Small business economic confidence reaches 2-year high [WSJ/Vistage Feb 2024]

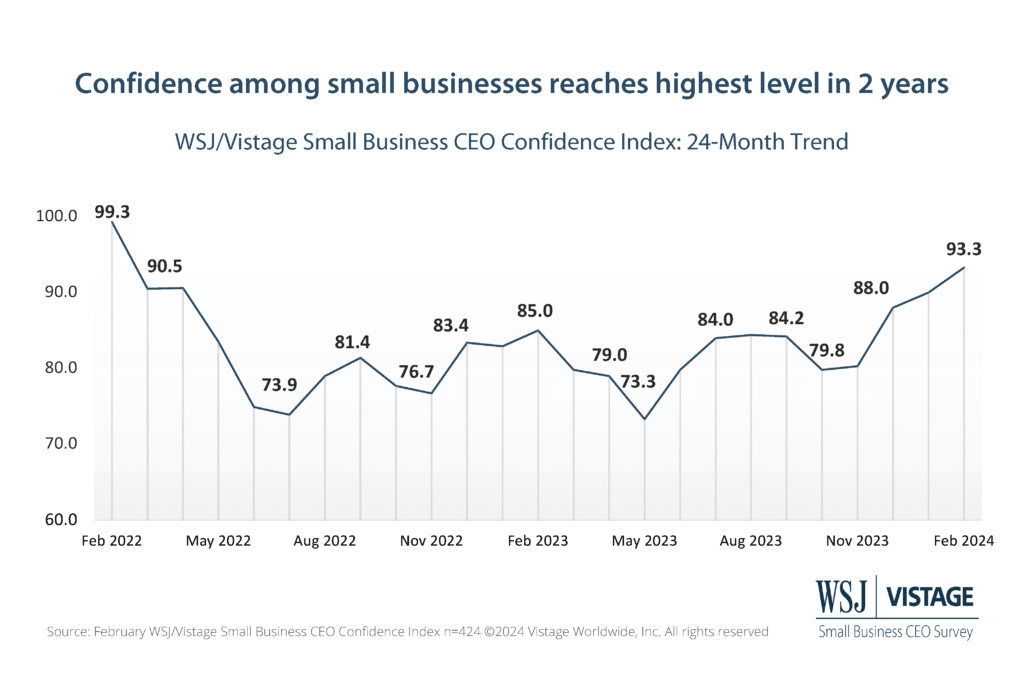

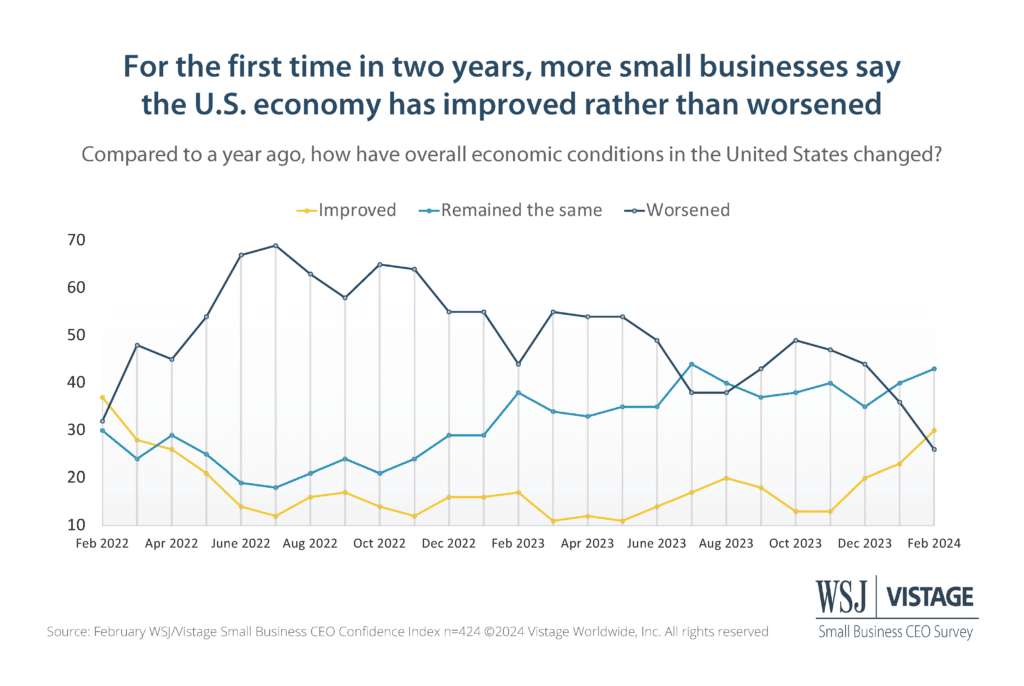

As 2023 gets further away in the rearview mirror, small business confidence continues to climb in February, marking the fourth consecutive monthly increase. The WSJ/Vistage Small Business CEO Confidence Index rose to 93.3, reaching its highest level since February 2022. Interestingly, the biggest driver of growing confidence is the one factor that looks backward; small businesses increasingly believe that the economy is better than a year ago. For the first time in two years, the proportion of small businesses that believe the economy is better than a year ago (30%) is larger than those who believe it is worse (26%).

