The CEO Pulse: Inflation’s implications for small and midsize businesses

Inflation’s relentless rise to 7.9% in February makes its March 2021 rate of 2.6% seem like a distant memory. The unexpected implications of massive government stimulus, pent-up consumer spending and the retreat of COVID-19 fueled inflation’s surge as rapidly resurgent demand quickly exceeded supply.

Further complicating matters is a sharp increase in wages — from signing bonuses to off-cycle pay bumps — that businesses have found necessary as competition grows over hiring and retaining top talent.

As if the wage increases and continuing supply chain disruptions weren’t enough, Russia’s invasion of Ukraine injected a new, unprecedented level of fear, uncertainty and doubt into the equation, turning many an analyst’s crystal balls opaque and signaling an unclear future.

With no end in sight for the Russian-Ukraine conflict, the once-promising prospect of inflation’s eventual decline later this year has dissolved into a cloud of uncertainty. Energy costs spiked just days after Russian tanks crossed from Belarus into the country, instantly “fueling” an inflationary response at the pump.

And as the war continues (at the time of this writing), the pressure on prices will only continue to grow.

Inflation’s implications

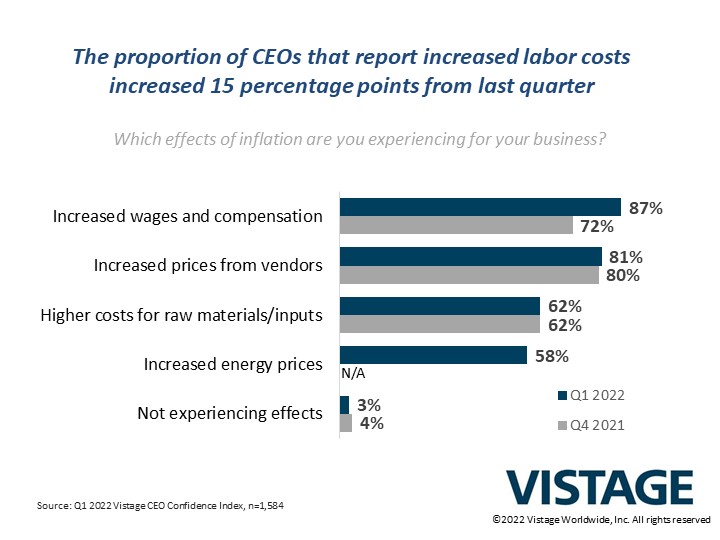

The proportion of small and midsize businesses affected by increased wages and compensation rose again to reach 87%, up from 80% in Q4 and 70% in Q3 2021. This was according to the 1,584 CEOs that responded to the Q1 2022 CEO Confidence Index survey that was in the field March 7-14 2022.

The percentage of respondents reporting increased prices from vendors was effectively the same as Q4 (80%), while those impacted by costs of raw materials dropped 8 points to 62%, reflecting what was once an improving supply chain. Increased energy prices affected 58% of CEOs, especially those dependent on transportation.

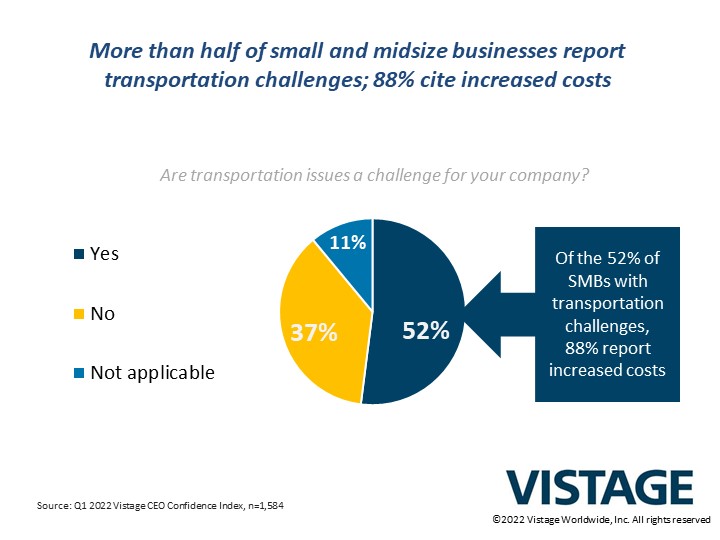

Transportation challenges often include the double-edged sword of both higher fuel costs and the demand for increased wages by truck drivers. Of the 52% of CEOs who identified transportation as a challenge for their business, 88% said rising transportation costs were a problem.

