Social trends for 2024 and beyond

Editor’s note: This is the final installment of an annual 4-part series on the trends impacting small and midsize businesses. Here, we study social trends for 2024.

Americans are concerned about a plethora of social issues ranging from gun violence to income inequality, illegal immigration and student loan debt. Here, we specifically focus on social issues facing small and midsize businesses, their customers, and employees.

More in this series

Part 1: Ecological trends for 2024 and beyond

Part 2: Technology trends for 2024 and beyond

Part 3: Economic trends for 2024 and beyond

Business trends for 2024 and beyond [Jan. 12 webinar]

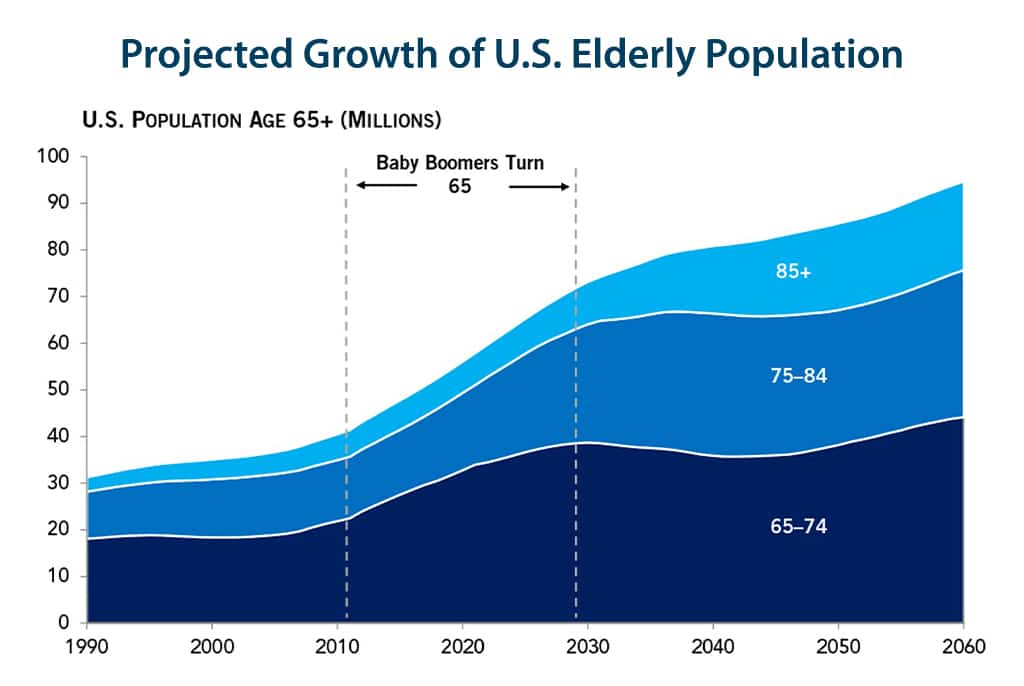

The aging of America

In the long term, perhaps the biggest issue facing most industrialized nations — including the U.S. — is an aging population. Coming out of the pandemic, the U.S. labor participation rate slumped and has plateaued at about 62%.

In the year 2000, there were 3.4 payees into Social Security for every U.S. retiree. By 2035, there will only be 2.3. This imbalance will put additional strain on the U.S. retirement system, which is vastly underfunded.

Source: U.S. Census Bureau

Life expectancy dropped slightly during the pandemic to 79 for women and 74 for men. However, AI and other technology advancements are expected to dramatically increase life expectancy in the years ahead, creating an additional burden for our health care and entitlement systems.

Employers are actively recruiting wisdom workers who want to work past the traditional retirement age. There are many benefits of hiring older workers including their tribal knowledge, experience and work ethic. Employers are also realizing the need to adapt benefits to suit older workers, such as providing medical benefits for part-time workers.