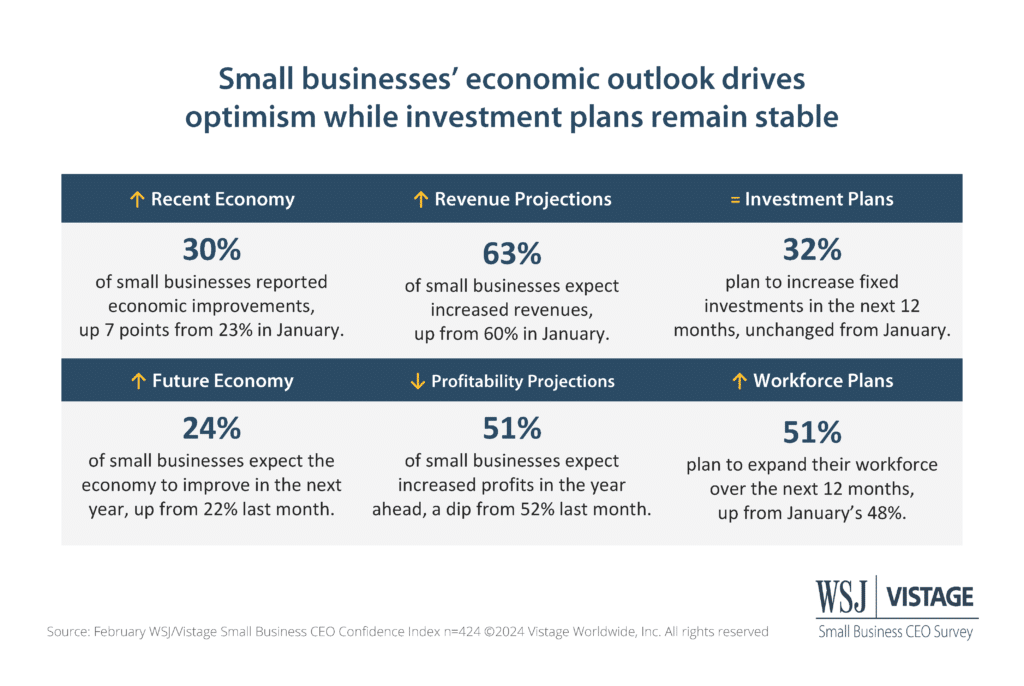

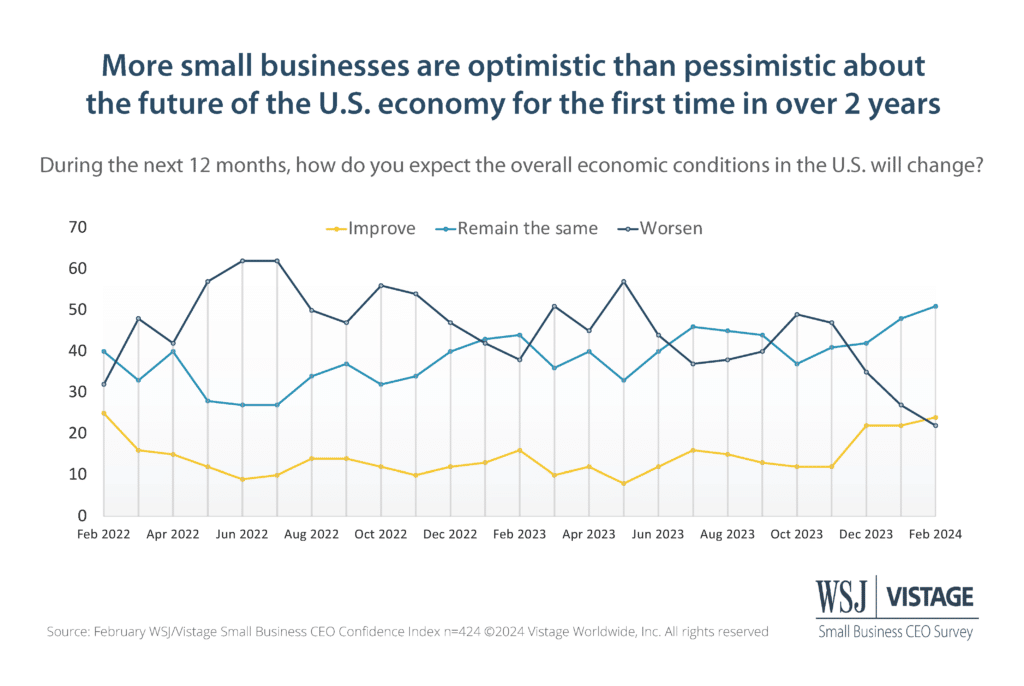

Small businesses are more optimistic about the future of the economy as well, with metrics also showing a 2-year high along with a similar reversal in proportions. Small businesses that believe the economy will improve in the year ahead reached 24% compared to 16% a year ago, while just 22% report it will worsen, down from 38% one year ago.