The fight for wages

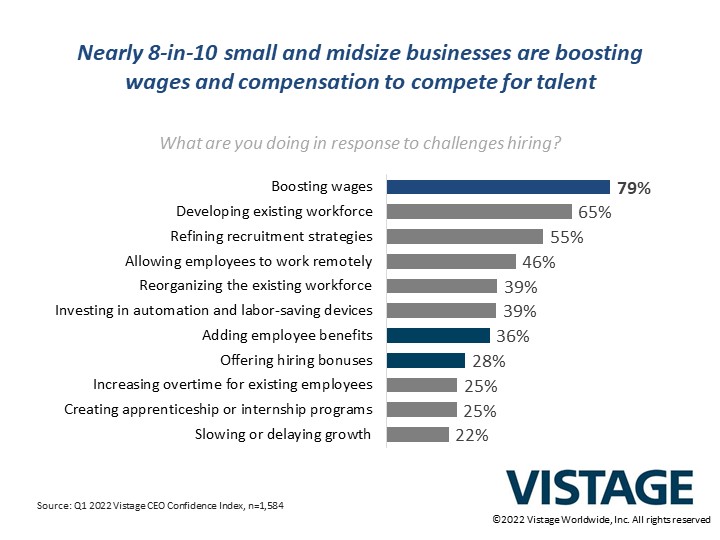

The hiring surge of CEOs looking to increase headcount in the year ahead slowed a bit in Q1 to 65%, down from the record-setting 76% recorded in Q4. This reflects the challenges of hiring and the major uncertainty surrounding the Russian-Ukraine war. Unfortunately, that hasn’t slowed the demand to increase wages as 79% of CEOs report increasing wages in response to hiring challenges.

72% of businesses reported these hiring obstacles have impeded their ability to operate at full capacity. That talent scarcity, coupled with ever-growing demand and continuing supply chain issues, has resulted in missed opportunities for small and midsize businesses at a crucial time. Many are still reeling and trying to recover from the initial economic slowdown that hit SMBs in 2020.

Still, CEOs report they must increase wages and associated compensation to compete for new hires. “How much is too much to pay for talent without alienating existing employees?” That’s a question CEOs are asking themselves as retention of the existing workforce is the foundation of any talent acquisition strategy in today’s environment.

Why? It simply takes longer and costs more to replace a lost employee with someone less qualified with less experience.

For a deeper dive into the challenges of hiring and retention pay, Vistage speaker Rena Somersan shares her insights on increasing wages.