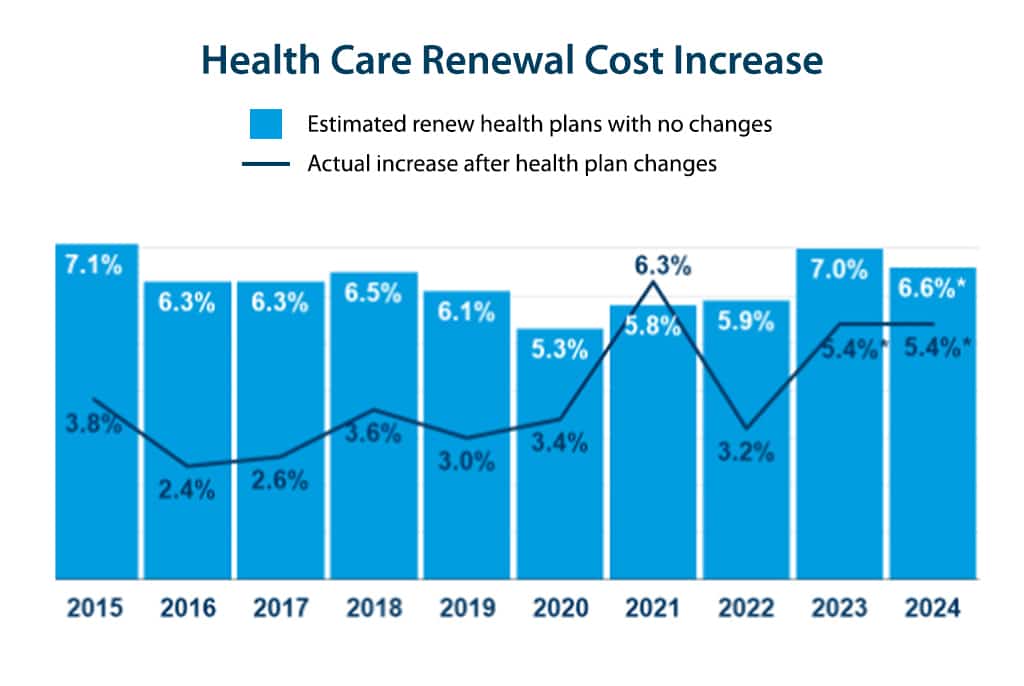

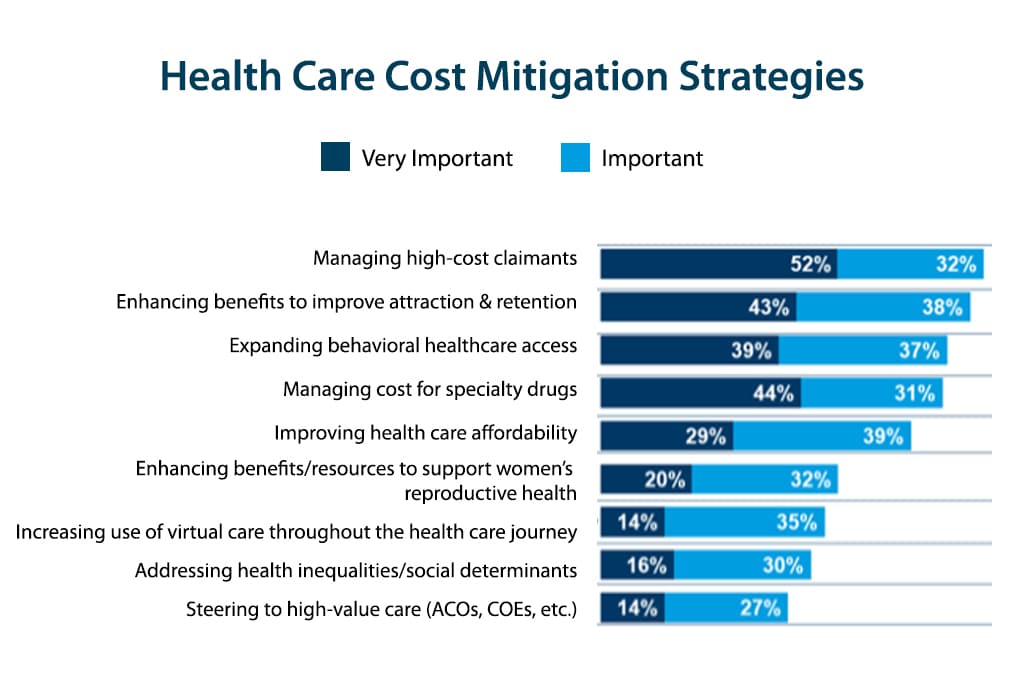

Health care costs

Employers are bracing for a 5.4% increase in health care costs in 2024, only because they will adjust benefits to reduce expenses. In the absence of such adjustments, the average cost is expected to go up 6.6% (about the same as last year). Chronic conditions and catastrophe coverage comprise 41% of increases.

Source: Mercer

Health care has been particularly impacted by inflation and labor shortages at a time when there was pent-up demand following the pandemic. However, patients are resuming preventative screenings and regular checkups.

Source: Mercer

See Mercer health care projections

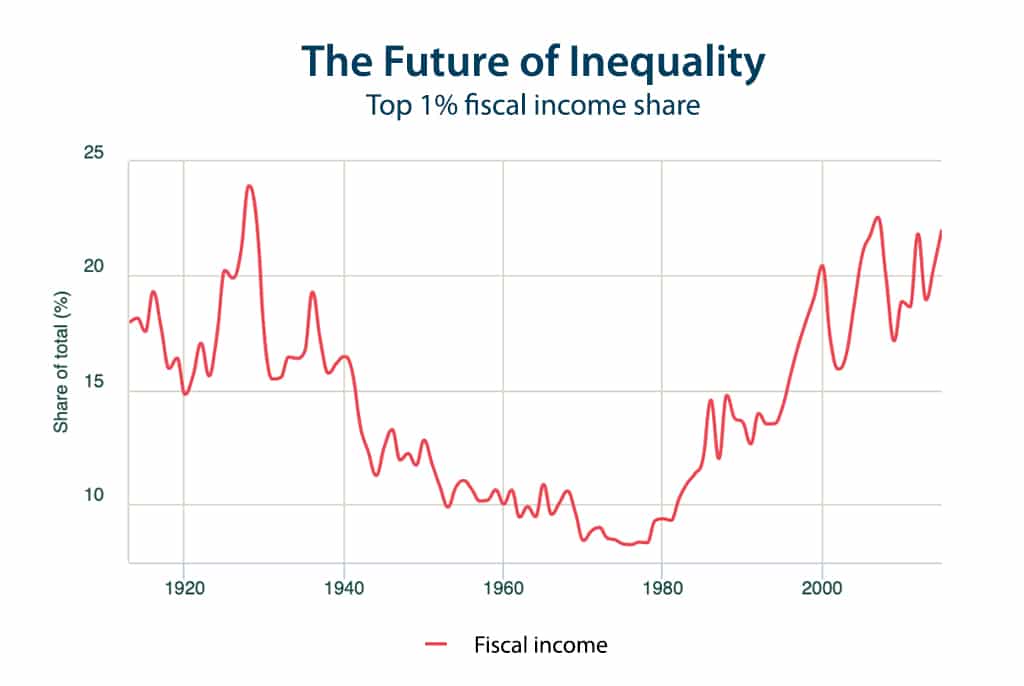

AI and wage inequality

Income inequality is already a polarizing issue, and the gap is only widening.

As we have written extensively, the prospects of AI eliminating jobs in the near term have been overstated. What’s more likely in the next 10 years is that AI will depress wages for unskilled workers (a pattern known as Engle’s Pause). However, the same companies who disrupt markets typically accelerate skills acquisition for low-wage workers.

Among the consequences of AI will also be an acceleration of wage inequality.

Source: Colorado State University

An example of this might be Google or Apple replacing newspapers (an industry that is displaced) with new technologies that promote high-paying jobs.

This is the only explanation for our economy being at full employment at a time when the adoption of technology is only accelerating. Full employment does not suggest every worker is earning a livable wage. There is a lag where workers will need to acquire new skills to compete.