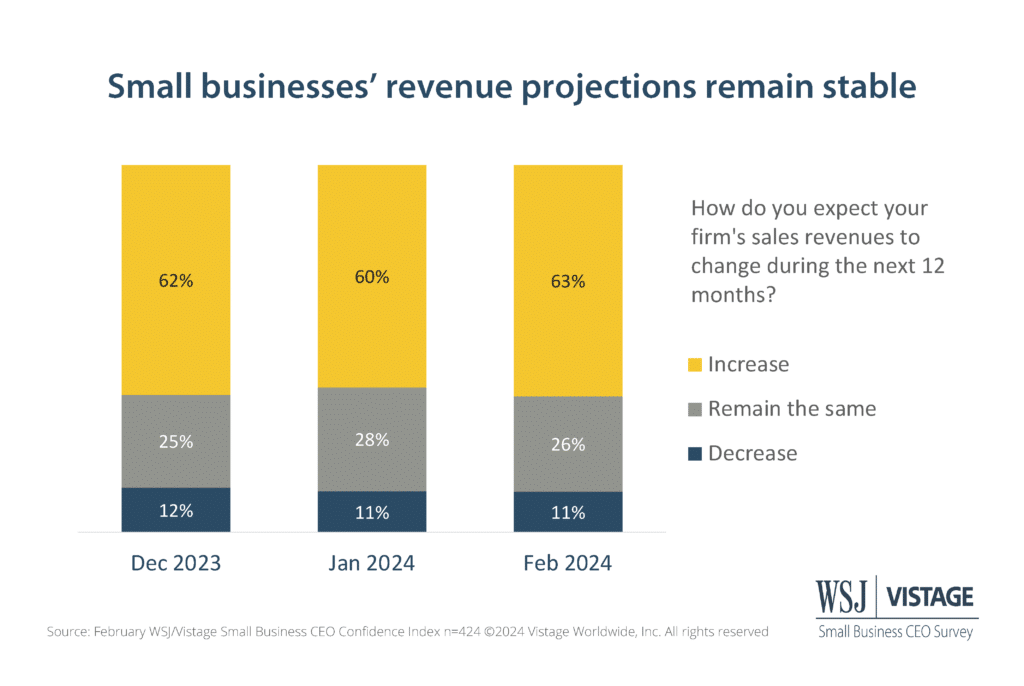

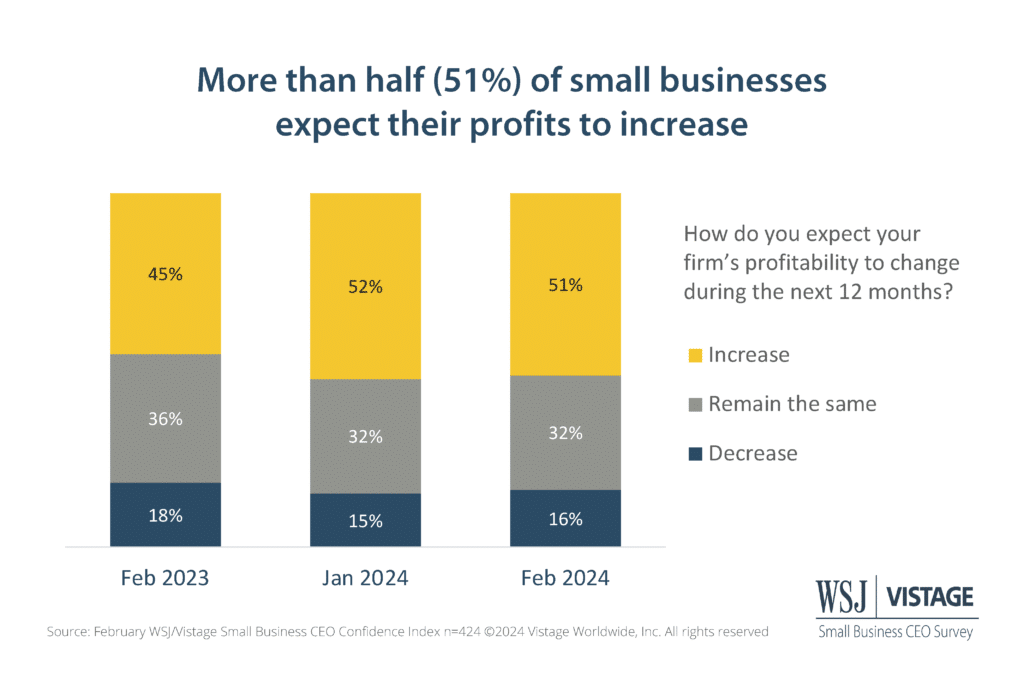

These healthier views of the economy among small businesses are reflected in stable projections for revenues and profitability. In the year ahead, 63% of small businesses expect increased revenues, and 51% expect increased profits.

