Small business confidence holds despite high-interest rates [WSJ/Vistage Nov 2023]

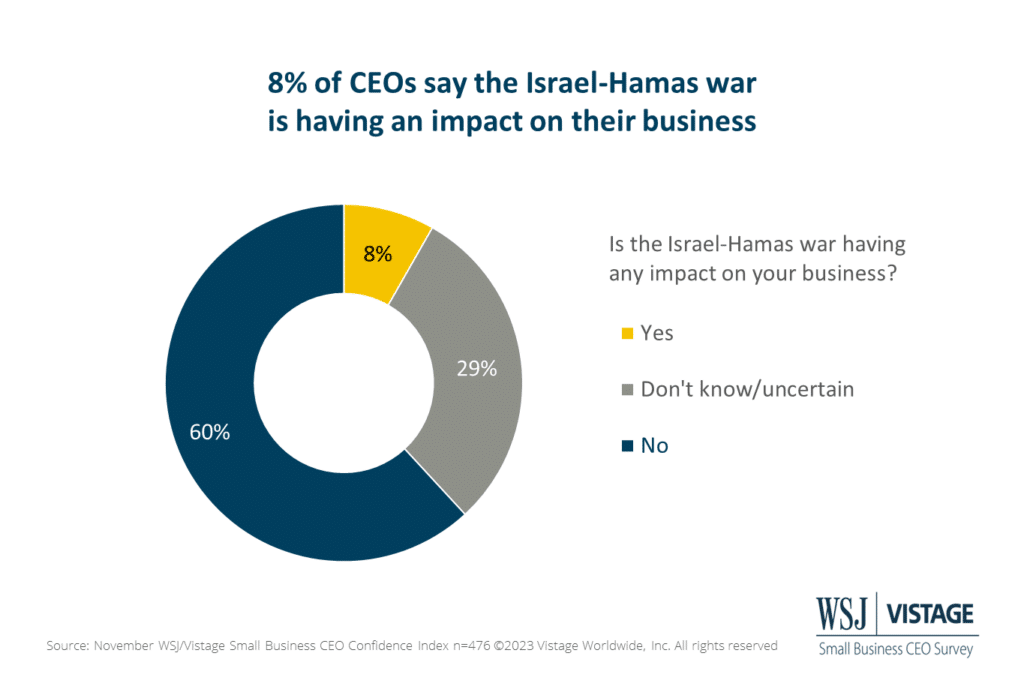

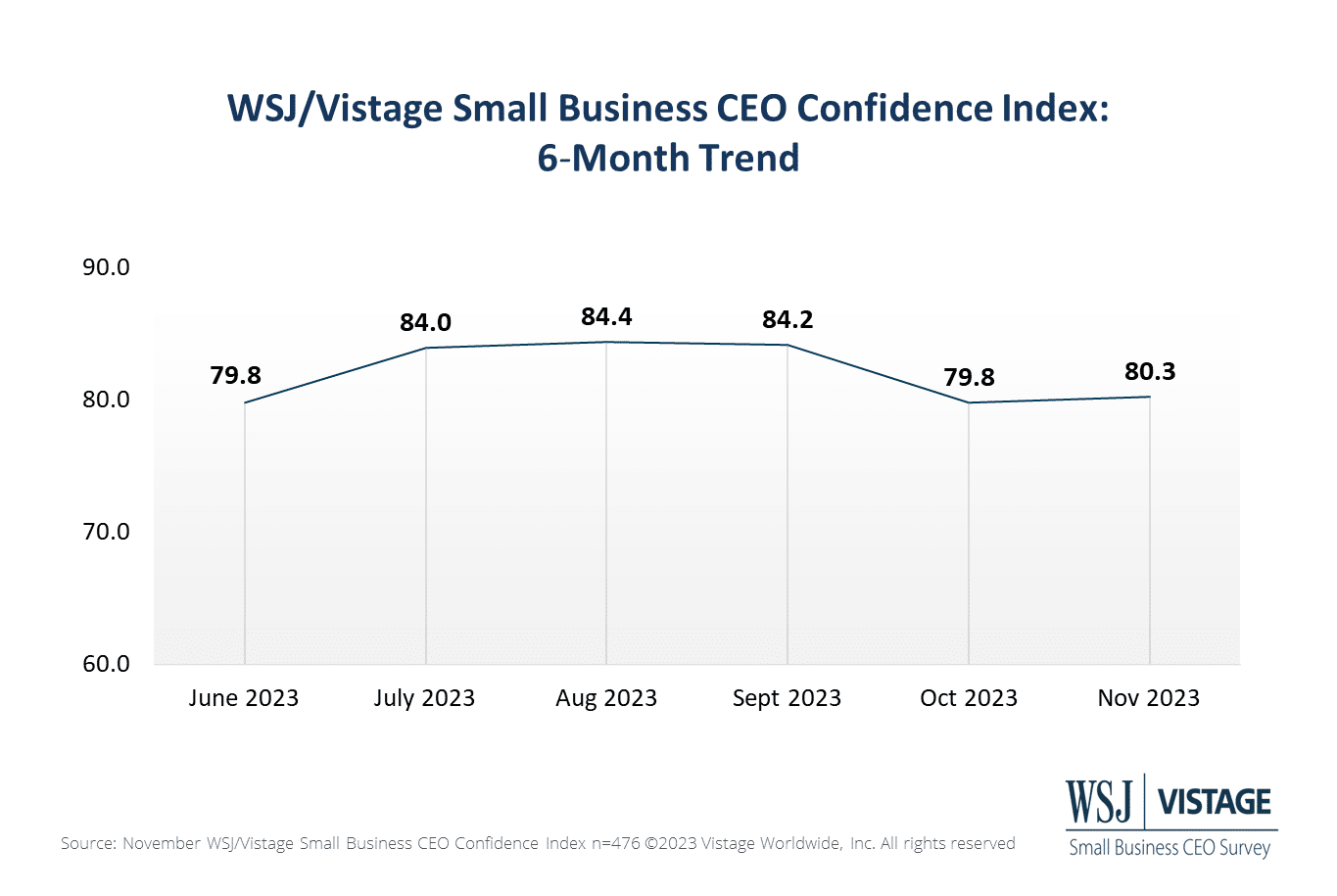

Small businesses have become numb to uncertainty. Over the last month, state elections, the Israeli-Hamas war and a potential shutdown of the U.S. government have not hindered small business confidence more than any