Small business confidence holds amid recession concerns [WSJ/Vistage April 2023]

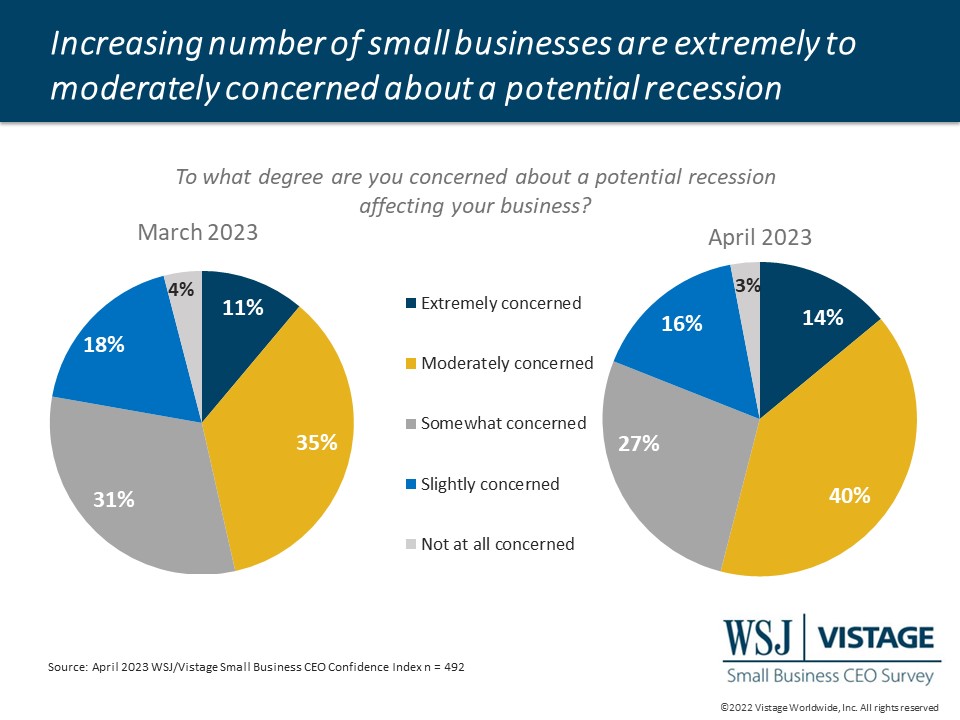

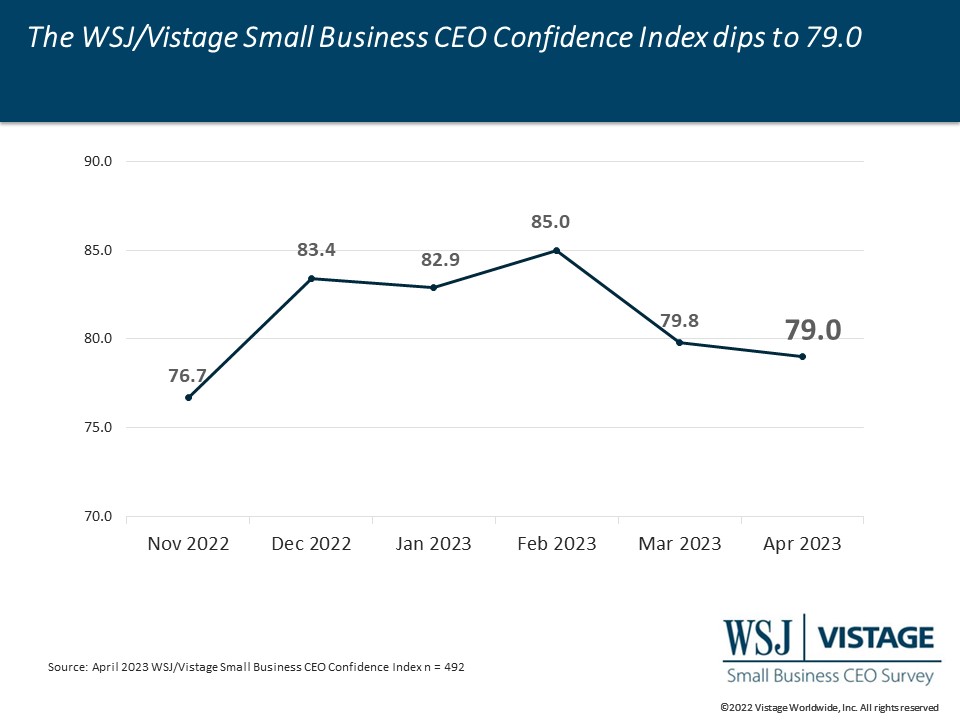

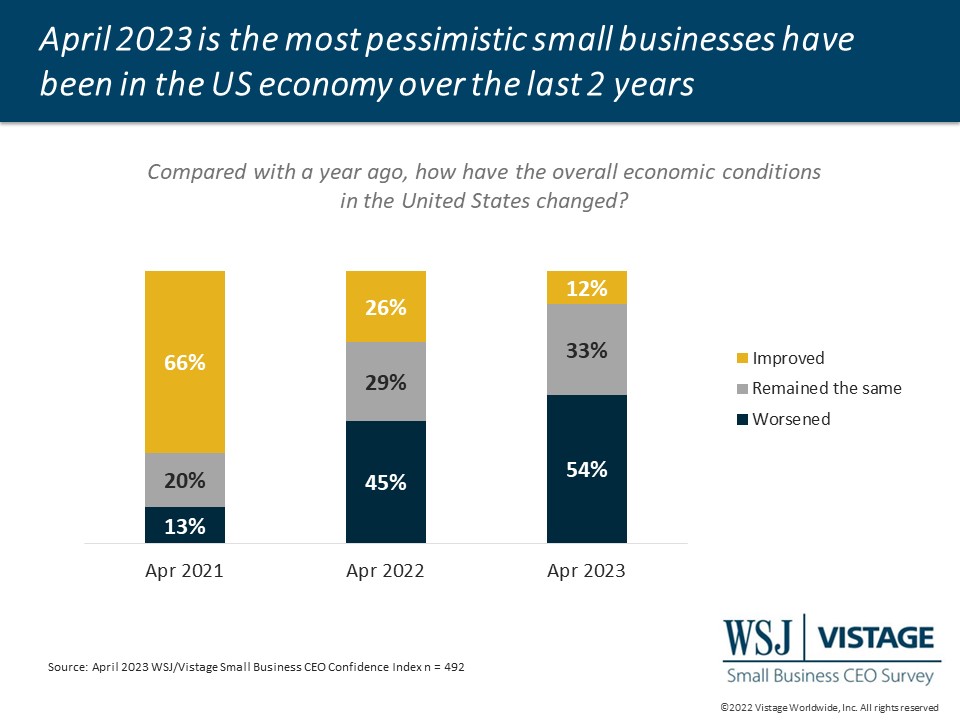

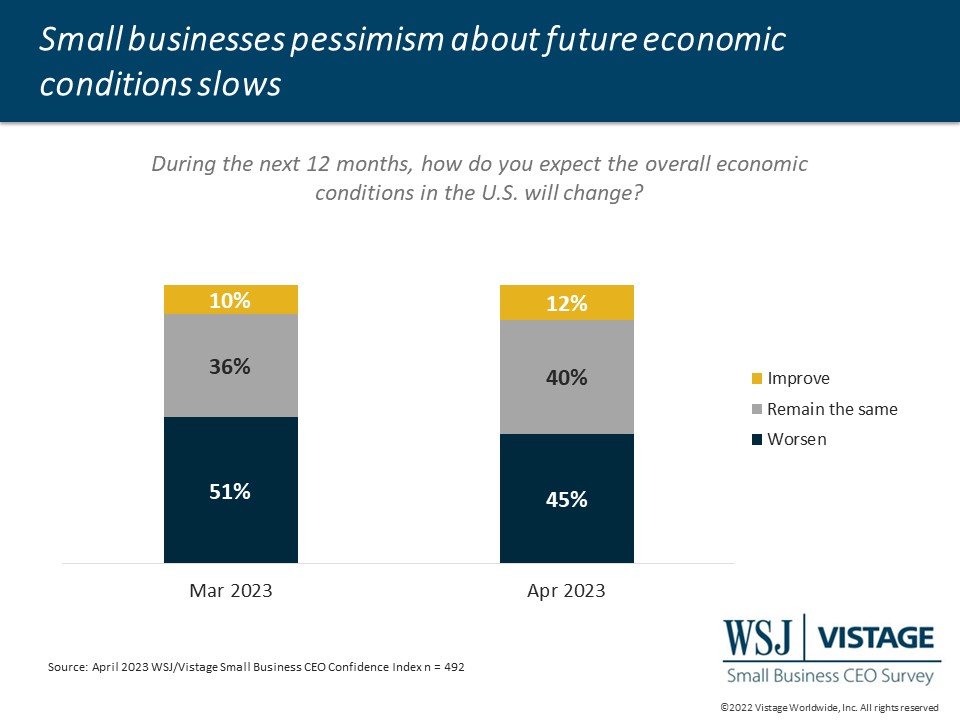

Despite positive — albeit slowing — growth in GDP and inflation rates easing, concerns about a recession are on the rise among small businesses. The proportion of small businesses that are moderately or extremely concerned about the impacts of a recession increased from 46% last month to 54% this month. It’s also interesting to note that while recession concerns are on the rise, overall confidence about the economy did not slip further. In fact, pessimism about the national economy eased compared to last month, which led to the WSJ/Vistage Small Business CEO Confidence Index remaining nearly flat at 79.0 compared to last monthly 79.8.

The bigger driver of the decline in the Small Business Index is cost management; the proportion of small businesses planning to increase workforce size or fixed investments in the next 12 months fell to lows comparable to August 2020.

Expansion plans of small businesses less aggressive

While the proportion of small businesses who plan to increase fixed investments inched up 2 percentage points from last month, the last 2 months have recorded lows not seen since the pandemic summer of 2020. The April survey revealed that just 30% plan to increase fixed investments, while 51% expect theirs will remain the same. For fixed investments to remain unchanged even as prices continue to increase equates to a lower volume.