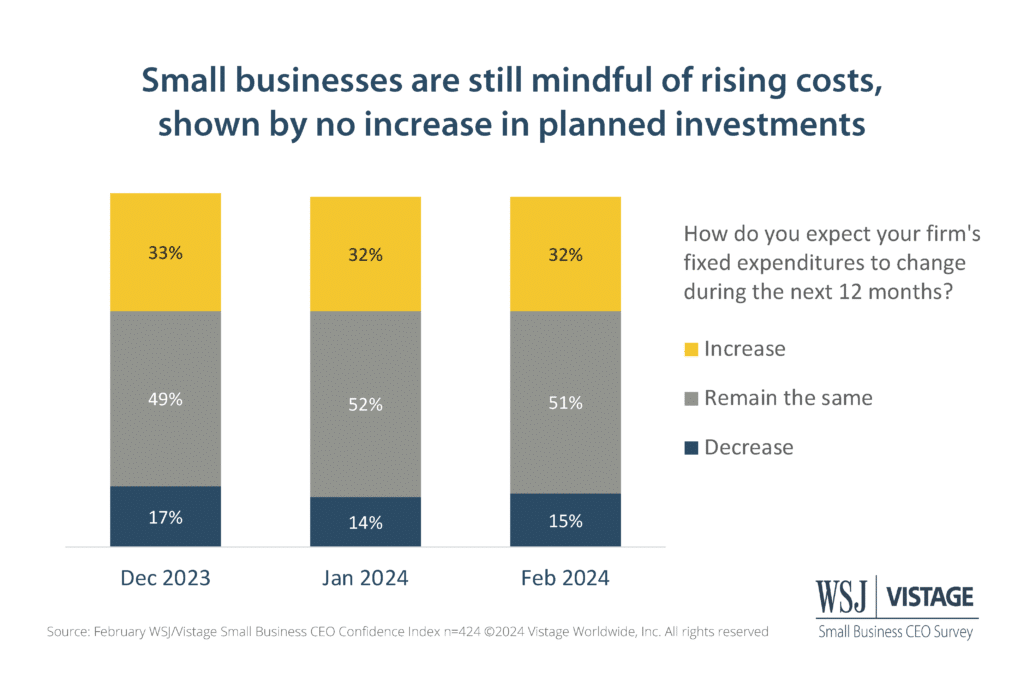

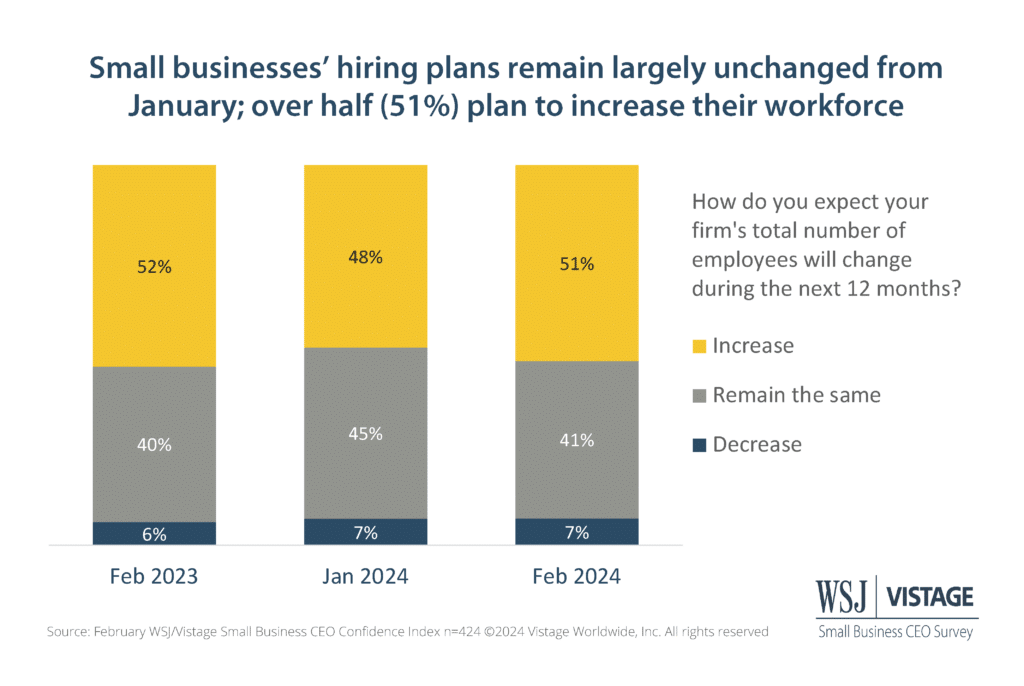

However, small businesses are still mindful of rising costs as there was little movement in planned investments. While the proportion of small businesses that plan to expand their workforce showed a 3-point gain from last month, this is in line with the 12-month average for workforce expansion and does not signal a significant change in hiring plans.