other event this year. The WSJ/Vistage Small Business CEO Confidence Index rose marginally to 80.3 in November.

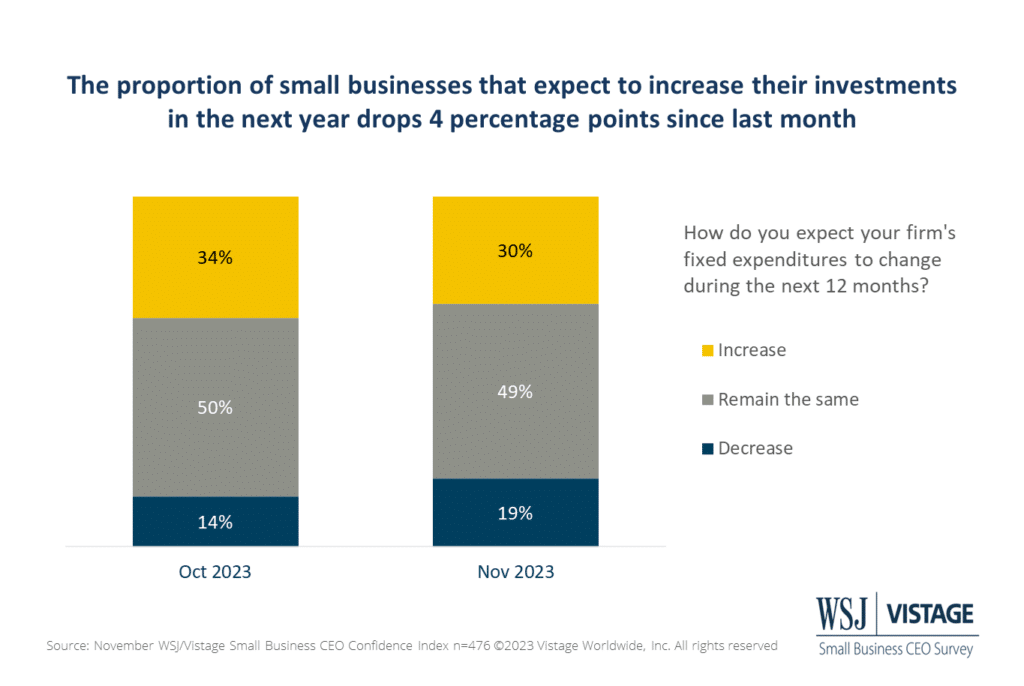

The biggest headline in the Index components is the shift in plans for fixed investments; the proportion that plan to increase investments fell by 4 percentage points, while those that plan to decrease investments grew by 5 points.