One development that will counter the trend is wealthier Americans facing higher taxes in the form of Trump-era cuts that will sunset in 2025.

Diversity, equity & inclusion

As we covered in our Ecology post, most DEI efforts today have fallen under a broader definition of ESG (environmental, social and governance).

Even well-intended private companies have had difficulty implementing such programs at a speed that would satisfy their proponents. While many companies have customers such as government contracts that require DEI policies, few provide clear definitions or guidelines, leaving it up to their vendors to originate suitable policies.

The Pew Research Center estimates that 61% of employers have a DEI policy. Companies are setting up steering committees, awarding contracts to minority- and woman-owned businesses, amping up communications in town halls, and recruiting from minority universities.

Affordable housing

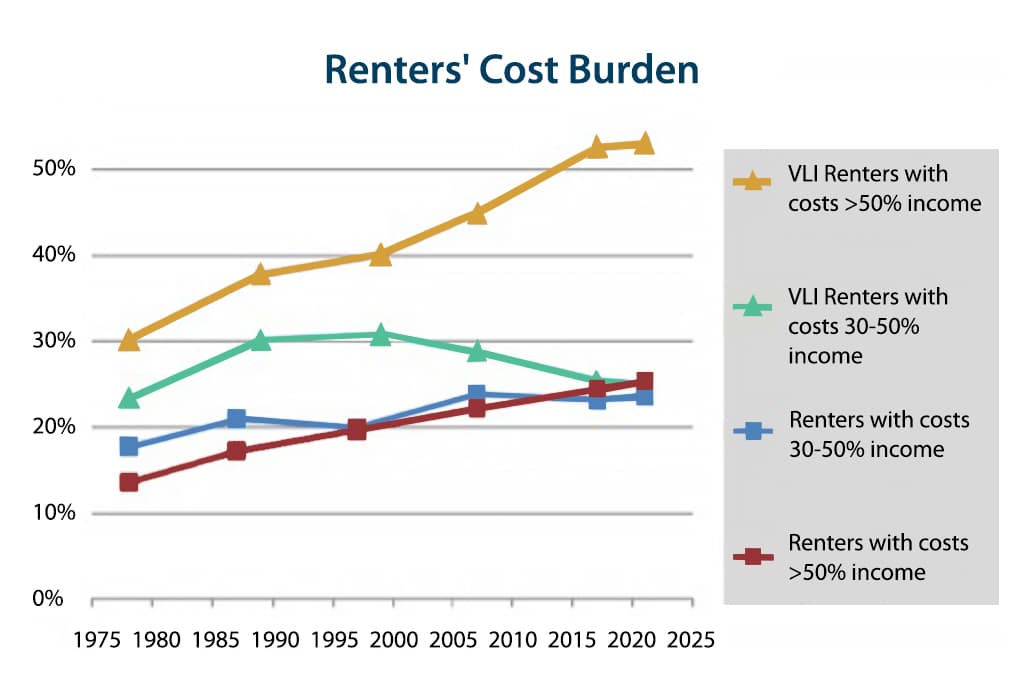

Housing has become completely unaffordable, especially for hourly workers in urban centers.

In 2023, renters with an average hourly wage earned just slightly above the amount needed for a one-bedroom apartment.

Source: American Housing Survey

A 2022 survey found that more than a third of those renting did not own a home because they couldn’t afford one. The median wage across many occupations vital to the economy fell short of the necessary income for rental housing.

Affordable housing has become one of the variables employers are trying to manage as they reconsider their commercial real estate footprint and migrate to hybrid work environments.

Meanwhile, buying a home remains inaccessible for those who don t already have one. The median home sale price is $416,100 as of Q2 2023. That’s a 26% increase from 2020, but down from the previous quarter, as interest rates have begun to stabilize prices.