12-month moving average goes into the positive

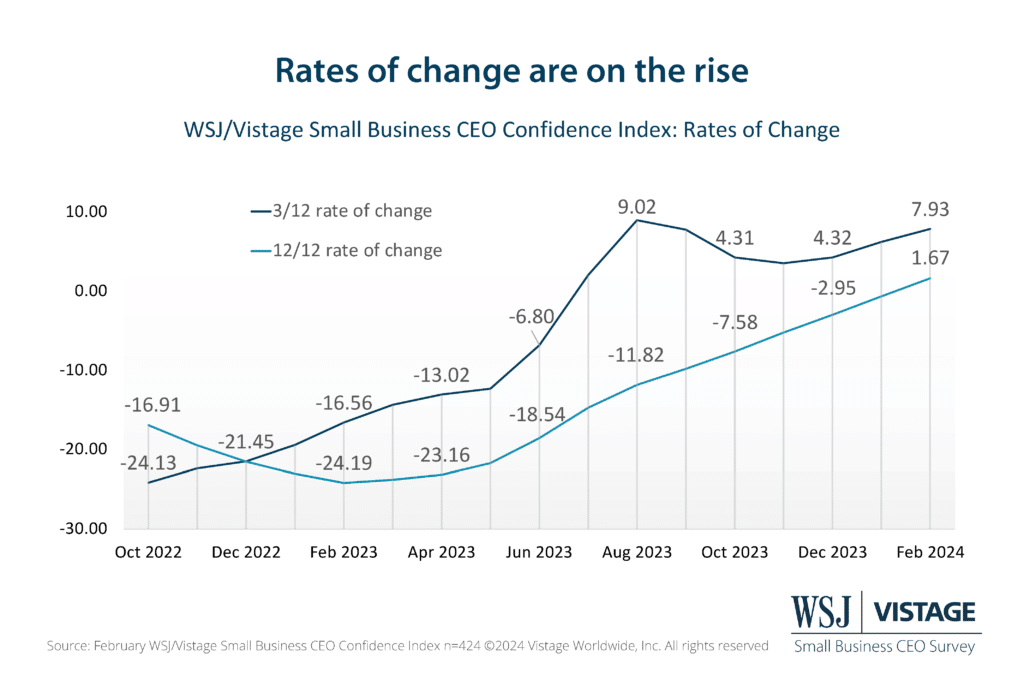

While year-over-year and month-over-month changes highlight trends, sometimes the variance seems nominal, which is why looking at rates of change can help indicate bigger trends. Looking at the 3-month moving average of the WSJ/Vistage Small Business Index compared to the same 3 months a year ago, the rates of change have been positive since July and have shown an increase over the last 4 months.

Taking a longer view, the 12-month moving average compares a 12-month moving average with the same 12 months from a year ago. While these rates of change have been improving steadily since last February, this is the first time they have broken into the positive.