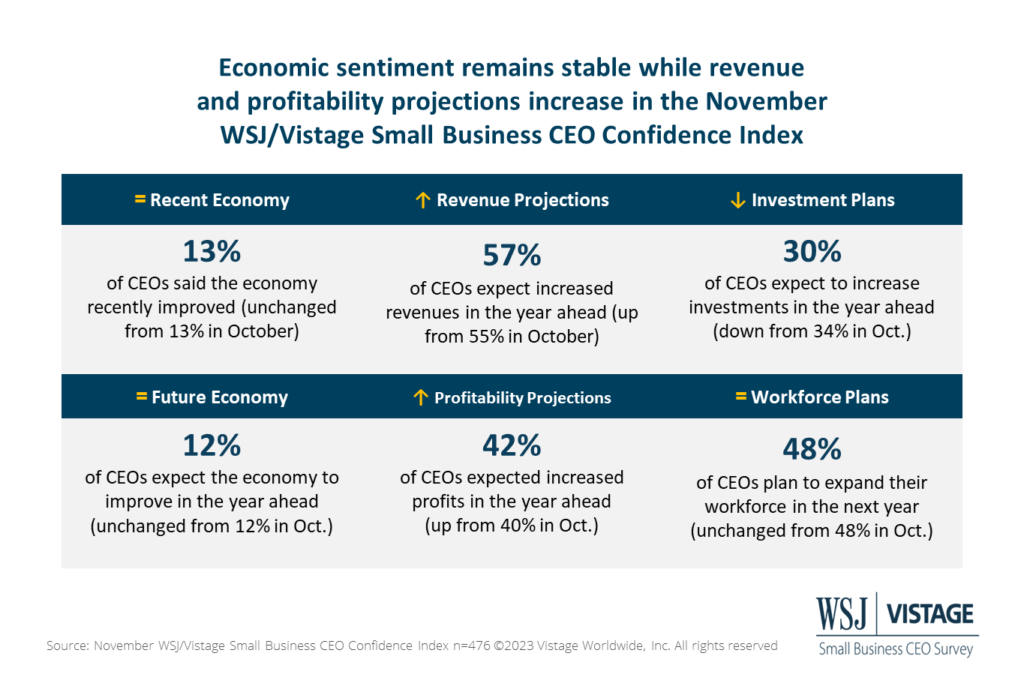

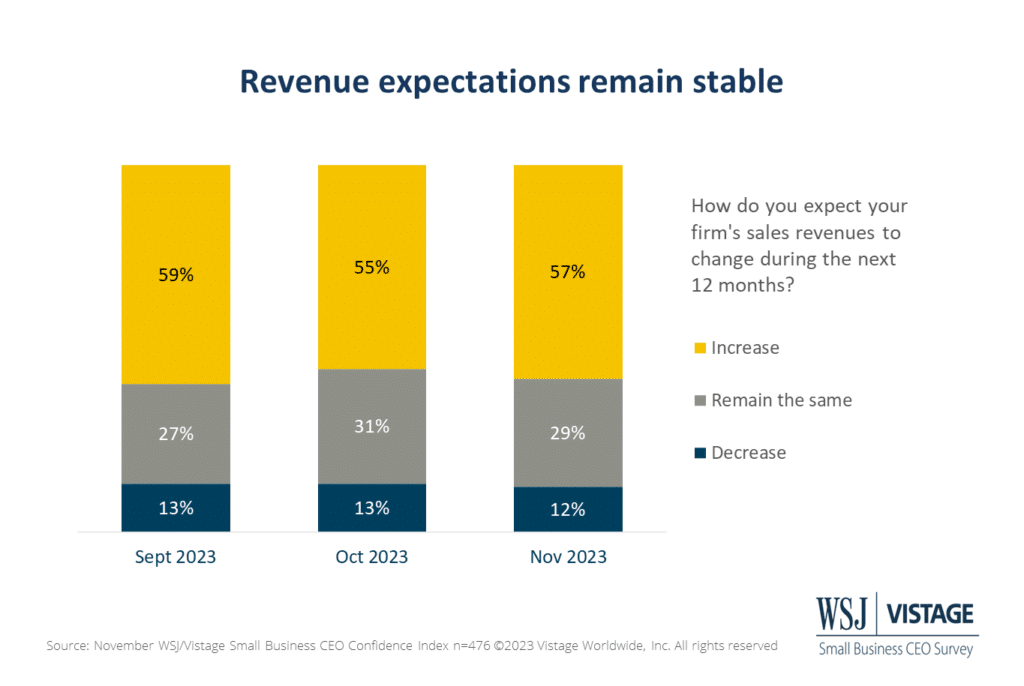

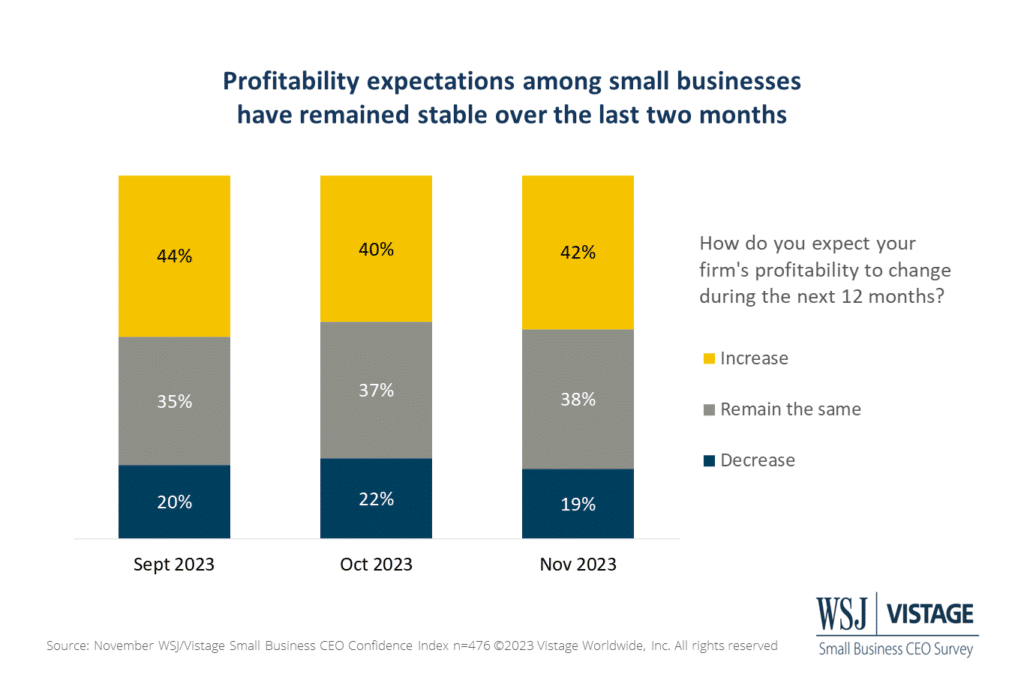

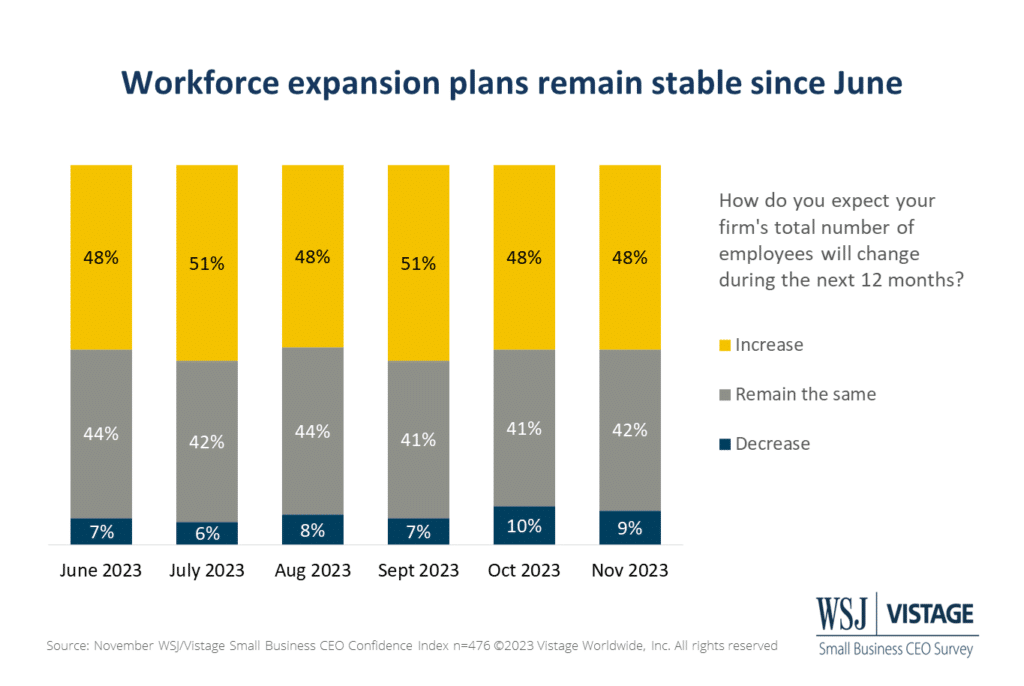

Those declines were offset by slight improvements in revenue and profit expectations, as well as a moderate decline in pessimism about the economy. Meanwhile, hiring plans remain stable, as the proportion of CEOs who plan to decrease their workforces did not rise this month.

