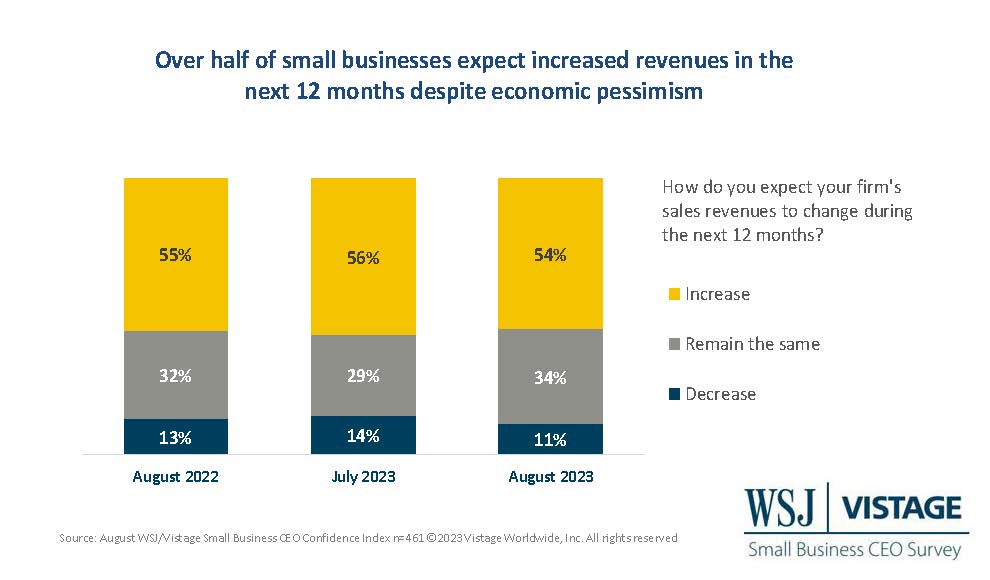

- Revenue projections: 54% of small businesses expect to see increased revenues over the next 12 months, while 11% expect them to decrease.

- Profitability projections: 42% of small businesses expect increased profitability in the next 12 months, well above last August’s 36% and slightly above the average over the past year.

- Fixed investment plans: Small businesses remain focused on managing costs, with 34% plan to increase their fixed investments. This is the 4th consecutive monthly increase. The proportion that plans to decrease fixed investments (16%) hovers at the year-to-date average of 17%.

- Workforce expansion plans: The percentage of small businesses planning to expand their workforce slid below 50%; 48% plan to increase and 44% plan to maintain the size of their workforce in the next 12 months.

For deeper insights on the August 2023 WSJ/Vistage Small Business data, visit our data center or download the infographic.

Category: Economic / Future Trends

Tags: Hiring and Retention, Recession, WSJ Vistage Small Business CEO Survey