Rates-of-change: A rate-of-change is the ratio comparing a data series during a specified time period to that series during the same period one year earlier. These figures are expressed as an annual percent change and reveal whether activity levels are rising or falling compared to the prior year. A 3/12 Rate of Change represents the year-over-year percent change of a three-month moving average, and the 12/12 rate of change represents the year-over-year percent change of a 12-month average.

Disruption of supply chain top impact of weather and natural disasters

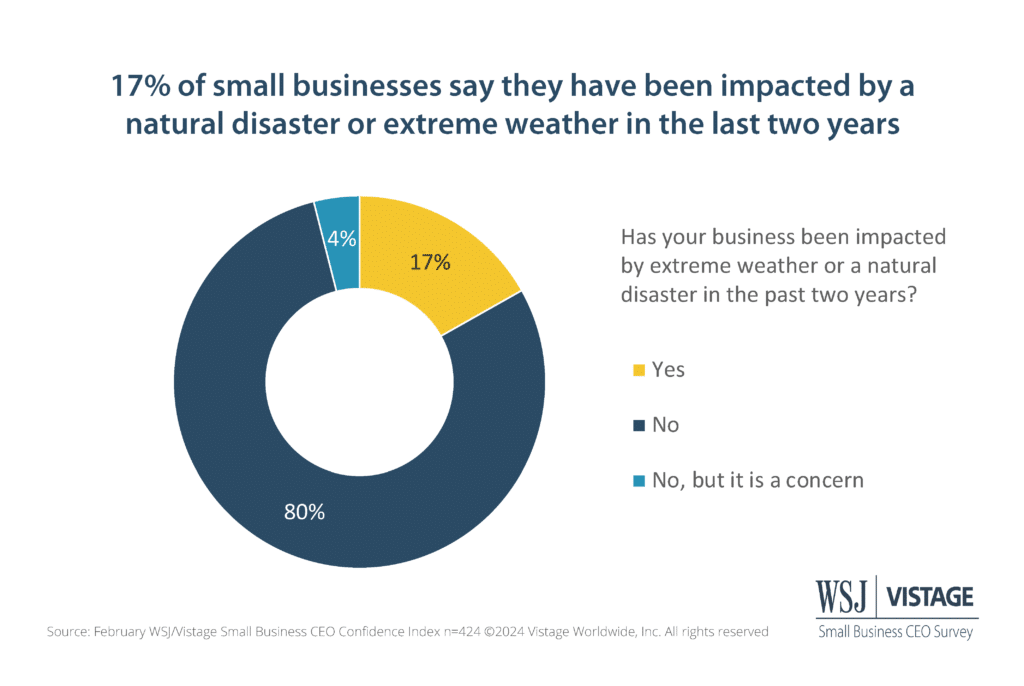

With flooding, wildfires and an assortment of weather-related events impacting regions across the country over the last several years, we wanted to understand how small businesses were impacted. Surprisingly — and fortunately — just 17% of small businesses reported impacts related to extreme weather or natural disasters in the past 2 years. An additional 4% reported that it was a concern for the future.