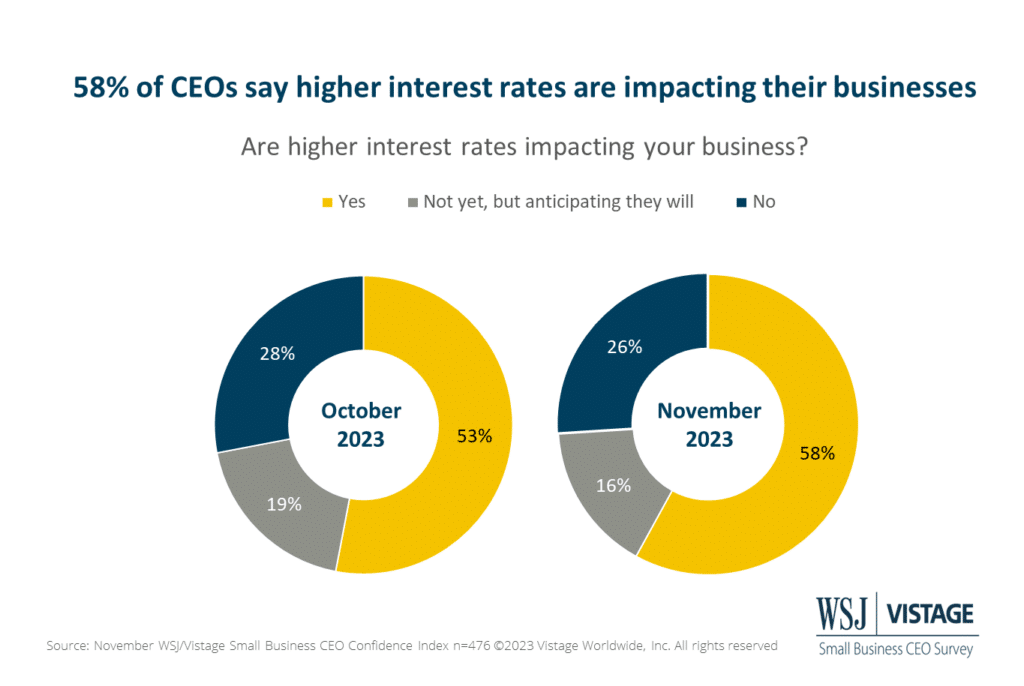

- Interest rates are impacting a greater proportion of small businesses; the proportion who say interest rates are impacting their business grew 5% from last month to 58%.