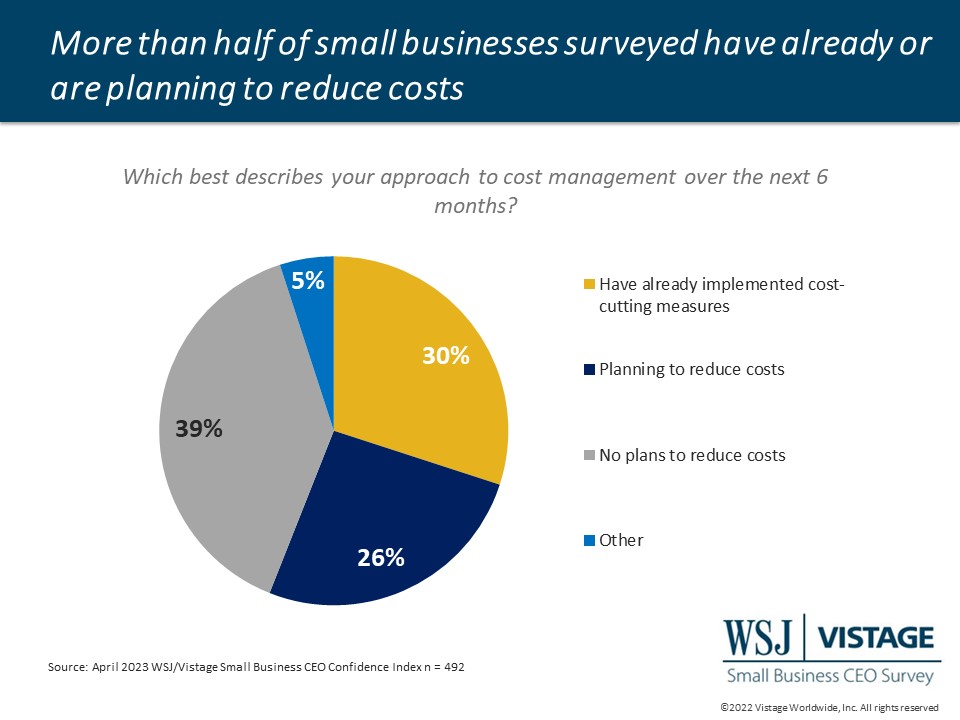

Indeed, when asked about cost reductions, small businesses are divided in their approach to cost management. While more than half of small businesses surveyed plan to reduce costs, over one-third (39%) have no plans to reduce costs, according to our April survey.

Personnel tops list for cost management among small businesses

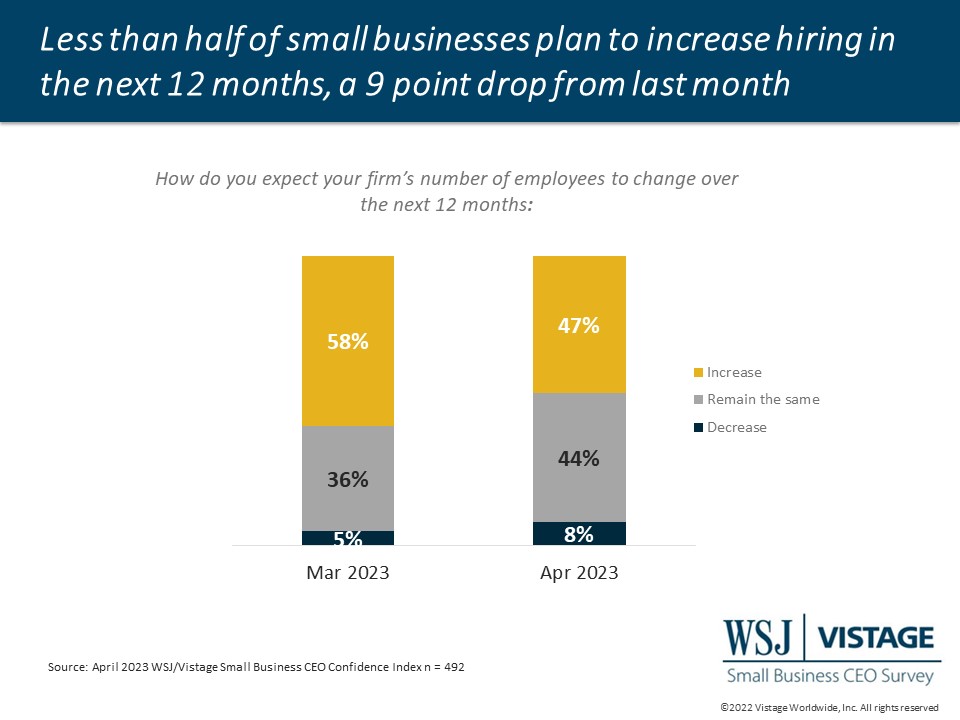

The survey also revealed that 47% of small businesses plan to increase the size of their workforce in the year ahead, a drop from last month’s 58%. And while just 8% report plans to decrease the workforce, of those who are looking to reduce costs, workforce reduction is the No. 2 area they are considering.