Supply chains challenges re-emerge

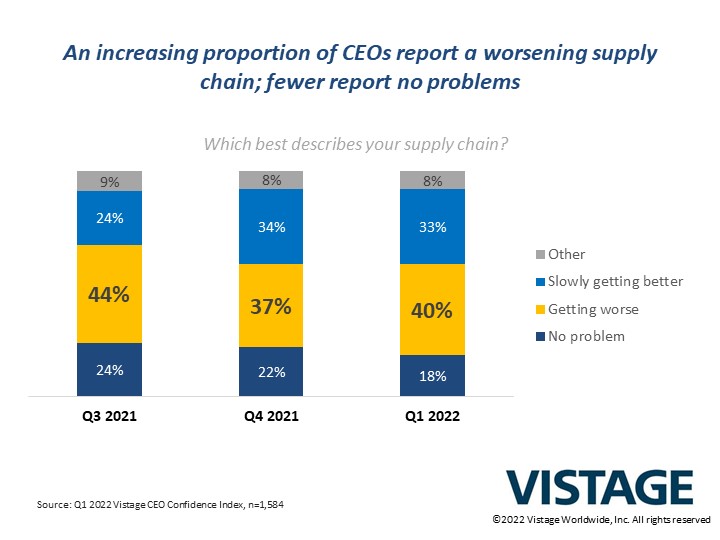

Any improvements in the global supply chain that connects small and midsize businesses were reversed in Q1, according to our data. Once described as a “slowly healing system struggling to recover from the rapid shutdown of COVID,” the supply chain has become problematic. Again.

40% of CEOs reported their supply chain issues were getting worse, up from 37% in Q4, and almost back to the 44% recorded in Q3. By the same token, 33% of CEOs said their supply chain had slowly improved in Q1, down from 44% in Q4, but still above the 24% of Q3. In its current state, the Russia-Ukraine war should not radically impact the physical supply chain but will affect exports of wheat, minerals and, of course, oil.

Pressure on pricing

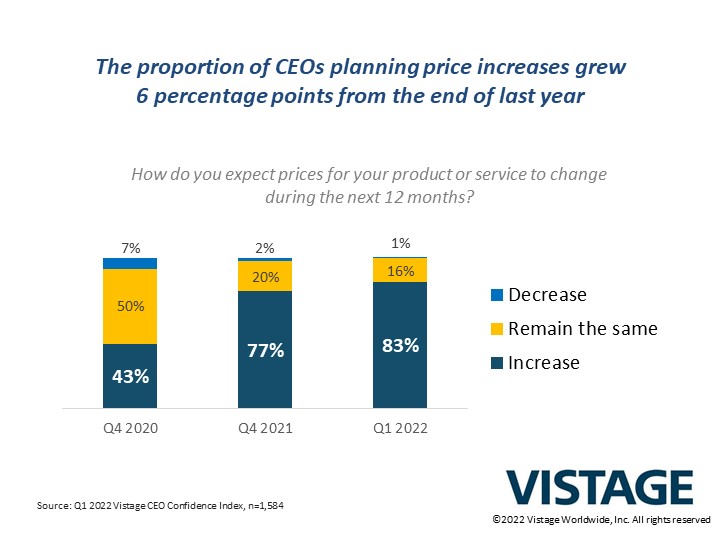

Higher prices from vendors, higher prices for raw materials and goods, and increasing labor costs are all part of the inflationary spiral that feeds on itself. The rising cost of everything is forcing CEOs to increase their prices as well. 83% of SMBs will be increasing their prices in the year ahead, up six percentage points from Q4 2021.

Before the pandemic, CEOs focused on improving efficiency or increasing sales to drive revenue, when a strategic approach to pricing could increase revenue and profit significantly. Now forced to raise prices to just keep up, the ability to be smart and conscious about pricing eludes most CEOs, resulting in fumbled messages to already exhausted customers.

To help small and midsize businesses maximize value without losing customers, Vistage speaker Casey Brown shares her expertise on pricing strategies and tactics.

No end in sight

The challenge of dealing with rising inflation is something completely new to this generation of CEOs. The decade from 2010 to 2020 — aka the “good old days” — saw both historically low inflation rates underwriting a steady and stable growth economy.

Then, COVID hit.

The pandemic threw that model out the window. Add to that a war between Russia and Ukraine, a mangled global supply chain and a bidding war over talent, and there is no way to reasonably assess how high inflation will go or when it will abate. At least, not until the war ends.

The war’s length and severity will certainly dictate the next chapter on inflation and the global economy, with all scenarios a possibility. Uncertainty will continue to escalate until CEOs can see beyond the war with a sense of stability and the Federal Reserve rate cuts take effect.

Category: Economic / Future Trends

Tags: inflation, small and midsize businesses, The CEO Pulse