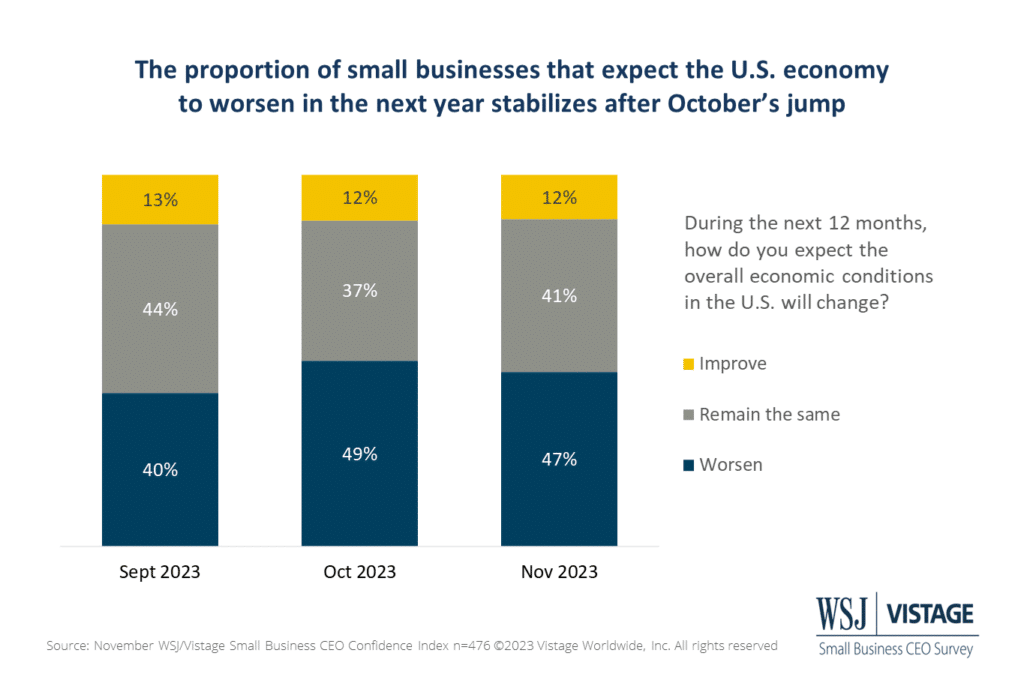

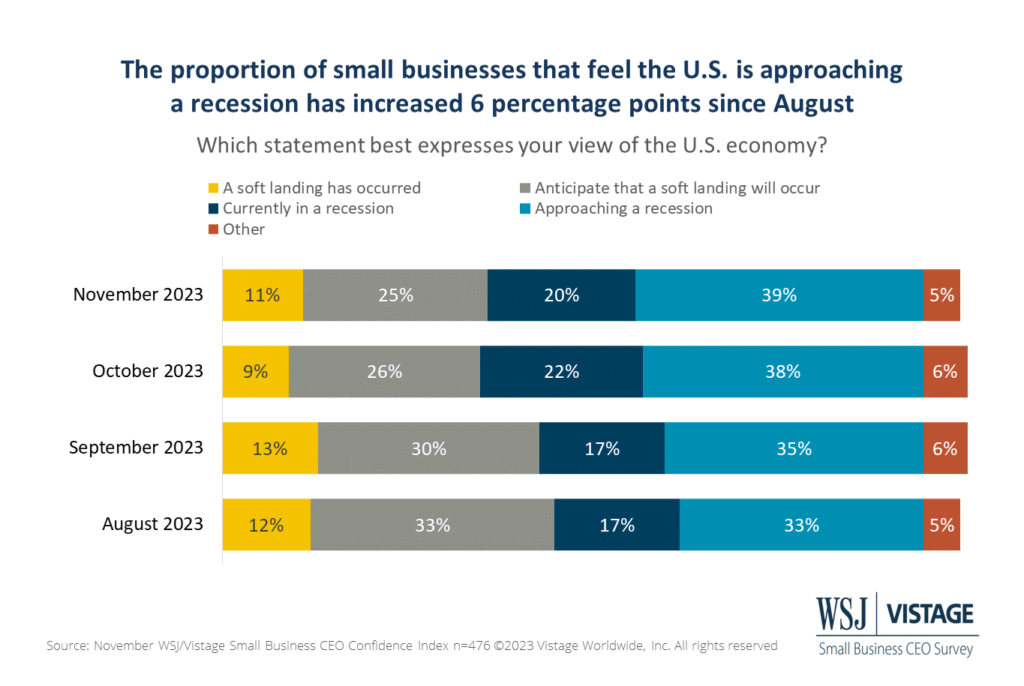

- In the battle of recession versus a soft landing for the U.S. economy, the proportion of small businesses that believe we are approaching a recession has grown 6 percentage points since August, while those anticipating a recession have fallen by 8 points.