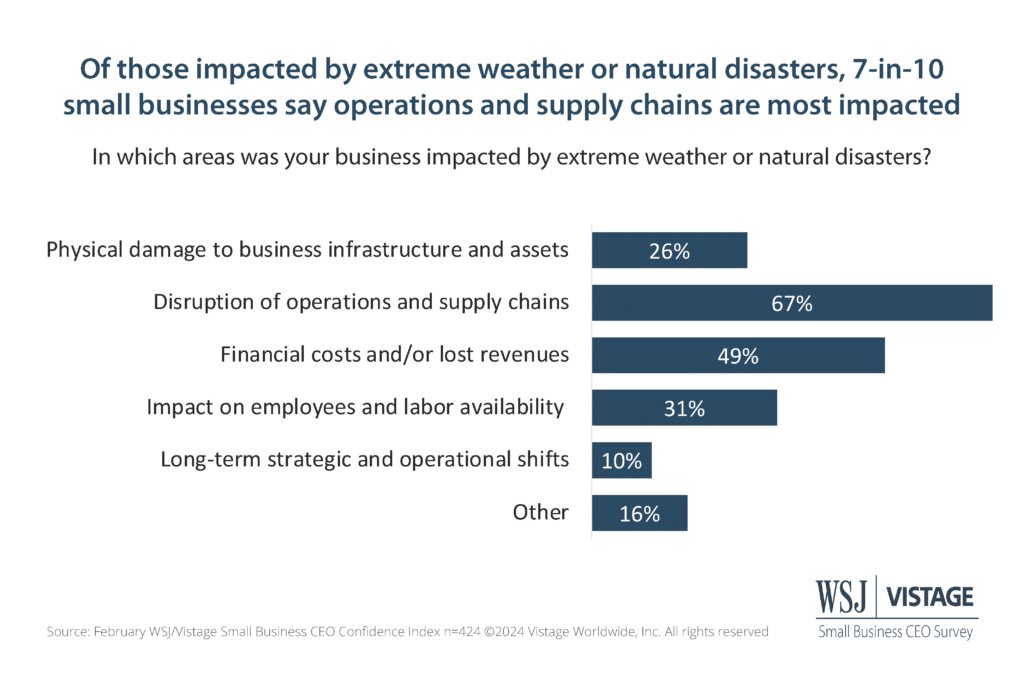

For those impacted by weather events, the disruption of operations and supply chains was the top impact, followed by financial costs and lost revenues. While these events may be detrimental to some businesses, those that provide services that support the recovery from these types of events see increased revenues, which was the primary response in the 16% of “Other” responses from small businesses.

The February WSJ/Vistage Small Business CEO Confidence Index was informed by 424 leaders of small businesses who represent respondents reporting annual revenues of $1-20 million in the February WSJ/Vistage Small Business CEO Confidence Index survey conducted February 5-12, 2024.

February highlights:

- Current Economy: While 30% of small businesses report that the U.S. economy has improved compared to one year ago, a lower proportion —26% — report that it worsened, a 10-point improvement from last month.

- Future Economy: The proportion of small businesses expecting the economy to improve in the next year rose to 24%, while the proportion that expect it to worsen decreased by 5 percentage points to 22%.

- Revenue projections: 63% of small businesses expect increased revenues in the next 12 months, a slight improvement from last month.

- Profitability projections: The proportion of small businesses who expect increased profits in the next 12 months remained stable from last month, with more than half (51%) expecting increased profits while 16% expect them to decline.

- Fixed investment plans: There was no change in plans to increase in fixed investments from January; nearly one-third (32%) of small businesses plan to increase fixed investments, while 15% plan to reduce spending in the next 12 months.

- Workforce expansion plans: Over half of small businesses (51%) plan to expand their workforce in the next 12 months — a 3 percentage-point increase from last month — while 41% plan to keep their workforce stable. Just remain 7% plan to reduce the size of their workforce.

For deeper insights and to explore the full dataset of the February 2024 WSJ/Vistage Small Business data, visit our data center or download the infographic.

Category: Economic / Future Trends

Tags: economic factors affecting business, Small business, WSJ Vistage Small Business CEO Survey