Education and student loan debt

In many ways, our education system still hasn’t recovered from the pandemic. During the 2021-2022 school year, 28% of school-age children were chronically absent. In New York and Los Angeles, chronic absenteeism reached 40%. Educators believe that families have just found a new routine.i

All of this coincides with a childcare crisis. The average cost to care for a child rose to $11,000 per year in 2022, up 12% from 2019. Many childcare centers are not even taking new clients, as parents report waiting lists lasting two years or more. Things are about to get worse as the American Rescue Plan subsidies ran out in September.

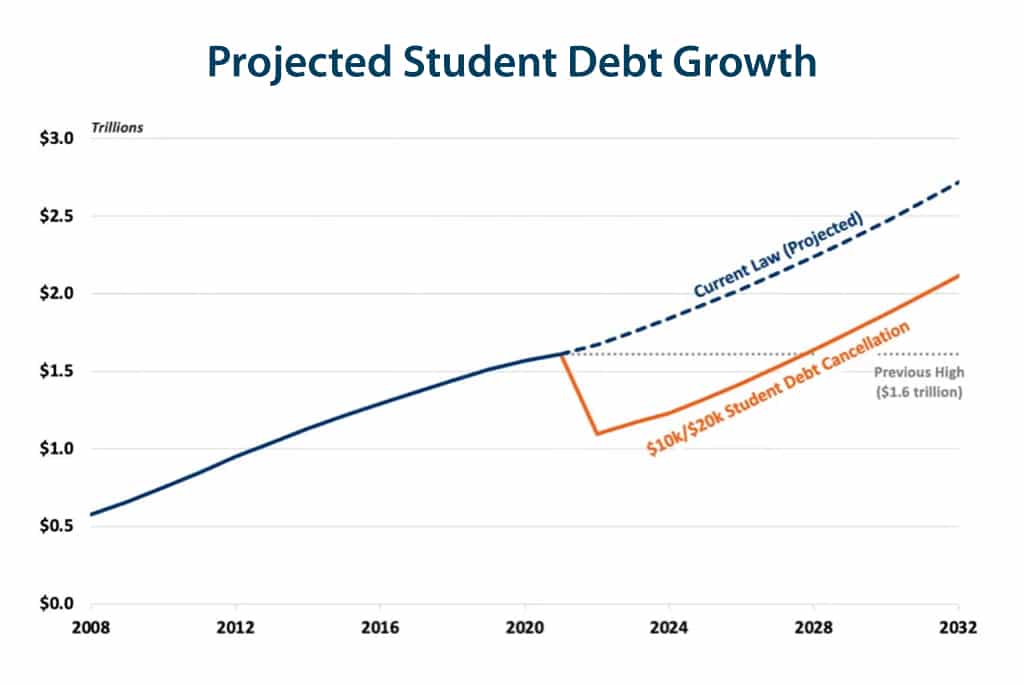

In June, the U.S. Supreme Court threw out the Biden-Harris Administration’s plan to cancel up to $10,000 in student loan debt per borrower, and up to $20,000 for Pell Grant recipients. That same week, President Biden announced a replacement plan based on debt relief under a different legal authority, the Higher Education Act (HEA) of 1965.ii

Student loan debt has increased 500% over two decades, outpacing all other forms of debt according to data from the New York Federal Reserve Bank. Requirements that students pay back part of their debt are expected to have a material impact on personal consumption.iii

Source: Department of Education, Congressional Budget Office

Can AI cure cancer?

Some scientific luminaries believe AI may be the key to unlocking scientific mysteries. AI is now being applied in almost every field within science, including the discovery of new antibodies.iv

Researchers are using robot scientists to accelerate studies. AI and other technologies will undoubtedly expedite cures and treatments. Proponents point out that the only thing that will slow AI in science is humans who fear the unknown.

As companies consider their strategies for 2024 and beyond, they will need to include these emerging social issues in their strategic plans.

References

i U.S. Childcare is broken – Bloomberg BusinessWeek

ii AmericanProgress.org

iii Federal Reserve Bank of New York

iv How AI can Revolutionize Science – The Economist

Category: Economic / Future Trends

Tags: social trends, social trends affecting business, trends affecting business