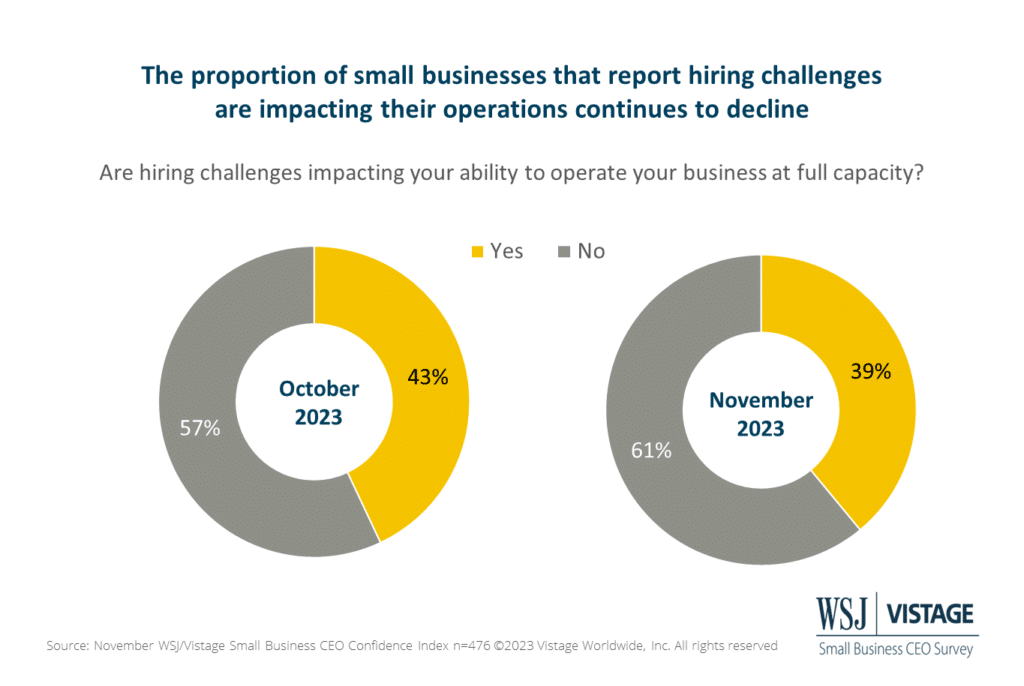

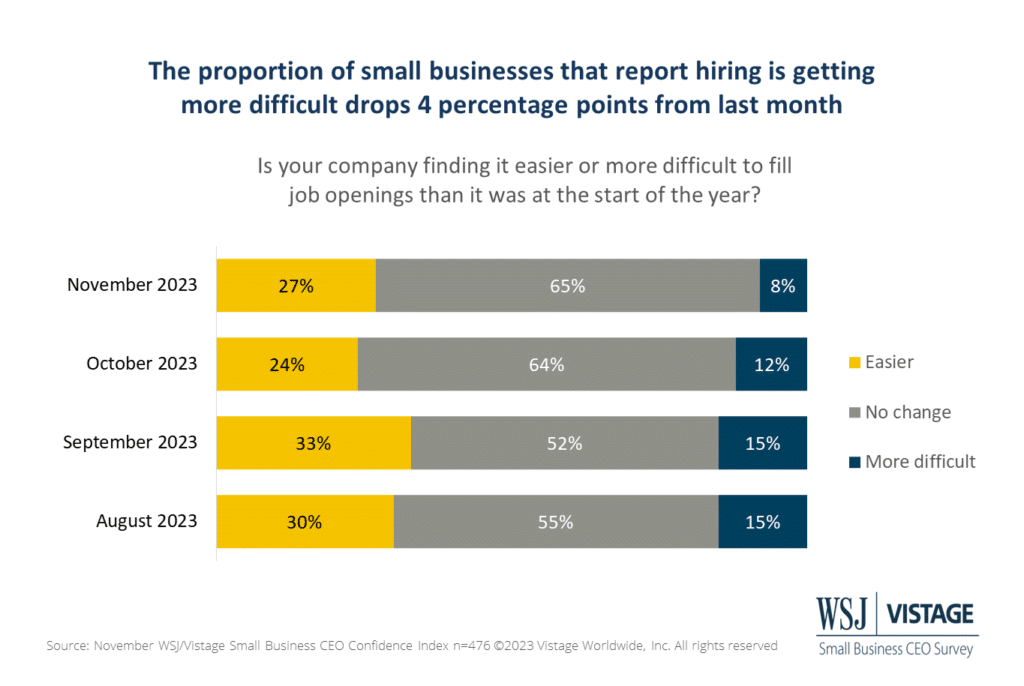

- The proportion of small businesses that believe hiring is more difficult than at the beginning of the year has dropped to 8%, the lowest since we started monitoring this sentiment in July 2022.

As with the past couple of months, the individual components bob along, some incrementally higher, some dipping lower.