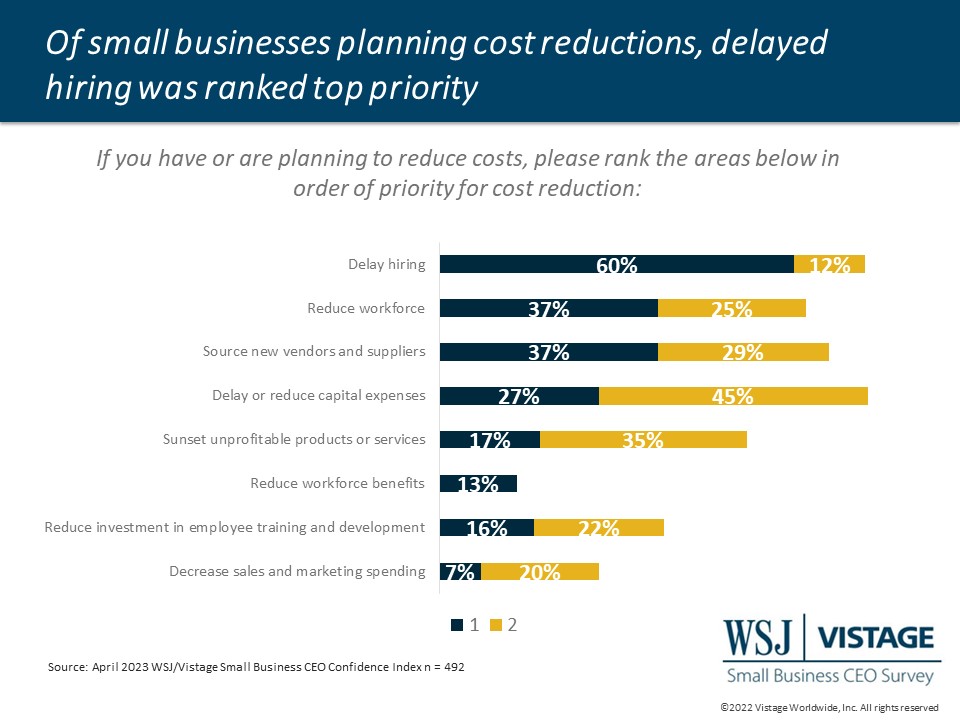

Of those planning cost reductions, personnel seems to be the primary area of focus when looking at areas ranked No. 1. Delayed hiring was reported by 60% of those planning on cost reductions as the top method to manage costs, with a reduction in force second. Those considering workforce reduction seem to be slowly inching up, but not nearly to the trends we see in big companies. When the survey asked participants to rank their top two areas of concern, 27% identified delay or reduction in capital spending as their first choice, while 45% ranked it as their second choice. Keep in mind, these rankings are of those who have implemented cost reductions.

Small businesses will need to hold on to their hard-won workforce to survive the mild recession that is predicted for late 2023 and into 2024. To help leaders consider how they can retain talent, look for our upcoming research report “Managing Workforce Velocity: Improving Employee Retention” later this month.

April Highlights

Download the April report for complete data and analysis

For the complete dataset and analysis of the April WSJ/Vistage Small Business CEO Confidence Index survey from the University of Michigan’s Dr. Richard Curtin, download the report and infographic to learn more, including:

- Pessimism about the economy improves slightly despite worsening concerns about recessionary impacts.

- Investment plans remain low, while workforce expansion dip 9 points.