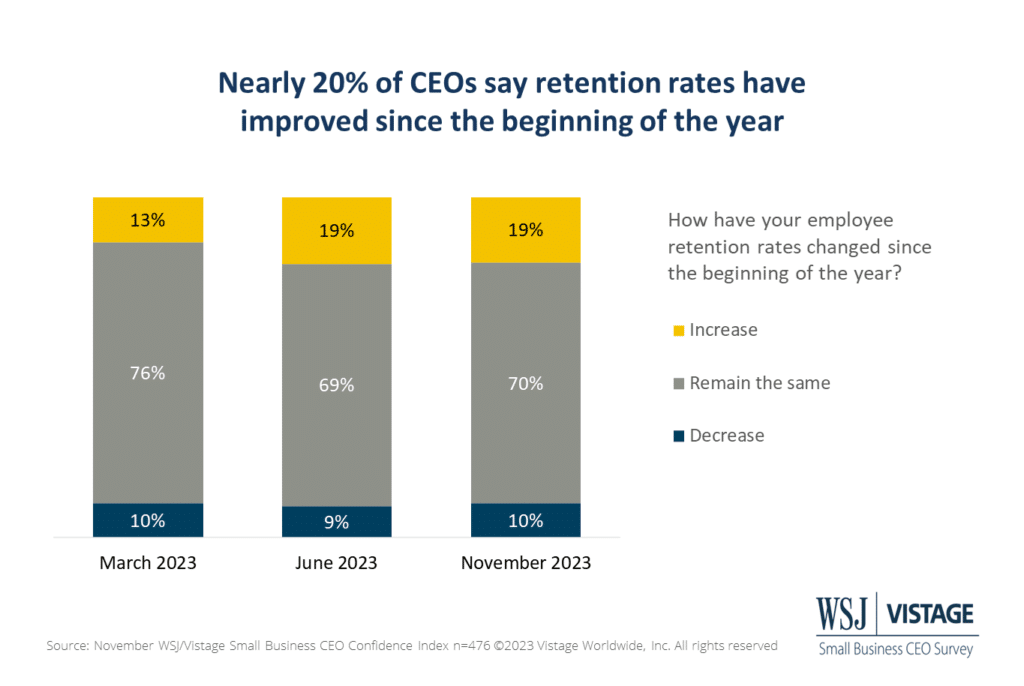

Economic sentiment has held stable — though at low rates — while the gap between revenues and profitability accelerates. As we look toward the next 12 months, investments will likely be scrutinized while talent is still needed to support demand and operate at full capacity. As with previous months, incremental declines and increases make it hard to discern a trend. But looking at rates of change versus a simple month-over-month or year-over-year view gives us a more nuanced picture of overall trends.

November highlights

The November WSJ/Vistage Small Business CEO Confidence Index was informed by 476 leaders of small businesses who responded to the November WSJ/Vistage Small Business CEO Confidence Index survey, which was in the field November 6-13, 2023. Highlights include:

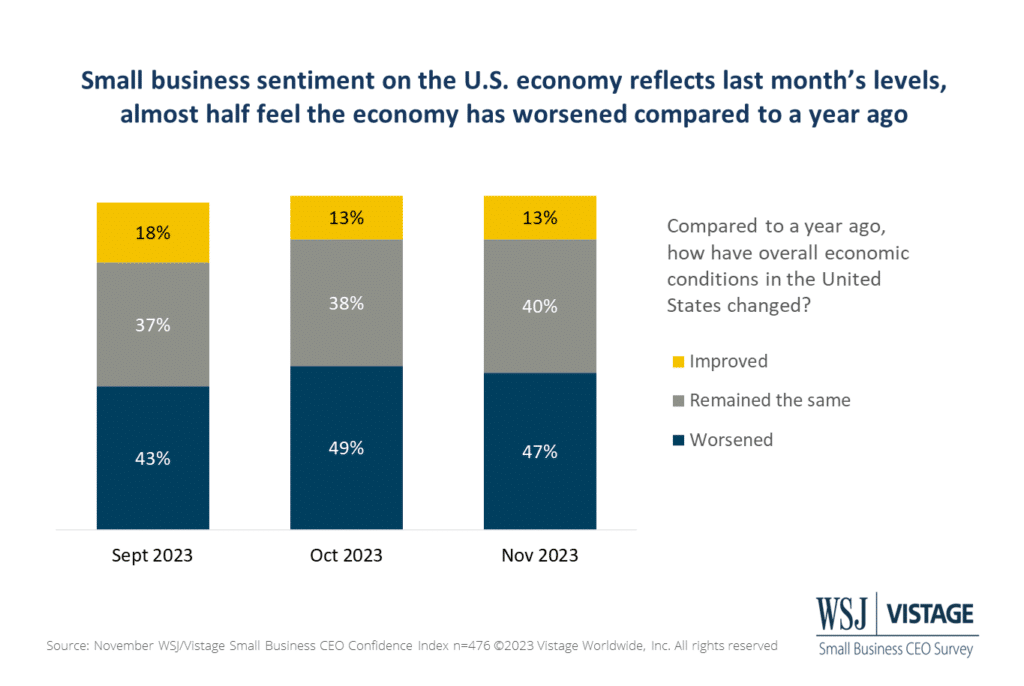

- Current Economy: Just 13% of small businesses reported an improved U.S. economy compared to last year, holding steady with last month.

- Future Economy: A scant 12% of small businesses expect the U.S. economy will improve over the next year. Conversely, 47% expect the economy to worsen, a marginal decline from 49% last month.

- Revenue projections: The proportion of small businesses expecting increased revenues in the next 12 months rose to 57%, while just 12% expect revenues to decrease over the next 12 months. These are improvements from last year when 53% expected increased revenues and 15% expected declines.

- Profitability projections: The gap between expected revenue and profitability expectations widens, as 42% of small businesses expect increased profits in the year, while 19% expect them to decline.

- Fixed investment plans: Managing costs remains a priority as wages increase and the CPI slowly decreases. Less than one-third (31%) of small businesses plan to increase fixed investments, while 19% plan to reduce spending in the next 12 months.

- Workforce expansion plans: Nearly half of small businesses (48%) intend to increase headcount, while 42% plan to maintain the size of their workforce in the next 12 months. Just 9% of small businesses are planning to decrease the size of their workforce.

For deeper insights and to explore the full dataset of the November 2023 WSJ/Vistage Small Business data, visit our data center or download the infographic.

Category: Economic / Future Trends

Tags: economic factors affecting business, rising costs, WSJ Vistage Small Business CEO Survey