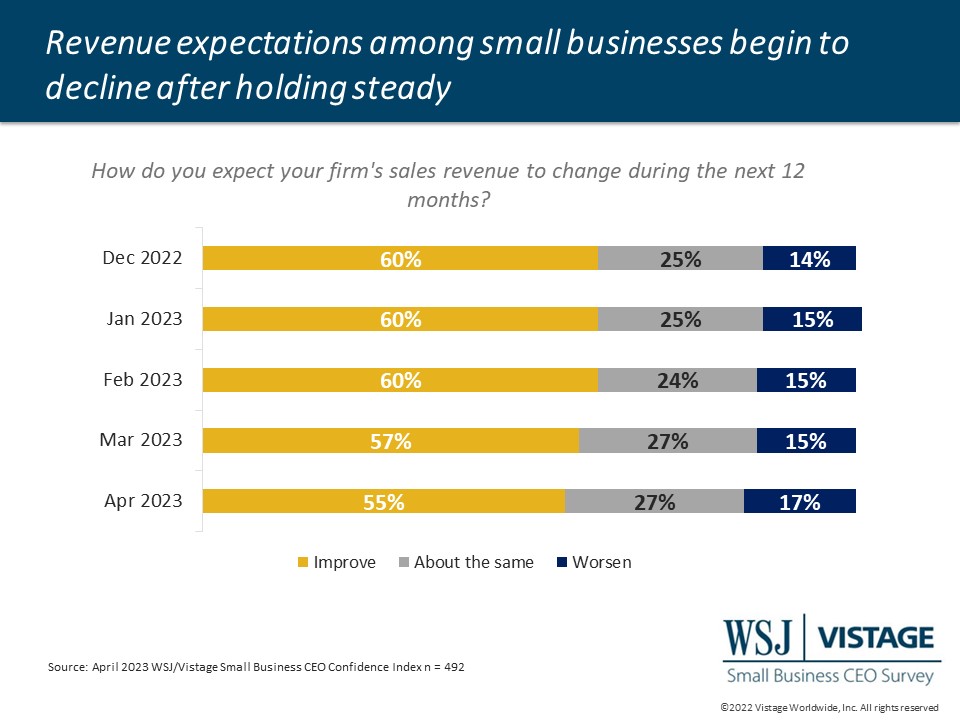

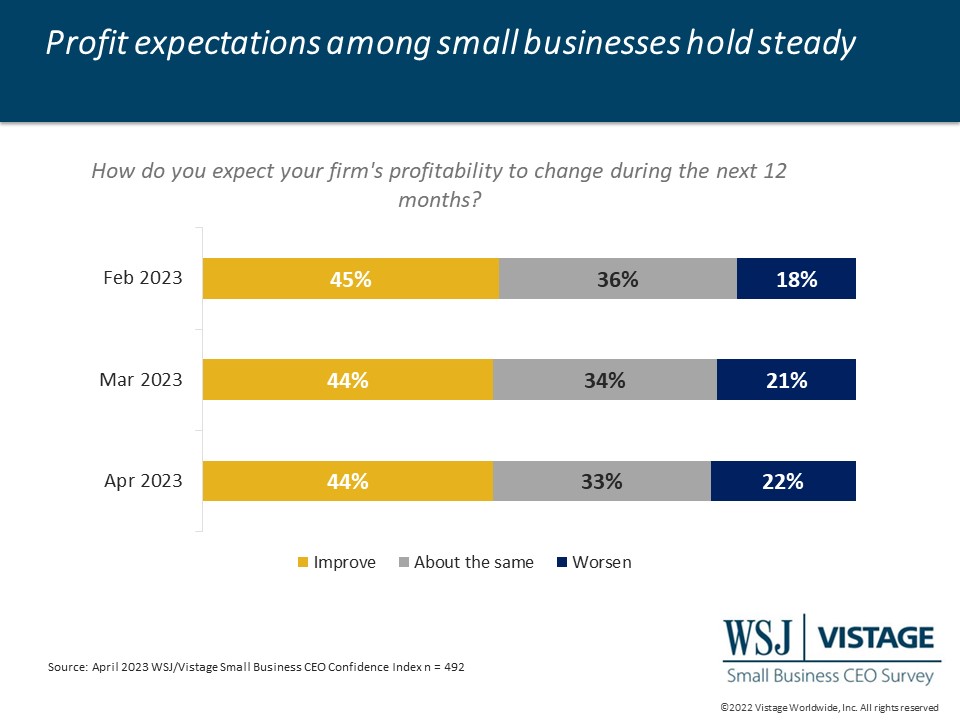

- Revenue expectations decline marginally, but profit expectations hold.

DOWNLOAD THE APRIL 2023 WSJ/VISTAGE SMALL BUSINESS REPORT

DOWNLOAD THE APRIL 2023 WSJ/VISTAGE SMALL BUSINESS INFOGRAPHIC

About the WSJ/Vistage Small Business CEO Survey

Interactive data from WSJ/Vistage Small Business survey

The April WSJ/Vistage Small Business CEO Confidence Index survey was conducted April 3-10, 2023, and gathered 492 responses from CEOs and leaders of small businesses reporting revenues between $1 million and $20 million. Our May survey will be in the field May 1-8, 2023.

Category: Economic / Future Trends

Tags: Costs, Hiring and Retention, Recession, WSJ Vistage Small Business CEO Survey